$800Bn.

$800Bn.

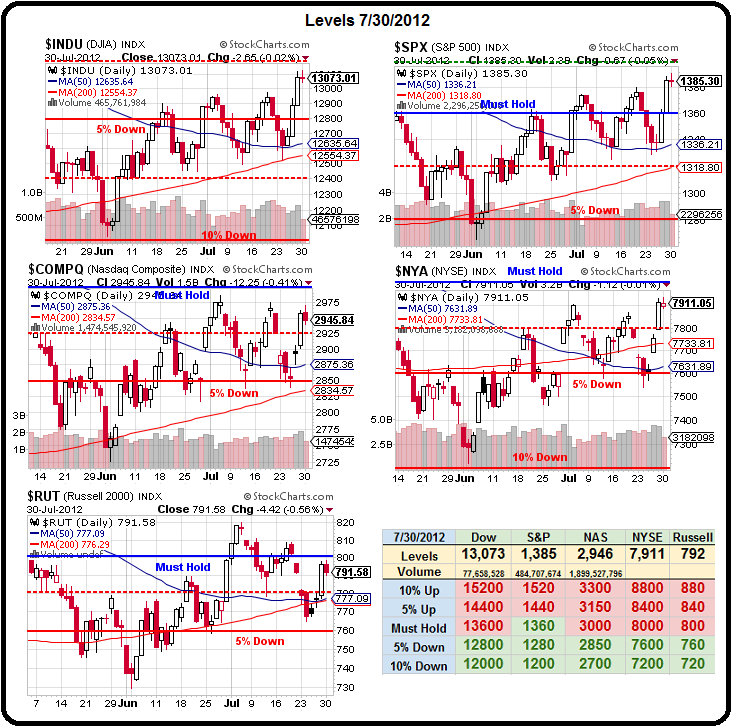

That's the number we came up with yesterday for the minimum bailout/stimulus required to hold Dow 13,000, S&P 1,380, Nasdaq 2,950, NYSE 7,900 and Russell 790. Buying a breakout over those levels will be even more expensive and, so far, we've gotten a grand total of ZERO actual commitments from the Central Banksters and other Government morons, most of whom are on vacation anyway.

As you can see from our Big Chart, this is within our rule of thumb that it costs $10Bn to buy an S&P point and that effect lasts for about 6 months. The S&P is up 105 points off the June lows and, so far, only China has committed stimulus Dollars (about $120Bn down with $400Bn still rumored), leaving a the gap to be filled by Europe, Japan and the US.

Of course China has, by far, the biggest hole to fill. In fact, Larry McDonald calls China's GDP "the new Libor," pointing out the pretty obvious fact that it makes no sense at all that Europe has negative growth while the US and Japan have minimal growth while China claims things are humming along at 8.5%.

Just this morning, Taiwan (China's neighbor) reported declining GDP, Korea reported their Industrial Production has gone negative and Singapore's Government Investment Corporation issued a report with a very gloomy outlook for the whole planet, stating:

"The developed economies will continue to be weighed down by an extended period of debt-deleveraging. In Europe, the debt crisis has spread beyond the periphery to the larger Spanish and Italian economies, In the United States, the fragile economic recovery could be aborted by automatic spending cuts and tax increases if political gridlock continues beyond the 2012 elections with no compromise on a long-term plan for reducing the public deficit. Growth in the emerging economies, particularly China, is also slowing."

Well, that sums it up quite nicely, doesn't it? Meanwhile, everyone is looking for the ESM to save us but Germany hasn't even approved the fund yet – that matter is tied up in their Constitutional Court (pictured left) until September 12th and you can bet those judges are on vacation and not sitting in Draghi's kitchen, plotting to spring an early approval on us on Thursday – as seems to be expected by the MSM.

Well, that sums it up quite nicely, doesn't it? Meanwhile, everyone is looking for the ESM to save us but Germany hasn't even approved the fund yet – that matter is tied up in their Constitutional Court (pictured left) until September 12th and you can bet those judges are on vacation and not sitting in Draghi's kitchen, plotting to spring an early approval on us on Thursday – as seems to be expected by the MSM.

Germany is not the only country that has yet to approve the ESM treaty. The fund will become operational as soon as member countries representing 90 percent of the fund's capital commitments have ratified it. Germany is the largest contributor, at 27 percent of the total, so the fund CAN'T be launched without German ratification.

So, let's try to be a little realistic and scratch Europe off our "rescue" list this week. That's a shame because Draghi has sort of backed himself into a corner by pledging to do "whatever it takes" to save the Euro last week and "whatever" is going to be about $3Tn – to start. As noted by the NY Times, "With expectations so high, anything short of a decisive display of financial firepower could send financial markets back to the panicky behavior of only a week ago — when the thin trading of summer was exaggerating stock market gloom and bond investors were bidding up the borrowing costs of Spain and Italy to potentially destructive levels."

So, let's try to be a little realistic and scratch Europe off our "rescue" list this week. That's a shame because Draghi has sort of backed himself into a corner by pledging to do "whatever it takes" to save the Euro last week and "whatever" is going to be about $3Tn – to start. As noted by the NY Times, "With expectations so high, anything short of a decisive display of financial firepower could send financial markets back to the panicky behavior of only a week ago — when the thin trading of summer was exaggerating stock market gloom and bond investors were bidding up the borrowing costs of Spain and Italy to potentially destructive levels."

Investors concluded that Mr. Draghi was signaling a major policy action, like huge purchases of government bonds to raise demand for debt from Spain and Italy and keep their borrowing costs at sustainable levels. Nearly identical statements by Chancellor Angela Merkel of Germany, President François Hollande of France and Prime Minister Mario Monti of Italy in recent days further raised expectations, though it was unclear if they all had the same policies in mind.

Of course Draghi and the EU Stooges and Wen Jiabao over in China are going to do whatever it takes to protect their phony-baloney jobs – that's a given. Unfortunately, the ECB is SUPPOSED to defend price stability above all else and is BARRED from financing governments. For the central bank to be sufficiently intimidating, it would have to violate some existing taboos. For example, it would have to abandon its practice of offsetting its bond purchases by taking in equal amounts in commercial bank deposits. By absorbing deposits, the bank takes as much cash out of the system as it puts in via bond purchases. By keeping the supply of money in the economy approximately even, it tries to avoid the appearance that it is printing money.

Of course Draghi and the EU Stooges and Wen Jiabao over in China are going to do whatever it takes to protect their phony-baloney jobs – that's a given. Unfortunately, the ECB is SUPPOSED to defend price stability above all else and is BARRED from financing governments. For the central bank to be sufficiently intimidating, it would have to violate some existing taboos. For example, it would have to abandon its practice of offsetting its bond purchases by taking in equal amounts in commercial bank deposits. By absorbing deposits, the bank takes as much cash out of the system as it puts in via bond purchases. By keeping the supply of money in the economy approximately even, it tries to avoid the appearance that it is printing money.

This has led us to conclude that there's a pretty good chance this week will end in failure and we cashed out longs and went more negative yesterday but used our Long Put List (see yesterday's Alert to Members for update) to avoid the mishap of being blown out of the water by somebody actually doing something helpful – doubtful but long-shots do come in once in a while…

I think the make or break moment for the bulls will come not tomorrow, with the Fed and Bernanke's speech, nor Thursday with the ECB's tap dance, but tonight, when Geithner, who just met with Germany's Schauble and some other EU Finance Ministers, will be on Bloomberg this evening – suspiciously at 10:30, when the Asian markets open.

I think the make or break moment for the bulls will come not tomorrow, with the Fed and Bernanke's speech, nor Thursday with the ECB's tap dance, but tonight, when Geithner, who just met with Germany's Schauble and some other EU Finance Ministers, will be on Bloomberg this evening – suspiciously at 10:30, when the Asian markets open.

If we are going to have successful stimulus, it will need to come from our Governments in the form of money given to the people – not in the form of Central Banksters giving more money to the top 1% that will ultimately create new debt for the people. We've done over $9Tn of that in the last 3 years and it clearly isn't helping – perhaps it's time to give real stimulus a chance.

Oil (/CL) has been failing $90 in the futures all morning and makes a great short off that line. Gold (/YG) is a tempting short too at $1,630 but very dangerous as it can pop on stimulus and, of course, shorting the Dow futures below the 13,000 line is a no brainer!

These would be quickie trades only, far too dangerous to hold open overnight (or while you go to the bathroom for that matter!) but could be fun if we get any negative commentary from Germany or the Chicago PMI (9:45) comes in negative or the Consumer Confidence (10:00) continues its downtrend. Also, we get the bad news on Agriculture Prices at 3pm and any Central Bankster who's supposed to be fighting inflation will have a very hard time ignoring that data.

Be careful out there!