Now we have dueling Fed heads weighing in on QE talk.

CNBC interviewed both Boston's Rosengren (dove), who said not only is QE necessary but that "it needs to be substantial enough that it off sets some of the shocks that we're getting from abroad and some of the concerns that people have with how weak the world economy has been – so we're in a Global slow-down." Isn't that great? He thinks the Global economy is TERRIBLE and that means we should rush out and pay 5-year highs for equities, right? What a silly market we have.

Then CNBC brings on Richard Fisher, who said additional stimulus would have little impact, as we're already at 0.25% and that's clearly not helping and that additional Fed stimulus now would look political and it's the US lawmakers, not the Fed, that need to "get their act together" if they want to stimulate the economy. Elsewhere, Fisher was backed up by KC's Esther George, who said that, at $3Tn on the balance sheet already, the Fed is only buying a future crisis when it comes time to unload these assets on a market that is ill-prepared to absorb them. “It’s always easy to buy,” George said. “We’ve never had to go back into the market to sell this quantity of assets.

Gosh that makes sense!

She said the Fed’s bond holdings further would create a “steeper hill” once policy starts to shift in the face of a stronger recovery. Add to that the burden imposed on savers, George said, and the pressure on pension funds, banks and insurance companies to take investment risks they normally wouldn’t take to earn a bit of income.

She said she didn’t know how Europe’s struggle to save its common currency, the euro, would come out. “Either way they go, the results are going to be dramatic and will be painful,” she said. “I see no short-term solution.”

The drought is likely to drive up food prices globally, if not this year then next, she said. George also noted that rising prices for food, energy and apparel were particularly hard on low-income Americans because those essentials accounted for a relatively large portion of their spending. "We know inflation can move quickly, and we’ll have to watch for that,” she said. The federal deficit and last summer’s contentious effort to raise the debt ceiling have had “a chilling effect on our economy,” George said. “We know we are on an unsustainable trajectory of debt.”

With the markets now up 25% since last August, you would think the economic news would be all wine and roses but that's not the way it works anymore. Why are we up 25% from last August? As we discussed on Monday, on September 21st of last year, the Fed announced Operation Twist and that, coupled with several FHA programs has allowed people to refinance their homes at 3.5-4%, shaving as much as $6,000 a year off a $300,000 mortgage.

With the markets now up 25% since last August, you would think the economic news would be all wine and roses but that's not the way it works anymore. Why are we up 25% from last August? As we discussed on Monday, on September 21st of last year, the Fed announced Operation Twist and that, coupled with several FHA programs has allowed people to refinance their homes at 3.5-4%, shaving as much as $6,000 a year off a $300,000 mortgage.

That's a lot of money! That's a stimulus they don't like to talk about because it makes you realize that 70% of the mortgages we're recording are refinances and, of course, it can't last – but at least it bought us some time.

The chart on the right, from Markettechreports, does a great job of highlighting the last 5 times the VIX was below 15 (now 14.50) and, of course, it's driven down in February, May, August and October by the S&P Futures rolling over, which means it's a good and predictable time for GS et al to herd all the sheeple into equities while they load up on cheap puts – right before they pull the rug out from the market. '

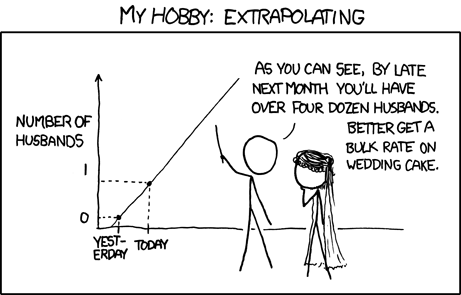

The bulls may not be wrong – Bernanke announced QE2 at Jackson Hole on August 27th of 2010 and you can see how we popped 25% off that run. Then we fell off a cliff and gave back 19% – BUT WE KEPT 6%! Sept 21st was the start of Operation Twist last year and here we are – up 25% again (so now up 31% from 2 years ago) and, of course, since we got stimulus this time of year two years in a row – we have to expect it now because nothing is more scientific that two data points to determine a trend.

The bulls may not be wrong – Bernanke announced QE2 at Jackson Hole on August 27th of 2010 and you can see how we popped 25% off that run. Then we fell off a cliff and gave back 19% – BUT WE KEPT 6%! Sept 21st was the start of Operation Twist last year and here we are – up 25% again (so now up 31% from 2 years ago) and, of course, since we got stimulus this time of year two years in a row – we have to expect it now because nothing is more scientific that two data points to determine a trend.

As I pointed out Monday, it's not quite the same as the Fed took action when the market had dropped 20% – at the bottom – not when it was up 31% but maybe it's worth another Trillion in Fed debt to pop us another 25% from here to S&P 1,750 which would, of course, plow the p/e of the S&P to 20 – a number not seen since before the great crash of 2000, when it was trying to keep up with the Nasdaq but maybe happy days are here again.

Maybe the S&P is simply trying to keep up with AMZN, which now has a p/e ratio of 289 to 1. In other words, at the current level of earnings, it will take AMZN 289 years to pay back your investment – an effective rate of return of 0.34%. We're short on AMZN because we think they may have a little trouble holding 300 for a p/e and, if we don't get QE3 to support it – they could go back to 200 very quickly. Last October, AMZN topped out at $246 (p/e 300) and fell back to $170 by December (down 30%) – we'll be happy with a 10% pullback.

We call it the AAPLDaq because AAPL has an 19% weighting in the Nasdaq but AMZN is 4% and is up 33% this year, adding 1.32% to the Nasdaq all by itself. AAPL, of course, is up 67% but it only started the year at 12% of the Nasdaq as it was cut back when it last went over 20% in a re–weighting of the index. Still, AAPL this year, by itself has added almost 8% to the index, which is up 11.8% so, other than AAPL and AMZN – the rest of the index has been flat, hence – AAPLDaq!

We call it the AAPLDaq because AAPL has an 19% weighting in the Nasdaq but AMZN is 4% and is up 33% this year, adding 1.32% to the Nasdaq all by itself. AAPL, of course, is up 67% but it only started the year at 12% of the Nasdaq as it was cut back when it last went over 20% in a re–weighting of the index. Still, AAPL this year, by itself has added almost 8% to the index, which is up 11.8% so, other than AAPL and AMZN – the rest of the index has been flat, hence – AAPLDaq!

To some extent, these two stocks also have an outsized influence on the S&P and the reweighting of the Nasdaq makes any comparisons to last year meaningless but that won't stop TA people from drawing charts and pontificating as if nothing that actually happens in the market matter except the squiggly lines that arbitrarily form on the charts. It's BRILLIANT and it works because everyone wants to know the future and this con has been influencing men of power since the first bones were cast or the first entrails were laid out on the floor of the cave.

Call me old fashioned but when I am about to give AMZN $240 of my hard-earned money (well, money, I don't really work that hard) – I might say to Jeff Bezos: "So, how much money can you make with $240?" Then Jeff says "Well, last quarter we lost 8 cents but, if all goes well, we'll make 55 cents next quarter and that will bring us up to 77 cents for the year!" No wonder people are putting money into TBills at 1.8% – 1.8% of $240 is $4.32.

Call me old fashioned but when I am about to give AMZN $240 of my hard-earned money (well, money, I don't really work that hard) – I might say to Jeff Bezos: "So, how much money can you make with $240?" Then Jeff says "Well, last quarter we lost 8 cents but, if all goes well, we'll make 55 cents next quarter and that will bring us up to 77 cents for the year!" No wonder people are putting money into TBills at 1.8% – 1.8% of $240 is $4.32.

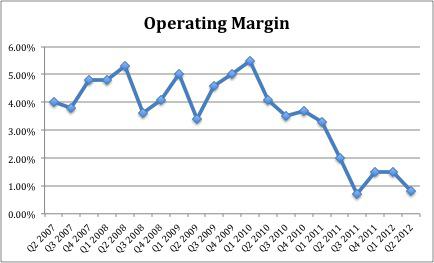

Even using the very top of AMZN's 3-year projections – assuming everything goes great and Europe doesn't collapse and China doesn't collapse and costs don't rise and the Operating Margins (currently near zero) turn around, etc – with all the best assumptions, AMZN will not pay me $4.32 on my $240 until the end of 2014 – I could have had $12.90 from the TBills by then!. Keep in mind that that is ASSUMING that earnings rise 300% next year! Last year they earned $1.37, this year .77 – that's DOWN 58%, not up 300%….

I don't want to pick on AMZN – QE Fever is giving us tons of companies that are grossly overvalued, maybe even sacred AAPL who, at $600Bn, only have a p/e of 15. If AAPL had AMZN's valuation, it would be a $12 TRILLION Dollar company – more than 1/2 of the S&P all by itself! AAPL gives you $44 for each $630 share you buy and that's projected to grow to $52.50 next year – assuming the IPhone 5 doesn't disappoint as much as the "New IPad" has.

I don't want to pick on AMZN – QE Fever is giving us tons of companies that are grossly overvalued, maybe even sacred AAPL who, at $600Bn, only have a p/e of 15. If AAPL had AMZN's valuation, it would be a $12 TRILLION Dollar company – more than 1/2 of the S&P all by itself! AAPL gives you $44 for each $630 share you buy and that's projected to grow to $52.50 next year – assuming the IPhone 5 doesn't disappoint as much as the "New IPad" has.

AAPL's problem is different than AMZN's because AMZN only has $48Bn in annual sales (which includes a lot of AAPL products) on which they make $631,000 (1.3%) while AAPL makes their $25Bn on $108Bn in sales (23%). So what is AAPL's problem? Well, in order to double sales, AAPL has to find $108Bn worth of new buyers. We saw GOOG hit the "law of diminishing returns" years ago, when they hit $20Bn in sales. While they have grown sales to $38Bn, the stock has gone nowhere for 5 years (p/e 19).

It's nice if the Fed pumps another $1Tn into the economy, but will 10% of that money go to AAPL? Also, keep in mind the Fed HAS been pumping $1Tn a year into the economy and maybe 10% of it does go to AAPL – what happens if they stop? Maybe the Fed has to do QE3 just to prevent the collapse that the end of QE2/Twist is likely to cause but, if so – what the Hell is AMZN so happy about?