If it's Tuesday, we must be at the week's highs.

If it's Tuesday, we must be at the week's highs.

Obviously, we're still bearish and the news we've been discussing this morning in Member Chat certainly hasn't changed my opinion on that. Back on August 7th (first Tuesday of last month), I said we were about $700Bn in stimulus short of what we need to support S&P 1,400 and we knew we would have to wait a month to see how much we got from Draghi and Bernanke but, so far, and with Ben already out of the way, we have zero.

At $10Bn per S&P point that puts our fair value all the way down to 1,330 but keep in mind that the $500Bn we did get only lasts for 6 months so more like 1,310 at this point without a proper commitment by the ECB or Fed this week. Even 1,310 would be up 50 from the June lows and it would represent a neat 2/3 retracement of the rally since then. Our $25,000 Portfolio has, if anything, gotten more bearish as we dragged along the top but another thing we've done each Tuesday has been to take aggressive bullish positions to cover ourselves IN CASE someone actually does put up the cash needed to goose the markets over our breakout levels (see Friday's post for current positions in the virtual Portfolio and our levels).

On Tuesday, August 14th, our trade ideas were as follows:

- 2 FAS Oct $105/115 bull call spread at $2, selling 1 BBY 2014 $18 puts for $3.25 for net .75, now $1.80 – up 140% (trade stopped at 150%) –

- 2014 SHLD $32.50 puts sold for $7.50, now $6 – up 20%

- 6 EWJ Jan $9 calls at .53, selling 1 BBY 2014 $18 put at $3.25 for a net .07 credit, still net $2.60 credit – down 3,800% (trade stopped at up 1,000%)

- TNA Oct $55/61 bull call spread at $2.50, selling Oct $42 puts for $1.90 for net .60, now $1.80 – up 200% (stopped at 200%)

While we do go into these trades looking for about 300% (not the short put, of course), when we make a quick 100-150%, we take it off the table and move on to what we call "fresh horses." It should be noted, however, that despite the now highly negative result on the EWJ trade, it now makes a terrific new entry as you can buy those 6 Jan $9s for .44 ($2.64) and sell the BBY 2014 $18 puts, which had dropped below $3, for $4 for a net credit of $1.36 and it could give you a tremendous early pay-off if BBY does get bought out. The EWJs topped out at .63 the same day the short puts bottomed out at $2.90 for net .88 so keep those expectations realistic and you'll do fine on trades like this.

While we do go into these trades looking for about 300% (not the short put, of course), when we make a quick 100-150%, we take it off the table and move on to what we call "fresh horses." It should be noted, however, that despite the now highly negative result on the EWJ trade, it now makes a terrific new entry as you can buy those 6 Jan $9s for .44 ($2.64) and sell the BBY 2014 $18 puts, which had dropped below $3, for $4 for a net credit of $1.36 and it could give you a tremendous early pay-off if BBY does get bought out. The EWJs topped out at .63 the same day the short puts bottomed out at $2.90 for net .88 so keep those expectations realistic and you'll do fine on trades like this.

The following Tuesday, the 21st, our new trade ideas were:

- 2 FAS Oct $107/117 bull call spreads at $2.05, selling 1 BBY 2014 $15 puts for $3.75 for net .35 is now net $1.30 – up 271% (stopped at up 334%)

- AGQ Oct $38/45 bull call spread at $3.10, selling BTU 2014 $20 puts for $3.60 for net .50 credit, now .75 – up 50% (stopped up 236%)

- 3 DIA Oct $135 calls at $4.05, selling 1 HPQ 2014 $20 put for $3.80 for net .25, now -$2.90 – down 1,260%

As I mentioned last Tuesday, when you live by the leverage, you die by the leverage but we took the money and ran on the first two trades, which more than paid for the losses on the third (even assuming you didn't stop out at some point more sensible than down 1,200%) and decided that, since that trade was so "off" that it would be the best one to use for our upside trade last week but we dropped to:

As I mentioned last Tuesday, when you live by the leverage, you die by the leverage but we took the money and ran on the first two trades, which more than paid for the losses on the third (even assuming you didn't stop out at some point more sensible than down 1,200%) and decided that, since that trade was so "off" that it would be the best one to use for our upside trade last week but we dropped to:

- 2 DIA Oct $135 calls at $1.23, selling 1 HPQ 2014 $15 put for $2.30 for net .16, now -.80 – down 600%

Clearly the Dow is not being very kind to the bulls and clearly, if you are a QE believer, this is still a fun way to play the upside – especially if you REALLY want to own 100 shares of HPQ for net $14.20, which is a 16% discount off the current price. So your worst case is owning HPQ for a 16% discount and your best case includes pocketing $1,000 at Dow 14,000 on some happy economic news between now and mid-October. And, of course, if you make that $1,000, then your net cost on 100 shares of HPQ is down to $420!

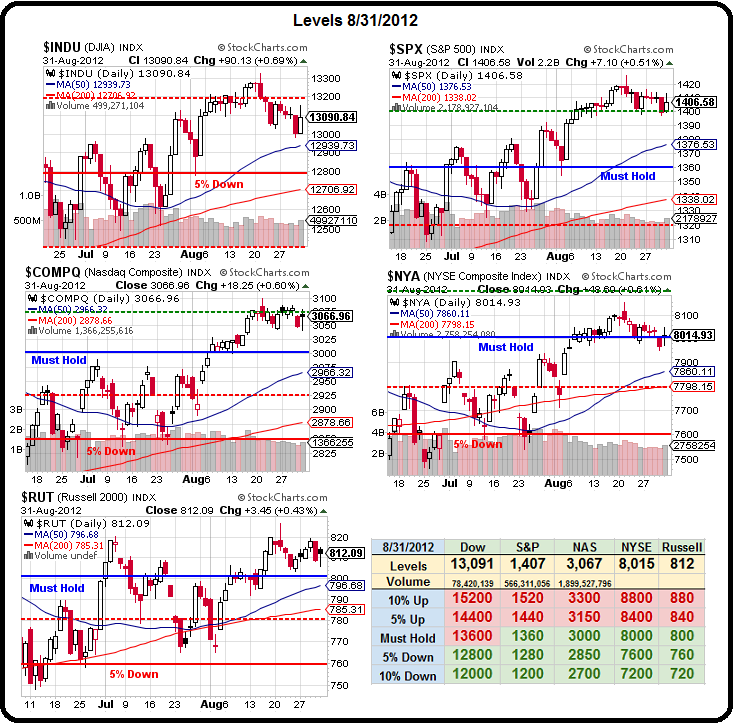

You can see from the Big Chart why we were not too keen on adding more upside hedges in the past two weeks as that top is looking more and more solid every day and it's only been the fear (for the bears) of massive Central Bank intervention that kept us from being much more bearish in our main portfolios. Even our Income Portfolio (Members Only), which is long-term bullish, was augmented with a TZA spread to provide us with an additional $35,000 in downside protection on a 10% drop in the Russell (back to 735).

You can see from the Big Chart why we were not too keen on adding more upside hedges in the past two weeks as that top is looking more and more solid every day and it's only been the fear (for the bears) of massive Central Bank intervention that kept us from being much more bearish in our main portfolios. Even our Income Portfolio (Members Only), which is long-term bullish, was augmented with a TZA spread to provide us with an additional $35,000 in downside protection on a 10% drop in the Russell (back to 735).

Yesterday, we were discussing strategies for setting up a hedge fund and we were forced to conclude that the best thing to do with cash is – STAY IN CASH! This is certainly not a good week to deploy capital in any kind of quantity and, for small positions, the downside is much more attractive than the upside to this market at the moment. Should there be an actual infusion of QE/Stimulus into the Global Economy, then we have plenty of time to BUYBUYBUY but, until then – we remain extremely skeptical.

On the whole, we'll be watching and mostly waiting this week to see how it all plays out.