This rally is never going to end!

This rally is never going to end!

Just look at this chart – we're breaking every level. THIS time is different – not only are we going to go on to 1,450, we're going to 1,500 and 1,550 and then 1,600 and then we're going to 1,700 and 1,800 and 1,900 and then we're going on to take on 2,000 – yeeeeeergh!

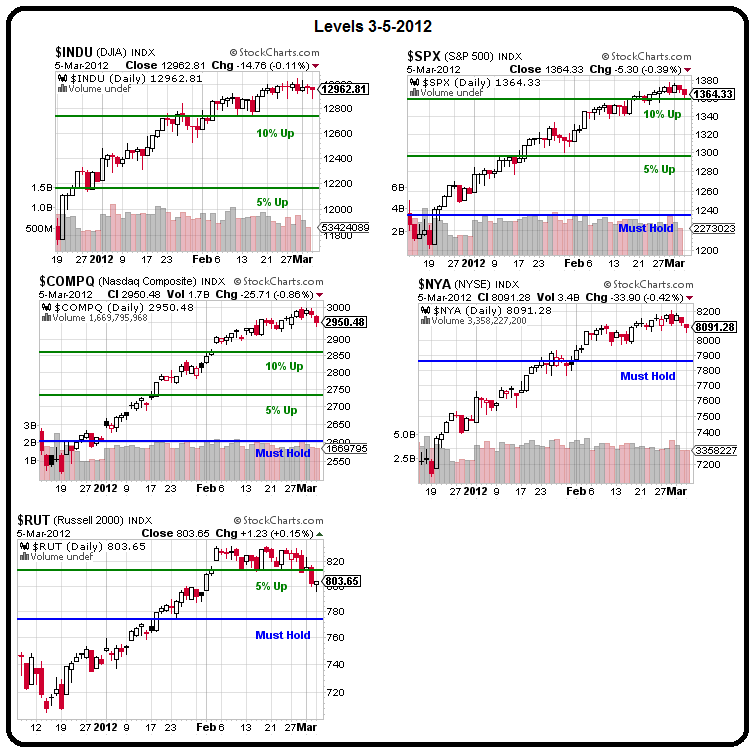

Sorry, I was channeling my inner Dean… Now that I've calmed down, I realize that this chart that got me so excited was actually the chart from March 5th and, as you can see from my end of February headlines like "Sell in March and Go Away," "This is the End – But For Who?" and "Fake-Out Thursday (March 8th) – Dollar Sacrificed on an Altar of Lies" – where I pointed out that rumors of more Fed easing (by John Hilsenrath of the WSJ, of course) had dumped the Dollar to 79 and that was accounting for the 1% gain in the S&P that day so – don't be fooled!

The ECB had just dropped $712,800,000,000 in fresh stimulus on the 29th and I asked "Will Another $712Bn Buy Us Another Day at 13,000?" Was I early? Yes. Did we miss the end of the rally? Yes. In fact, our $25,000 Portfolio at the time was so bearish, we were down almost $8,000 with huge bearish bets like 10 Short XRT March $55 calls, 10 short GLL March $17 puts, 10 April SCO 31/39 bull call spreads and 10 SCO short March $34 puts, 5 short FAS $88 calls, 5 March TZA $18 calls, 10 short SQQQ June $14 puts, 40 USO April $40 puts, 5 short FAS March $75 calls, 10 long FAS March $85 calls and 10 short FAS March $89 calls (a bearish spread), 10 TLT March $114/115 bull call spreads and 10 DIA March $129 puts.

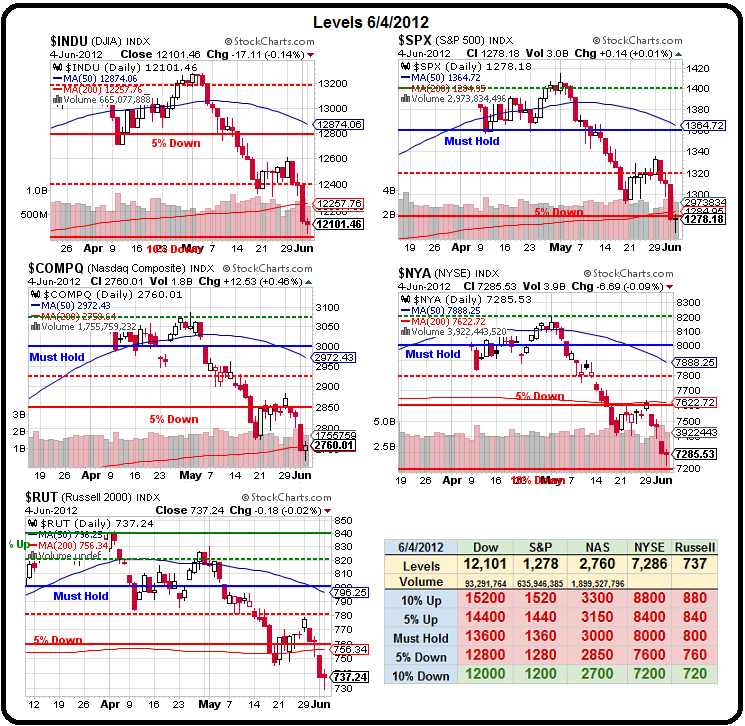

The only bullish play we had at the time in our virtual portfolio was DMND, where we had 4 hopeless June $29 calls which we lucked out on when they spike on rumors in mid-March. Every other bullish position had been dumped and we were practically 100% bearish because the rally, at that point, seemed totally ridiculous. Just a months later, the Portfolio turned around and was up $8,000 and by May 14th, we were UP $16,742 and the Big Chart, by the beginning of June, looked just as ugly to the Downside as it does angelic to the upside now.

The only bullish play we had at the time in our virtual portfolio was DMND, where we had 4 hopeless June $29 calls which we lucked out on when they spike on rumors in mid-March. Every other bullish position had been dumped and we were practically 100% bearish because the rally, at that point, seemed totally ridiculous. Just a months later, the Portfolio turned around and was up $8,000 and by May 14th, we were UP $16,742 and the Big Chart, by the beginning of June, looked just as ugly to the Downside as it does angelic to the upside now.

Just as the MSM had been whipped into a "you just can't lose" buying frenzy back in March (which we made fun of), by early June they were in a selling frenzy and I noted, June 4th: "Monday – "Markets in Turmoil" According to CNBC – Must be Time to Buy!" We were so bullish in that post, we were even long on oil (at $82) and AAPL hit our buy-in point at $555 and we went short on TLT at $130.36, long on TQQQ at $41.96 and XLF at $13.50 – right in that morning's post.

We did a lot of bottom fishing in June and, after a choppy start, things were good enough that we started 2 new $25,000 Portfolios for our Members on the 21st – catching that ongoing rally very nicely. Last Friday, I published our $25KP positions and we were up about $14,000 at the time and very bearish. Thankfully, ahead of Draghi – we took our own advice and added the aggressive bullish trades I suggested on Wednesday and the FAS spread I suggested that morning – the Oct $108/120 bull call spread for $2, selling XLF 2014 $14 puts for $1.55 for net .45 is now net $1.78, up 295% (which was our goal – 300%) in 2 days. That's not a bad way to offset your bearish bets!

We have been making bullish bets like that every Tuesday for the past month as the markets go up and up. It's very easy to make this kind of money in a bull market – the trick is not to lose it all betting on things going the other way. We modified that bet in the $25KP, and offset 10 of the FAS spreads with the short sale of 5 GS Oct $97.50 puts at $1.50 because they gave us a faster payoff (more aggressive) as we didn't really want to hold 2014 short puts in our short-term $25,000 Portfolio.

We have been making bullish bets like that every Tuesday for the past month as the markets go up and up. It's very easy to make this kind of money in a bull market – the trick is not to lose it all betting on things going the other way. We modified that bet in the $25KP, and offset 10 of the FAS spreads with the short sale of 5 GS Oct $97.50 puts at $1.50 because they gave us a faster payoff (more aggressive) as we didn't really want to hold 2014 short puts in our short-term $25,000 Portfolio.

The GS puts dropped to .70 already, so up 53% and, from a cash basis, it was $2,000 for the 10 spreads less $750 for the sale of the GS puts for $1,250 and now the spread is $4,000 and the puts are $400 for net $3,600 – up a quick 188% playing it that way. We also grabbed 10 EDC Oct $97 calls at .80 and they short up to $1.30 yesterday (up 62.5%) but that's nothing as today the Hang Seng jumped 600 points (3%) and Shanghai is up 4% and India is up 2% – thank you Mario!

The real question is – do we keep those trades open or take the money and run? I'm inclined to take the money and run but our $25KPs are VERY bearish and it would be very painful for us if the rally continues next week and we don't have our longs (and just that FAS trade can hit $10,750 in total profits at FAS $120) so we'll probably kill EDC and the short GS puts but leave the FAS spread as a compromise, which will put us fairly short again going into the weekend.

Why can't I just give up and love this rally? Because it's BS, that's why. It's the same BS for the same BS reasons as we were pumped up on back in March. We have to protect the upside, mainly against the Fed doing something next week and FAS is ideal for that but, my prediction from early morning chat already came true when I said to Members (4:40 am):

Why can't I just give up and love this rally? Because it's BS, that's why. It's the same BS for the same BS reasons as we were pumped up on back in March. We have to protect the upside, mainly against the Fed doing something next week and FAS is ideal for that but, my prediction from early morning chat already came true when I said to Members (4:40 am):

Obama didn't talk about jobs. Since he had today's ADP report, I have to think it's going to miss this morning. That could lead to a sharp reversal of yesterday's move but, on the other hand, the bulls may (as usual) take the bad news as good news because it green-lights Uncle Ben for another money drop.

What did move down sharply this morning, on a pathetic jobs report (just 96,000 in July and downward revisions to June and May of 41,000), was the Dollar, which fell from 81.20 to 80.40 (down 1%) and is now masking a massive sell-off in the Futures as oil stays flat against the weakness (even though no one is driving to work) and gold jumps back to $1,730 and silver $33.30 and copper $3.59 and gasoline $3.03. Isn't that great, not only are there not jobs AND shorter work-weeks for those who do have them, but the commodity pushers want our citizens to pay record high prices for gasoline at the same time. Ah Capitalism – it's amazing how thoroughly you can destroy the working class…

What did move down sharply this morning, on a pathetic jobs report (just 96,000 in July and downward revisions to June and May of 41,000), was the Dollar, which fell from 81.20 to 80.40 (down 1%) and is now masking a massive sell-off in the Futures as oil stays flat against the weakness (even though no one is driving to work) and gold jumps back to $1,730 and silver $33.30 and copper $3.59 and gasoline $3.03. Isn't that great, not only are there not jobs AND shorter work-weeks for those who do have them, but the commodity pushers want our citizens to pay record high prices for gasoline at the same time. Ah Capitalism – it's amazing how thoroughly you can destroy the working class…

So, unfortunately, we may still be a bit early on our shorts but we made our adjustments and we offset with good longs and it's QE3 or bust next week so let's all be VERY careful out there!

Have a great weekend,

– Phil