Europe is getting a $650,000,000,000 bailout!

Europe is getting a $650,000,000,000 bailout!

The German courts approved the ESM and the markets are up almost half a point in all the excitement. Stimulus really works, doesn't it? As I have been saying, all this stuff is baked in – the only shocker you'll see is if Uncle Ben fails us – again – tomorrow. For those of you with very short attention spans, he just failed to provide QE3 at Jackson Hole two weeks ago but the markets have rambled higher, unperturbed, because he didn't say he WOULDN'T give us QE3.

What should really worry the bulls this morning is that the Dollar dipped all the way to 79.64 on this fantastic news out of Germany and all the futures managed was to get back to yesterday's highs. Oil had a good old time rocketing to $98 but has already crossed our shorting spot at $97.50 (/CL) and we'll likely take the money and run on any turn back up and short them again AHEAD of inventories, which should show a nice build as the shipping channels re-open.

As noted in Member Chat this morning (among many other things), there are over 600M barrels on order at the NYMEX and as of the 20th, 165M of those barrels have to be rolled to the next 3 months that already have over 500M barrels on pretend order so we can expect some real scrambling out of oil longs between now and next Thursday (we're short on oil with SCO Oct $37 calls, now $2.45 in addition to our Futures targets).

As noted in Member Chat this morning (among many other things), there are over 600M barrels on order at the NYMEX and as of the 20th, 165M of those barrels have to be rolled to the next 3 months that already have over 500M barrels on pretend order so we can expect some real scrambling out of oil longs between now and next Thursday (we're short on oil with SCO Oct $37 calls, now $2.45 in addition to our Futures targets).

What's keeping oil prices from tanking (also discussed this morning) is another round of "Israel Willl Attack Iran By Lunch" articles that seem to crop up every time NYMEX traders find themselves faking demand for more contracts than they can comfortably unload. Usually, that number is 500,000 contracts (1,000 barrels per contract), not 600,0000 and usually the new month they are rolling into only has 40M open barrel orders – not stuffed with 110M barrels already like January is.

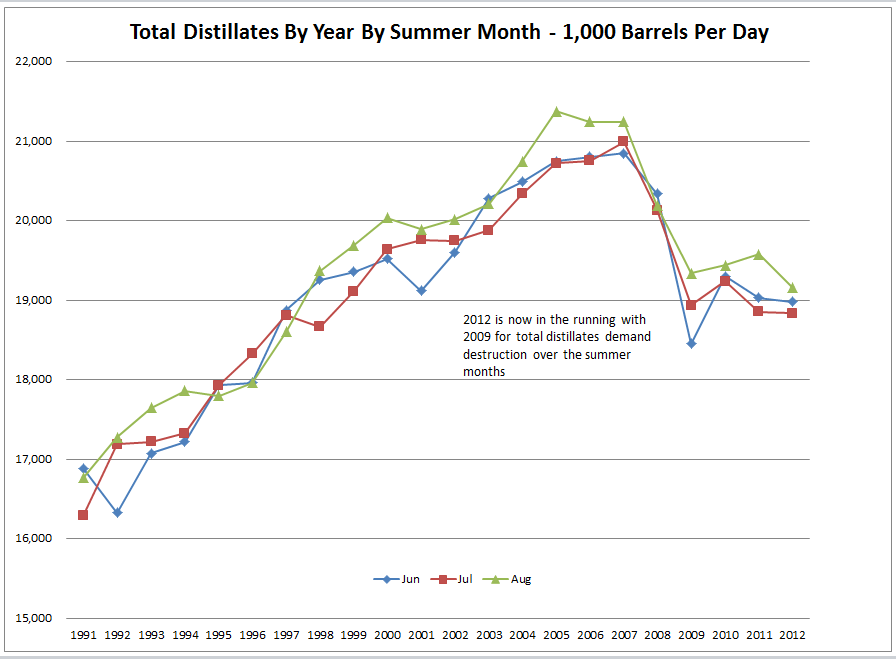

Clearly demand for crude has fallen off the cliff – as evidenced by the chart on the right which illustrates how a combination of the recession and Obama's rising CAFE standards are causing a very steady drop in US demand by as much as 2Mbd less than we used in 2007.

Clearly demand for crude has fallen off the cliff – as evidenced by the chart on the right which illustrates how a combination of the recession and Obama's rising CAFE standards are causing a very steady drop in US demand by as much as 2Mbd less than we used in 2007.

At the same time, we are producing 1.5Mbd more US oil than we did in 2007 and global production is up overall – despite sanctions against Iran knocking 1.5Mb of their oil off the markets. At this point, Iran is down to exporting less than 1Mbd – maybe this is a good time for Israel to attack…

Don't expect a bounce on that chart either. Even if the economy improves and people decide they don't mind paying $60 to fill up the tank, between now and 2025 the evil Obama has decreed that our auto fleet move from today's average 24.1 mpg all the way to 54 mpg – almost halving our current demand! Who knew it would be this easy to solve the energy crisis? Oh yeah, Al Gore almost 20 years ago…. Well who else???

We have $21Bn worth of 10-year notes to sell today at 1pm and tomorrow we sell some 30-years ahead of the Fed, who announce at 12:30 ahead of Bernanke speaking at 1:45 and the official FOMC Forecasts for GDP will be released at 2pm so a wild 30 hours ahead of us starting this morning.

We have $21Bn worth of 10-year notes to sell today at 1pm and tomorrow we sell some 30-years ahead of the Fed, who announce at 12:30 ahead of Bernanke speaking at 1:45 and the official FOMC Forecasts for GDP will be released at 2pm so a wild 30 hours ahead of us starting this morning.

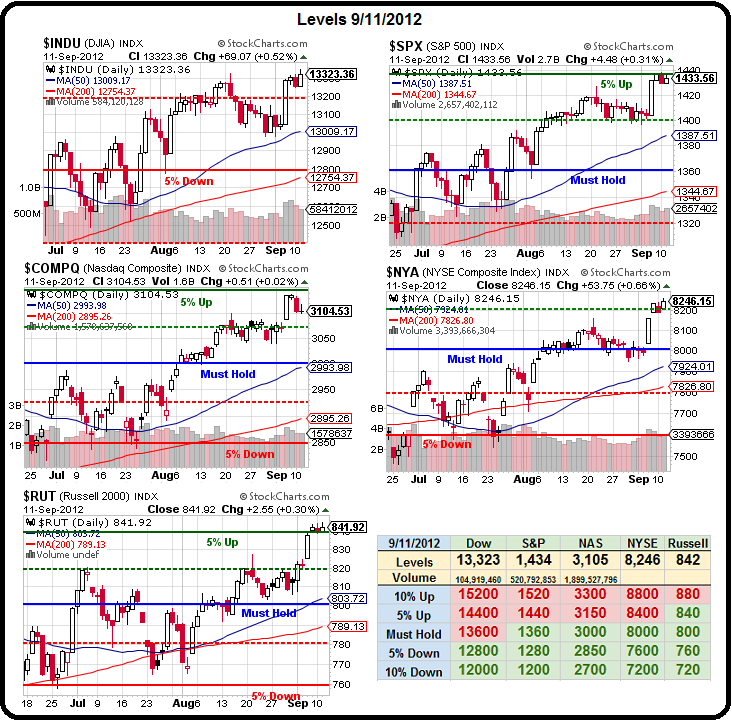

As you can see from our Big Chart – we're painting a pretty picture of a breakout but, as I pointed out to Members last night, this chart was drawn at Dollar 84 – now we're below 80 and we need to move our lines up 5% to compensate. Someone wrote me a note saying it doesn't make sense to adjust the charts because he only buys in Dollars anyway but that is a very false logic.

Imagine we were charting the speed of a race car, trying to measure the results of changes we make to the engine but, along the way, we change our measurements from miles an hour to kilometers per hour but keep the same chart. The numbers would appear to go through the roof but would it be giving you an accurate reading?

The Dollar, which we measure our stocks in, has fallen 5% since August 3rd. The S&P 500 has risen from 1,360 on Aug 3rd to 1,435 – that's 5.5%. This is not brain surgery folks – this is statistical analysis 101 – keep your measurements constant! So, very simply, we need to bump up our lines by 5% (2 notches) and we see that the Dow is still below the 5% down line and still below the 200 dma,, which must be adjusted to 13,392, the S&P is just under the adjusted Must Hold line at 1,440 but well below it's adjusted 50 dma at 1,456, the Nasdaq is also under the Must Hold at 3,150 and just below its adjusted 50 dma at 3,143.

The Dollar, which we measure our stocks in, has fallen 5% since August 3rd. The S&P 500 has risen from 1,360 on Aug 3rd to 1,435 – that's 5.5%. This is not brain surgery folks – this is statistical analysis 101 – keep your measurements constant! So, very simply, we need to bump up our lines by 5% (2 notches) and we see that the Dow is still below the 5% down line and still below the 200 dma,, which must be adjusted to 13,392, the S&P is just under the adjusted Must Hold line at 1,440 but well below it's adjusted 50 dma at 1,456, the Nasdaq is also under the Must Hold at 3,150 and just below its adjusted 50 dma at 3,143.

The NYSE is just over the -2.5% line and just over the adjusted 200 dma at 8,218 but trapped below the adjusted 50 dma at 8,320 and the Russell is almost dead on the must hold line and trying to break it's adjusted 50 dma at 844 and, if you look at the day's chart – you can see how it struggled at that line all day.

We're still ready, willing and able to flip bullish IF we break over our levels but our levels keep rising to keep up with the falling Dollar so we don't get drawn into a false breakout – like the one we are having. We could finally have a real breakout tomorrow if Uncle Ben waves the stimulus wand but, for reasons we discussed yesterday, I simply don't see any rational justification for him to do it.

How disappointed will the markets be when there is no QE in their stockings tomorrow afternoon? It depends on the language the Fed uses in their statement and Bernanke's spin in his speech. Most likely, they will extend their ultra-low rate time-frame to 2015 and like Japan, that can go on for decades. Most likely, the Fed will reiterate they stand ready to help but, if they give specific targets – like unemployment must be under 8% by Q1 or they will act – that might put in the sort of floor investors are looking for to really break us out to new highs as the Fed will essentially be saying they are now defending these market levels.

Anything less will likely be a disappointment that tanks the markets – tune in tomorrow.