What will Ben Bernanke do?

What will Ben Bernanke do?

I've been predicting nothing so this will be a great day for all the Phil bashers if he does. My logic is that, although clearly insane, the Fed Chairman is not so irrational that he will engage in any form of additional Quantitative Easing while stocks and commodities are near all-time highs.

The FOMC will announce their decision at 12:30 and lack of QE language there (which would be a huge change from last to add it) may, by itself, cause the market to drop until 2:15 just after we get the Fed's GDP outlook and then Uncle Ben's press conference, when it's almost a sure thing that he will leave the door open for more QE but, without specific discussions of targets, time-frames and triggers – I'm not sure the same old song and dance is going to do it for markets – who have already had such a huge run-up in anticipation of this event.

As you can see from the chart on the left, QE has come at S&P 800 (no arguing with that one) in November of '08, S&P 1,200 in November of '10 and S&P 1,100 in November of last year, which was extended this June at S&P 1,300.

As you can see from the chart on the left, QE has come at S&P 800 (no arguing with that one) in November of '08, S&P 1,200 in November of '10 and S&P 1,100 in November of last year, which was extended this June at S&P 1,300.

Now the S&P is up 10% from June and jobs and housing are somewhat improving – do we really feel the Fed now feels the NEED to support S&P 1,430 and, are things so dire that the Fed will now act to ease for the 3rd time in 12 months? They didn't do that 600 points ago and they didn't do that 300 points ago but, if you listen to the MSM – now they HAVE to. Really?

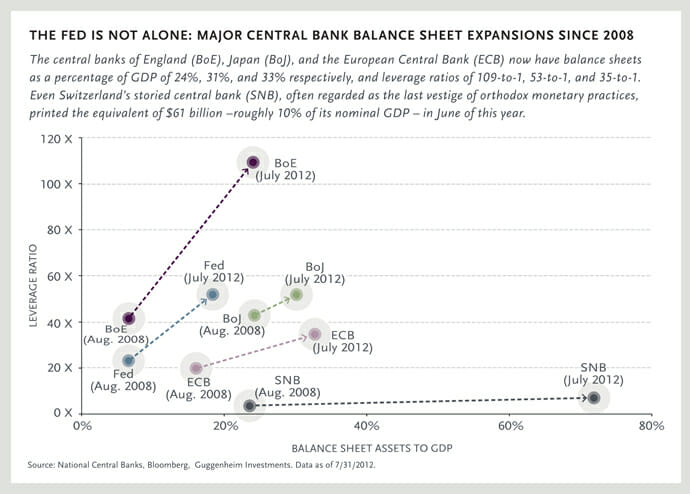

Of course, Central Banksters can remain irrational longer than their countries can remain solvent. Take the Swiss, for example, who just this morning pledged to support the Euro with "unlimited quantities" of currency purchases in order to keep the Franc low – even while cutting both their inflation and growth forecasts. There are just so many things wrong with this combination statement that I don't know where to start…

Of course, Central Banksters can remain irrational longer than their countries can remain solvent. Take the Swiss, for example, who just this morning pledged to support the Euro with "unlimited quantities" of currency purchases in order to keep the Franc low – even while cutting both their inflation and growth forecasts. There are just so many things wrong with this combination statement that I don't know where to start…

The SNB's benchmark interest rate is already zero so, unless they are going to pay us to borrow money (and, if they are, I'll take $30Bn please), there's nowhere to go from there. The Swiss make Bernanke look like a tightwad at 0.25%. What the SNB is illustrating, however, is what a joke money is. It's nothing, it's meaningless and even more so when a small country like Switzerland (GDP $635Bn) tells you they have "unlimited" firepower to fight the $4Tn PER DAY Forex markets.

"Print as many Euros (GDP $16Tn), Dollars (GDP $15Tn), Yen (GDP $6Tn) and Yuan (GDP $7.5Tn) as you want," say the Swiss – "we'll buy them all!" While this sounds awfully nice of the Swiss – it's a lot like if the banker in Monopoly just keeps handing out $500 Bills for no reason – what's the point of playing the game if the money is meaningless? This is the end game of the Global economy if we keep heading down this road – eventually someone is going to knock over the board in frustration and we'll all be very, very screwed.

"Print as many Euros (GDP $16Tn), Dollars (GDP $15Tn), Yen (GDP $6Tn) and Yuan (GDP $7.5Tn) as you want," say the Swiss – "we'll buy them all!" While this sounds awfully nice of the Swiss – it's a lot like if the banker in Monopoly just keeps handing out $500 Bills for no reason – what's the point of playing the game if the money is meaningless? This is the end game of the Global economy if we keep heading down this road – eventually someone is going to knock over the board in frustration and we'll all be very, very screwed.

This morning, we got a couple of signs that all this easy money sloshing around is already pushing inflation to uncomfortable levels. First of all, NYC's Apartment Vacancy Rate has hit a 3-year high as renters are being driven out of the market by rising prices. Then we got the PPI report, which jumped a stunning 1.7% from 0.3% in July. Ex food and energy, the core PPI is "only" rising 0.2% per month (still faster than wages) but somewhere between 0.2% and 1.7% per month is reality and you can ask the 382,000 people who lost their jobs last week which one they feel is closer….

Given this data, tomorrow's CPI Report is likely to be about 0.6% – a 7.2% annualized rate of inflation. Is this the environment for more QE? We'll find out this afternoon.