NEW: Newsletters writers are available to chat with Members, comments are found below each post.

While Stock World Weekly is on vacation, please enjoy the Market Shadows newsletter.

Market Shadows Newsletter: Pumping It Up

(Musical accompaniment: "Pump it up, until you can feel it, Pump it up, when you don't really need it…" Elvis Costello)

Full newsletter: MarketShadows "Pumping it Up" (Sept. 16 2012)

Highlights:

Quantitative – INFINITE – easing (QE) will again be the central and primary force driving our financial markets into the foreseeable and not-so-foreseeable future. Dr. Ben Bernanke stepped on the gas of his incredible money-printing machine. His monster, Bernankenstein, is showing no signs of fatigue.

QE is not new. Our neighbor to the West, Japan, embarked on this process over 20 years ago. In 1989 in Japan, asset prices were in a bubble. In some areas of the country, the price per square foot of real estate hit $139,000. When the Japanese real estate market and the Tokyo stock exchange jointly collapsed, trillions of dollars were wiped out. Japan's economy had been driven by its high rates of reinvestment, so the crash hit particularly hard. Subsequently, investments were increasingly directed out of the country (China, India).

As a repercussion of the loss of investment, Japanese manufacturing firms soon lost a significant degree of their technological edge. The negative effects combined, and Japanese products became less competitive overseas. Lower consumption both internally and externally began feeding a deflationary spiral that has not ended yet.

Popular financial blogger Mish Shedlock has been arguing, correctly, that the US will "go in and out of deflation over a period of years, just like Japan."

Mish defines his terms as follows:

- Inflation: a net increase in money supply and credit, with credit marked-to- market.

- Deflation: a net decrease in money supply and credit, with credit marked-to- market.

According to Mish, "If one woodenly sticks to the view that inflation and deflation are about prices (while ignoring a devastating collapse in housing), then yes, the US is still in a period of inflation. Likewise, if one foolishly sticks to measures of money supply like M1, M2,.. then the US is also in a period of inflation.

“[But] neither money supply nor the CPI can adequately explain interest rates, housing prices, lack of jobs, and numerous other real-world phenomena. In the real-world, in a credit-based economy, it is credit that matters." (Zero Hedge Provides Empirical Proof of Deflation (However, He Does Not Even Realize It))

Mish: "Failure to include credit in the definition of inflation and the analysis of economic activity causes many problems. Credit influences consumer prices, jobs creation, and asset prices. The mark-to-market value of credit influences the ability and willingness of banks to lend.

"From a practical standpoint of economic analysis of the economy, debt-deflation (deflation) and consumer deleveraging is of paramount importance and is likely to remain of paramount importance for some time, no matter what definition one assigns to the process." (Yes Virginia, U.S. Back in Deflation; Inflation Scare Ends; Hyperinflationists Wrong Twice Over)

There are many ways deflation hurts an economy:

- De-leveraging: The high debt of house- holds and corporations cause people to increase savings, decrease spending, and pay down debts. This takes cash out of circulation.

- Bank lending: In the face of falling asset prices (house prices), banks become less willing to lend. This lending con- straint causes ripple effects, as capital goods and services become underuti- lized.

- Wealth effect: Asset prices (houses, stocks) decline, spending decreases.

- Manufacturing/production: At optimal capacity, what goes into an assembly line comes out for consumption. When money is tight, demand decreases, inventories rise, and prices fall.

- Lower profit margins: Profit margins come under pressure. This leads to higher unemployment as firms cut costs. Weaker profit margins often translate into lower stock prices.

- Employment: Employees are expensive. Employment usually takes a hit early in a deflationary cycle. This can lead to more de-leveraging, as people shift from spending to paying off debt.

- Decreasing spending: Consumers post- pone purchases when they expect pric- es to fall.

- Increasing debts: The real value of debt rises as price levels fall. This also de- creases spending.

- Real borrowing costs increase during deflationary periods because prices are falling. The relative interest paid on loans increases. This inhibits borrowing.

QE is a mechanism to lower interest rates, in line with declining asset prices. In 1990, the Japanese economy began its deflationary phase. The Bank of Japan (BOJ) lowered interest rates to 0% (a form of quantitative easing). Interest rates have remained low. The BOJ has also thrown billions of dollars into the economy by buying bonds and printing money, to keep Japan’s manufacturing edge alive. Twenty years later, the Japanese economy continues to struggle with a deflationary economy.

QE is a mechanism to lower interest rates, in line with declining asset prices. In 1990, the Japanese economy began its deflationary phase. The Bank of Japan (BOJ) lowered interest rates to 0% (a form of quantitative easing). Interest rates have remained low. The BOJ has also thrown billions of dollars into the economy by buying bonds and printing money, to keep Japan’s manufacturing edge alive. Twenty years later, the Japanese economy continues to struggle with a deflationary economy.

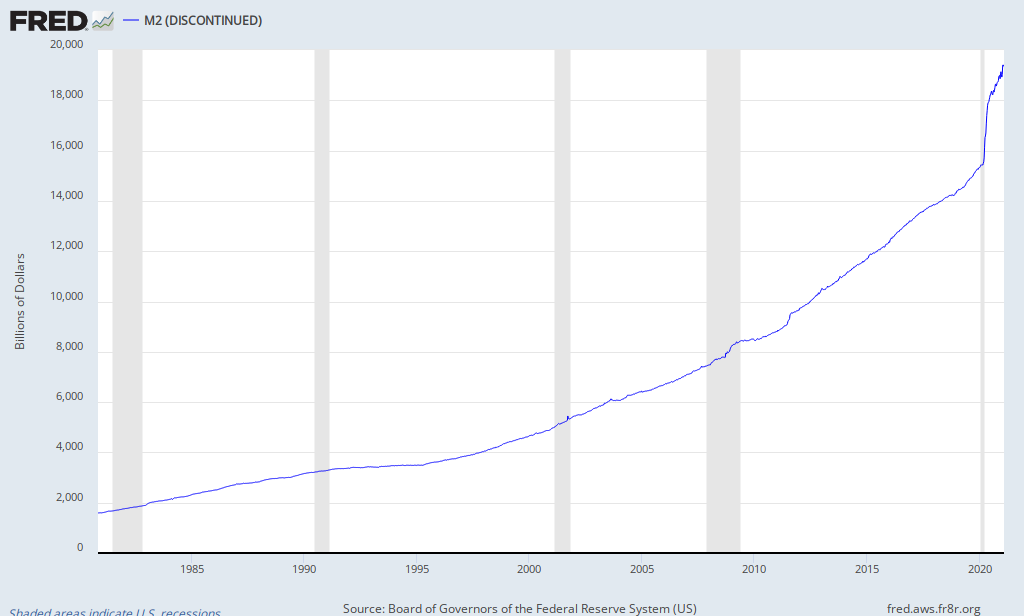

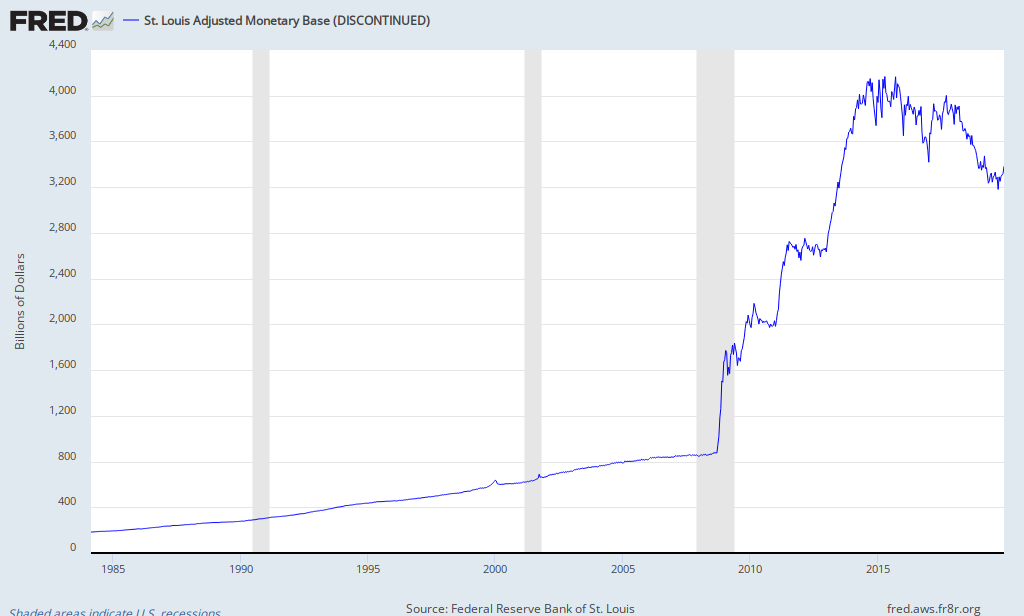

In the US, we have a similar situation. Dr. Bernankenstein’s objective is to put a floor under home prices and to stimulate hiring. The money supply is at all time highs (see charts below). The Fed wants the banks to lend. Banks can lend to the Fed and get a return on their cash, because they can borrow from the Fed at 0%, and buy 10 year bonds for 1.8%. That benefit, captured by the banks, does not trickle down to the average person, but Bernanke claims it does.

Mish also noted, "That money supply would spike in deflation is counterintuitive. Yet, if one concentrates on expectations of what the Fed would do to combat deflation, that expectation is crystal clear. However, like a drug addict on heroin, the medicine has worn off. The money sits as excess reserves at the central bank."

Pragmatic Capitalism reported: “In today’s press conference Q&A Dr. Bernanke said something that I believe confirms this view. Pedro da Costa asked how the transmission mechanism works and why QE is different than trickle down economics since it seems to boost Wall Street, but doesn’t do much else. The Fed Chief answered:

"‘The tools we have involve affecting financial asset prices. Those are the tools of monetary policy. There are a number of different channels. Mortgage rates, other rates, I mentioned corporate bond rates. Also the prices of various assets. For example, the prices of homes. To the extent that the prices of homes begin to rise, consumers will feel wealthier, they’ll begin to feel more disposed to spend. If home prices are rising they may feel more may be more willing to buy home because they think they’ll make a better return on that purchase. So house prices is one vehicle. Stock prices… The issue here is whether improving asset prices will make people more willing to spend… If people feel their financial position is better they’ll be more likely to spend….’”

In his teachings, Hyman Minsky discussed how Ponzi finance and financial instability distort asset prices and financial markets. With the Fed's incessant QE-Infinity (money printing) practices, our economy is continually reaching new heights in Ponzi financing. Asset prices reflect the summation of the decisions of the inefficient participants who are buying and selling of those assets and, as PragCap notes, “Irrational human decision making leads people to chase asset prices and underestimate the degree to which stability results in instability. The recent housing bubble and chasing of assets should have made this more than abundantly clear, but myths persist…” (A Disturbing Look Inside the Mind of Ben Bernanke)

Even though the banks are flush with cash, they are saying that there is no demand for loans. But senior loan officers seem to disagree, according to a Fed survey. There has been a reversal of demand for loans for primary residences since the month before QE1 began and continuing through the most recent survey. Current demand for mortgages on primary residences is up significantly, an exact reversal from October 2008. Yet, the banks’ willingness to lend is increasing at a far slower pace.” (Tables below, WStreet.com)…

In the current situation, with commodities and staples at all time highs, and even the stock market hitting levels last seen in 2007, why would the Fed launch QE3?

Bruce Krasting speculated that Dr. Bernankenstein’s purpose is to do exactly what he's already done, increase inflation expectations. (Note the spike on the right of the chart, below.) His goal may be to counter the natural deflationary course we are on by unleashing inflationary forces.

“The sick part of this is that if Bernanke saw this graph, he would cry with tears of happiness. This is exactly what he was pray- ing for. Ben thinks that inflation is a good thing. That it will cause demand to be pulled forward as people realize that things are going to cost more tomorrow than they do today.

.

“I suspect Ben is right. Higher inflation expectations in the US will filter around the globe. Post the extraordinary steps Ben took yesterday, people will be stocking up on “stuff.” Things like rice, flour, cooking oil, soy, wheat and sugar. If you can eat it, buy it now. It will be more expensive in a month. While your at it, fill up the gas tank, the price is going up next week and every week for the next few months.

.

“Ben doesn’t care about that stuff. He ignores this altogether. Maybe he’s right, after all, food and energy are really not so important to the 7Bn folks who happen to be passing through this decade, right?” (Bruce Krasting, Ben Wins – Who Loses?)

Mish also discussed the Fed's motivation for QE-Infinity in Panic!: "So what is Bernanke panicked about? One word: 'jobs.' If you want a second word it's 'recession.' I covered both aspects last Friday in 'Yes Virginia, It's a Recession.'

"Yesterday I was asked if the services ISM changed my view about the US being in re- cession. I responded that I wanted to see today's job report first. Well I have seen it and the report is nothing short of a certified disaster….

"Were it not for people dropping out of the labor force, the unemployment rate would be well over 11%.

.

"Over the past several years people have dropped out of the labor force at an astounding, almost unbelievable rate, hold- ing the unemployment rate artificially low. Some of this was due to major revisions last month on account of the 2010 census finally factored in. However, most of it is simply economic weakness.

.

"In the last year, the civilian population rose by 3,695,000. Yet the labor force only rose by 971,000.

.

"Those not in the labor force rose by 2,723,000 to yet another record high 88,921,000.

.

"That is an amazing 'achievement' to say the least, and one that has the Fed in panic mode." (Panic!)

The Fed is panicking about unemployment and seems to believe, counter to evidence, that more QE will help stimulate employment. We disagree with Ben. It is more likely that the unintended (or at least negative) consequences – inflation in food and energy prices, and loss value in the US dollar – will cause more problems than the Fed is anticipating.

…

Read more in MarketShadows: Pumping it Up (9/16)

-

Charting the Universe, with Allan and Springheel Jack – both are bullish.

-

Pharmboy's new long positions, and an updated Market Shadows Virtual Portfolio.

-

Glimpse into the future, includes my interview about QE-Infinity with Lee Adler.

***

Visit Market Shadows on Facebook here.

Frankenstein picture via Jesse’s Cafe Americain