What's wrong with the Dow?

What's wrong with the Dow?

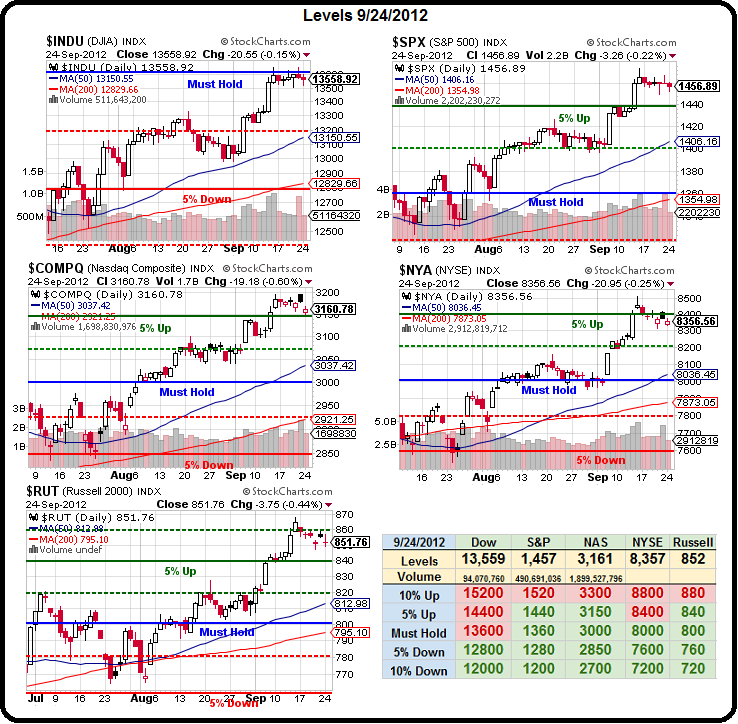

Weighed down by Transports, the Dow is our only index unable to break over the Must Hold line – the same Must Hold line, at 13,600, that we've been using all year to see if a rally is real or not. In March and April, it was decidedly not and the Dow was our canary in the coal mine, letting us know the broad markets were not as strong as we thought. Now, with the help of QE3 and the anticipation leading up to it, the Dow is making a really good attempt at the 13,600 line but, so far, no closes over the line.

This is not even our Dollar-adjusted levels – that's a very big concern. With Dollar-adjusted levels (up 5%) then all of our indexes are in trouble as we're barely hanging on to those +5% lines on our Big Chart.

At the moment, the Dow is acting like an anchor and the other indices are going to have a very hard time moving more than 7.5% away from the Dow so it's a good idea to look at the components to see if we have any room to run. CVX and XOM, for example, are major components in the price-weighted index, accounting for $210 out of $1,765 (12%) and we think oil is toppy here so no help from those two.

AXP, BAC, GE, JPM and TRV represent the Financials at $199 for 11% and those should have room to grow under QE3 so let's say a conservative 20% for $40 more in that group. AA, BA, CAT, DD, and UTX actually make stuff for $301 (17%) and you would think the weak Dollar would be great for them but CAT just warned this morning and lowered guidance so we'll call this group neutral at best.

Tech is well represented with CSCO, HPQ, IBM, INTC, MSFT, T and VZ (better than separate Telco category) at $378 (21.5%) and they have been mixed this year and should have room to run if Q3 earnings aren't terrible – call it 10% for $38 there. That leaves consumerish stocks like DIS, HD, JNJ, KO, MCD, MMM, PG and WMT at $482 (27%) who have little room to improve and, finally, health care stocks: JNJ, MRK, PFE & UNH with $194 (11%) who are not likely to do anything ahead of the elections.

So, we're just finding $78 of likely improvements in the near future and that's just 4.4% – not exactly rally fuel is it? No wonder the Dow is having so much trouble getting over the Must Hold line – it's already exhausted! But, on the other hand, we don't have any particular reason to short it at the moment so we'll just have to watch earnings very, very closely in the weeks ahead.

Europe and Asia were flat this morning but our Futures got a pop as the Dollar was smacked back below the 79.40 line at just about 8:30 – whatever it takes to boost the market, I guess…

Europe and Asia were flat this morning but our Futures got a pop as the Dollar was smacked back below the 79.40 line at just about 8:30 – whatever it takes to boost the market, I guess…

Credit card data highlight the uneven nature of the recovery as flat usage nationwide masks continued shrinkage in areas where the housing bust hit worst, according to data from Equifax. Total credit card debt of $585.3B is 22% off from the October peak. "We are seeing the trend of the 'disciplined consumer.'" says Trey Loughran. We're short V and, as noted above, this does not bode well for our consumer sector ALTHOUGH an optimist would say consumers have a lot of spending power saved up for the holidays.

ICSC Retail Store Sales are up 0.6% this week after dropping 2.5% last week and, although that's still down net 1.9% – it does seem to be helping the futures just a bit (8:55). As you can see by the chart – attempts by consumers to cut their gas bills by driving less are being negated by the relentless rise in fuel prices – contrary to all laws of supply and demand. In fact, Despite a drop in crude prices from near $100 /bbl three weeks ago to ~$92, AAA's daily report shows the U.S. average price for regular is $3.810/gallon, down a bit from last week but up from $3.748 a month ago.

International regulators have withdrawn proposals for tougher oversight of the physical oil market after opposition from the IEA, OPEC and major oil companies, the FT reports. Regulators had wanted to use only completed deals to set benchmarks and enforce mandatory reporting of transaction data, but will settle for the current system of bids and offers despite acknowledging the potential for manipulation. Think about this – the IEA objects to properly reporting oil prices and lobbies to maintain the current corrupt, manipulated system (see last week's commentary).

International regulators have withdrawn proposals for tougher oversight of the physical oil market after opposition from the IEA, OPEC and major oil companies, the FT reports. Regulators had wanted to use only completed deals to set benchmarks and enforce mandatory reporting of transaction data, but will settle for the current system of bids and offers despite acknowledging the potential for manipulation. Think about this – the IEA objects to properly reporting oil prices and lobbies to maintain the current corrupt, manipulated system (see last week's commentary).

Who lobbies on behalf of the people? No one. This planet is like an Old West town that has been taken over by bandits…

Nonetheless, we can't beat them so we join them and we have been adding some bullish plays to our Income Portfolio (updated for Members yesterday), maintaining TZA ($13.88) as our primary hedge but are still fairly balanced in our $25,000 Portfolio – taking advantage of the dip in the Qs yesterday to go long on them as well as AAPL (as planned in the morning post).

After all, as I pointed out to Members in yesterday's chat – the Fed plans to spend $85Bn a month for the next 3 months boosting the economy. That's a pace of $1.02Tn a year in a $15Tn Appleconomy – a fitting 6.66% from the evil Central Banksters. Even if you think QE3 is a poor program and is only 25% effective – it's still a 1.5% pop in GDP – not something we can ignore.

Sure the data still sucks but we have plenty of fuel now for a Santa Clause Rally. Last year we sold off in October and made it all back in November/December and that rally ran from S&P 1,100 to 1,400 (27%) and that was just on Operation Twist. Now we have QE3 and the S&P ran up from 1,300 to 1,450 in anticipation but that's only 10% – it's not unreasonable to expect another 10% before we're done. All we have to do is hope Europe or China or Japan don't blow up too soon.