September 13th.

September 13th.

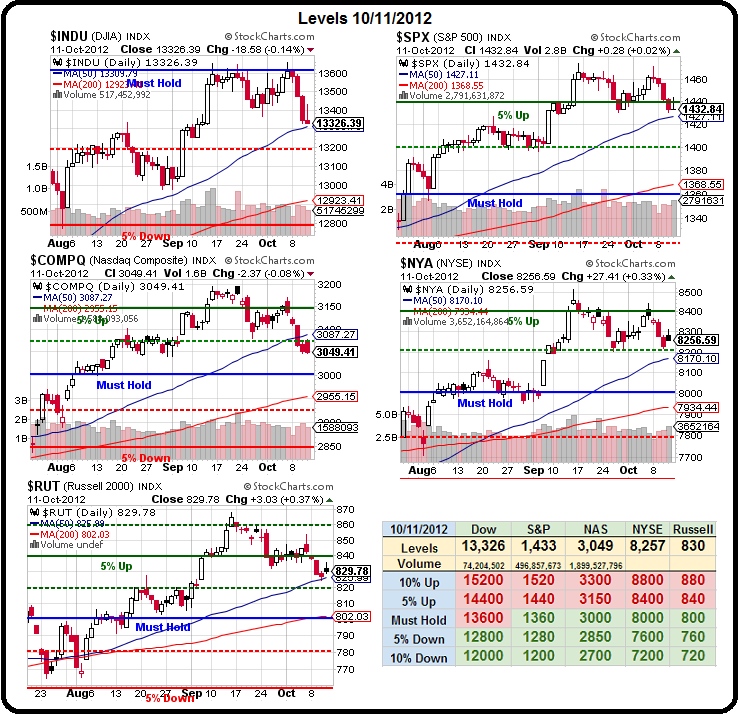

That was the day the Fed announced QInfinity and the Dow gained 200 points from 13,329 to 13,539 and the next day we topped out at 13,596 and held just under 13,600 until October 9th (Tuesday, in case you lost track) when we dropped 100 points and now, we're back at 13,326 – on the road to nowhere – exactly one month later.

Does that make sense? Now, I was the first to argue that the run-up to QE was already overdone and that NOT getting QE that Thursday would have been a complete disaster but we not only did get QE3 but the Fed threw in QE4, 5 and 6 for good measure – making it very clear they were never going to stop giving us free money – unless someone stopped them.

So what could have gone wrong? Mitt Romney. Actually it was Barack Obama – he blew the debate and that allowed people to believe Romney actually had a chance and suddenly Romney's fatwah against Bernanke became an issue people were taking seriously. Maybe QInfinity was only going to be QUntil Romney takes office. That spooked investors and, suddenly, all the gains of QEvaporated in just one week.

We all know that Republicans are generally stock market poison in the best of times but putting one in charge during a recession – well, you would think Hoover, Nixon/Ford and Bush would have taught us a lesson but Romney's chicken in every pot performance last week gave Conservatives hope that soon they would have a chance to destroy the US Economy – just 4 years after they already destroyed it!

And you can't blame the GOP – expanding Government spending (while saying they are cutting it), robbing from the poor and giving to the rich, destroying the environment, throwing the poor, seniors, students, veterans and the middle class under the bus and charging $5 a gallon to fill that bus up with fuel while avoiding all taxes is what they do – it's like inviting a bunch of tigers over for dinner and then being upset when you realize they'd rather eat you than the macaroni and cheese they said "would be fine."

No, we blame Obama for this week's poor market performance because he raised the specter of a possible Romney victory in 30 days and now we can thank Joe Biden for today's rally (if any) as InTrade shows a very quick turn-around in Obama's chances (never went below 60%) of being re-elected next month after last night's debate. Notice how the chart on the right a mirrors the market performance of the past month – from a momentum standpoint, this may have been a pause that refreshes as we move back to 80% over the next few weeks but that is now solely up to Obama, who cannot repeat last week's debate debacle or I may have to vote for Romney myself!

No, we blame Obama for this week's poor market performance because he raised the specter of a possible Romney victory in 30 days and now we can thank Joe Biden for today's rally (if any) as InTrade shows a very quick turn-around in Obama's chances (never went below 60%) of being re-elected next month after last night's debate. Notice how the chart on the right a mirrors the market performance of the past month – from a momentum standpoint, this may have been a pause that refreshes as we move back to 80% over the next few weeks but that is now solely up to Obama, who cannot repeat last week's debate debacle or I may have to vote for Romney myself!

Asia was fairly flat this morning and Europe is flat despite a surprisingly strong Industrial Production report (+0.6% vs -0.4% expected) and our September Producer Price Index came in hot at 1.1% but the Fed's beloved Core PPI (for all those who survive without food or energy) was up just 0.1%, down from 0.2% prior (rounding error). WFC beat earnings by a penny but missed revenues by 1% and they are down about 2.5% in a very unforgiving pre-market. JPM, on the other hand, beat by .18 (about 15%) and beat revenues by another $2Bn (7%) and all that is doing is leaving them flat pre-market because total loans and net interest margin both declined over last quarter.

Impacting the entire XLF, regulatory guidance (page 8) forced $825M in charge-offs on mortgage loans. WFC had $576M in charge-offs and, while both of these banks can well afford it, that may not be the case for BAC and C who don't make anything near JPM's $4.5Bn per quarter.

Impacting the entire XLF, regulatory guidance (page 8) forced $825M in charge-offs on mortgage loans. WFC had $576M in charge-offs and, while both of these banks can well afford it, that may not be the case for BAC and C who don't make anything near JPM's $4.5Bn per quarter.

Speaking of companies making $10Bn a quarter, AAPL continued to be slapped around yesterday, failing to hold $630 and finishing at $628.10 for the day. We now have a firm date for the IPad Mini, on October 23rd, which is one week after the original rumored roll-out of Oct 17th. That takes October out of the sales picture for the Mini but still leaves room for December revenue to punch over $55Bn (was $46Bn last year) with net income possibly as high as $15Bn in what AAPL considers Q1 of 2013.

To put that number in perspective – AAPL's total REVENUES in 2007 were $25Bn with a $3.5Bn profit when the stock traded between $100 and $200 per share. Now AAPL is making $3.5Bn PER MONTH (12x) and is trading at about 4-5x higher – seems like a good deal to me…

We'll see if we get a Biden Bounce today but it is Friday and a lot of weekly options expiring has changed the weekly dynamics so we tend to flatline on Fridays. We have Consumer Sentiment at 9:55 and we'd better do better than last month's pathetic 78.3 reading but it won't matter until 12:35, when the Fed's Lacker (hawk) gives a probably depressing speech titled "Challenges to Economic Growth" at the University of Virgina (speaking to a Washington audience). No doubt the words "fiscal cliff" will be bandied about.

If we survive that, it could be a decent day.

Have a nice weekend,

– Phil