NEW: Newsletter writers are available to chat with Members regarding topics presented in newsletters, comments are found below each post.

Value in the eye of the storm

Here’s this week’s newsletter: Value in the eye of the storm (takes a couple clicks to get to)

Here’s this week’s newsletter: Value in the eye of the storm (takes a couple clicks to get to)

One of the best. Please give us your feedback in comments below.

Random Excerpts:

Third quarter Gross Domestic Product (GDP) showed that the US economy expanded more than forecast (2% vs. 1.8%). The increase was due to consumer spending, a rebound in government outlays, and gains in residential construction. The housing market is improving (see last week’s A Little Perspective)…

Nevertheless, since September 1, North American companies have announced plans to eliminate more than 62,600 positions at home and abroad. This is the biggest two-month drop since 2010…

As discussed with Jesse of Jesse’s Cafe Americain in “As Far As The Eye Can See: Stagnation,” consumers are suffering from wage stagnation. Interest rates are being kept artificially low by the Federal Reserve buying government bonds. Foreign money has also moved into US bonds, as lending money to EU countries has become more risky. Thus US bond prices, supported by the Fed and by inflows from foreign countries, are higher – some would argue in a bubble.

Barry Ritholtz’s chart shows that the correlation between the S&P and treasuries has generally been positive, averaging +0.2 between 1875 and 2002 – stocks up, bonds up, yields down. Lower yields push people out of bonds, towards equities. But since 2002, the correlation has been negative (-0.3). As Barry Ritholz noted, “The problem is that the last ten years were an outlier…”

Arguing that stocks are not cheap, John Hussman wrote, “The enormous volume of debt being held at high valuations should be a red flag for bond market investors, but is it a green flag for stocks?

“According to Ned Davis Research… Valuations are wicked once you normalize for profit margins… Stock valuations are not depressed as a share of the economy. Rather, they are elevated because they assume that the highest profit margins in history will be sustained indefinitely (despite those profit margins being dependent on massive budget deficits – see Too Little to Lock In for the accounting relationships on this). In my view, there are red flags all around.” (The Data-Generating Process)

Dr. Paul Price of Beating Buffett (this week’s featured author) takes the other side: ”We now live in a world with fiat-based paper money being printed with impunity. There are no risk- free assets anymore, anywhere. Good-quality stocks offer the best chance of protecting your wealth in the times to come. Bonds are in the biggest bubble in the history of the world. I own none. While shares could get hit short-term, I think holding paper money is a bigger risk than owning stocks of firms with low or no debt.”

Paul disagrees with the general gloominess about stocks. In his opinion, bad news sells, and scaring people out of stocks is a media tactic to attract viewers:

Scare Tactics – Prepare Yourself to be Bombarded

Last Tuesday’s 243 point drop in the DJIA represented an unpleasant 1.82% daily de- cline. It came just days after the broad market set a post-2007 high. After the dip the DJ In- dustrial index is still plus 7.2% year to date. The S&P 500 was down a relatively lesser 20.71 points or (1.44%). It’s still ahead by 12.4% YTD.

Would you panic if a $10 stock went down 18 cents? Why, then, should you be getting sweaty palms when the DJIA makes the same percentage move to the downside?

Probably because of click-producing, real- time charts like the ones below…

“I Never Met a Rich Pessimist”

Paul takes these words to heart in investing. We have to be hopeful about something (even if it’s the assent of gold, farmland and guns). We need a plan, a strategy. Without those, what begins as trading or investing often ends in chaos and regrets.

Paul’s recent article ”Stop Calling Markets, Start Buying Individual Values” explains his philosophy of not relying on isolated chart patterns and absolute numbers… Paul’s goal, in a nutshell, seems be to “buy low, sell high.” In looking at stock prices, Paul considers many company-specific factors. But in looking at the indices, he weighs macro-economic factors more heavily.

For example, Paul noted that when the DJIA peaked in October of 2007, the trailing P/E for the index was 17.7x. That’s high by historical standards. The chart below compares the valuations (P/Es) of stocks in the DJIA in October, 2007, to valuations today.

Never Met a Rich Pessimist: Interview with Dr. Paul Price

Excerpt:

Ilene: According to your research, lately, higher corporate profits have placed trailing and forward P/Es at discounts to “normalized” market valuations. After the recent weakness in earnings, do you still believe that stocks are trading at discounts?

Paul: The overall market appears somewhat undervalued but there is a wide variation among individual stocks. I see both great bargains and some very overpriced compa- nies.

….

Ilene: Recently, you wrote,

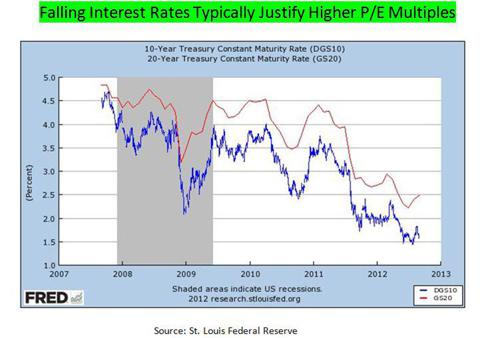

“Equities must always compete with fixed income when fighting for market share of the total investment dollars that need to be put to work. CD, Treasury bond and corpo- rate bond coupon rates have an inverse effect on where P/E ratios tend to settle out.

“When risk-free returns are high, multiples tend to be low and vice versa. Both 10 and 20-year rates have plummeted over the past five years. In theory, P/E multiples should now be way above what they were at the time the DJIA peaked in 2007. Instead we have exactly the opposite situation.”

Why do you think there’s a discrepancy between the lower yields, and lower than normal P/Es?

Paul: These are unprecedented times. The Fed’s artificially low interest rates make any fixed-income investment a guaranteed loser.

Typically, rates even higher than today’s would have sent the market soaring to new heights. Even a 20 multiple equals a 5% after-tax return. That means anything less than an outrageously high P/E offers a better return than bonds, CDs or treasuries…

Also in the newsletter: Springheel Jack’s Speculative Buys, Paul’s Exploration into Value Stocks and

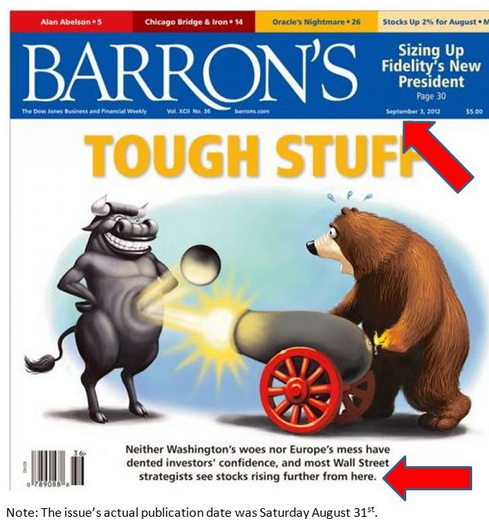

Schizophrenic ‘Rear-View Mirror’ Covers from Barrons

Barron’s weekly investment magazine is published by Dow Jones. Many people seek it out for insights into how best to play the financial markets.

Two fairly recent cover stories show that Barrons really is telling you what’s already happened rather than what is likely to come along next. Their September 3, 2012 issue (published Aug. 31) pictured an indestructible Bull while noting that, “Most Wall Street strategists see stocks rising further from here.”…

Click here to go to MarketShadows (10/29): Value in the Eye of the Storm