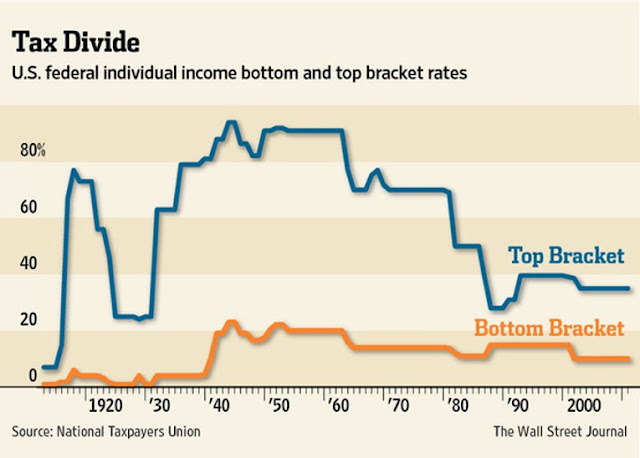

US Tax Brackets Spread For the Past 100 Years and the Concentration of Economic Decision Making

Courtesy of Jesse's Cafe Americain

These are the nominal rates and do not account for tax shelters and deductions. This also does not include non-income taxes such as the federal gasoline tax.

Below this I also include a chart that shows the share of income obtained by the top 1%. I am not necessarily implying that low tax rates on the wealthy leads to a greater share of income for them, in a causal manner.

I think it is a correlation, that low tax rates for the wealthy are an artifact of their increased political power because of wealth obtained by other means, whether it be through monopolies, changes in public policy, cartels, financial fraud, technological change, and quite often corruption.

There should be little doubt from the last chart that the great turning point occurred during the Reagan era, but that it also obtained a 'second life' during the second term of Clinton and the beginning of the twin financial bubbles in tech and housing.

What was damaging in the Reagan philosophy was not so much any change in tax rates, but the promotion of the idea that the rule of unfettered markets was naturally superior to the rule of law, with beneficial effects for everyone. What this ignores is the tendency of unregulated markets to duopoly, monopoly, cartels, frauds and spectacular failures.

I hypothesize that not only does 'supply side economics' not work, but rather, a concentration of wealth and political power in the top one percent actually tends to drag down the overall well-being of the country in terms of robust growth and median standards of living.

This concentration of economic decision making tends to 'starve' the real economy by dampening aggregate demand, and distorting investment from the real to the artificial, particular, and ostentatious, in the manner of many third world oligarchies. It is similar to the concept that decisions made across the broadest number of market participants tend to be the most correct.

This is a somewhat counter-intuitive observation, that a ruling elite tends to 'get it wrong' as compared to a more broadly based decision model in a transparent information model, because their perspective tends more to distortion and group-think as compared to one that includes a reasonably educated and informed middle class. In other words, for all its flaws, democracy works when information flows.

Oligarchies never work, because benevolent dictatorships are mythical for many of the same reasons as the naturally efficient markets model.

Or as Lord Acton put it so succinctly some years ago:

"Where you have a concentration of power in a few hands, all too frequently men with the mentality of gangsters get control. History has proven that.

Lord Acton

There are two major models for recovering from such a situation: the Japanese model and the Swedish model, with a number of variations.

The Japanese model attempts to hold the financial structure largely intact, diverting huge amounts of policy action and public funds to supporting 'zombie banks' and interwoven corporate cartels. This led to a protracted period of stagnation.

The Swedish model is to nationalize, reorganize, reregulate and reform the financial sector into a more benign banking system. This has proven to be more successful in several instances, including Iceland more recently.

It will be interesting to see how the next ten years play out in North America and Europe.

h/t Barry Ritholtz

Source: WSJ

Looking Past Fiscal Cliff to Fixing Taxes

By Gerald F. Seib

Let's imagine you just landed from Mars and discovered that America's political system is in gridlock, and its economy is being held hostage. What, you would ask, is the giant problem creating all this trouble?

The big dispute, you would discover, is over whether the top individual marginal tax rate should be 35% (the rate established under George W. Bush) or 39.6% (the rate under Bill Clinton).

That is an oversimplification of the issues that are driving Washington toward the so-called fiscal cliff, of course. Still, that top rate is at the heart of the roaring economic debate.

Read the rest here.

Top 1% Share of the Wealth of the US During the same 100 Year Period

.svg.png)