Is it time for the Santa Clause Rally?

Is it time for the Santa Clause Rally?

For a thing people seem to take for granted – they never seem to know what time (or day) it's supposed to start or how big it's supposed to be or how long it's supposed to last. That doesn't stop the MSM from obsessing over the "Santa Clause Rally" each December and, the closer we get to Christmas – the more likely they are to claim any forward market movement to be a rally – much as my daughter used to call any old man with white hair and a beard Santa when she was five and we'd be in New York during the holidays.

If you believe in something hard enough – you can see it. Some call that faith, some wishful thinking, some madness and hallucinations. There's a lot of all of that in Stock Market Technicians and the truly "faithful" are put on television and given the task of recruiting others to their cause. Sometimes they share visions of the futures and sometimes they even show signs of the prophesies being fulfilled – and who doesn't love being shown a quick and easy way to get into heaven?

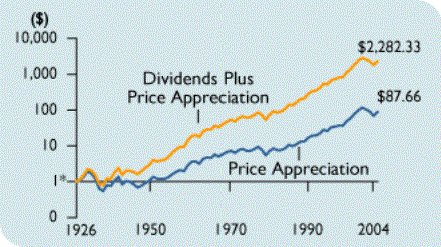

At our PSW Conference in Las Vegas last month, we spent a lot of time extolling the virtues of slow, steady investing strategies. While it's fun to "bet" on short-term market moves, Santa Rallies, Fiscal Cliffs, etc (whatever the fad of the moment may be) – investors often lose focus in WHY we are investing in the first place – and that's to BUILD a future for ourselves.

There are two ways to build a building. One way is to save up money each month, buy materials, make plans and set aside time to put in labor and keep repeating the process week after week, year after year – until the project is completed. The other way is to save up money each month, gamble it – and hope one day you win enough to buy a building with. The first way has a 99% success rate and lets people retire in buildings they built and earned through years of hard work. The second way has a 15% success rate and lets people retire in buildings they lucked into. Unfortunately, most "investors" prefer to take method number 2.

We spend a lot of time with new Members at PSW trying to break them of these bad habits. This morning, for example, in our Member Chat, we discussed a trade idea for T in which we buy the stock for $34 and sell 2015 $30 puts and calls for $8.50 for a net entry of $25.50. If the stock is called away at $30 in Jan 2015, we make $4.50 but we also collect (assuming it doesn't change) $3.60 in dividends for a total profit of $8.10 against our $25.50 entry. That's a pretty nice 31.7% return over 2 years and our worst case is we are forced to buy another round of T at $30 (from the puts) if the stock is below there and then we have 2x T at net $27.75 but we still collect our $3.60 in dividends so net/net $26.15 per share, which is 23% below the current price.

So here's an INVESTMENT, where we either make 31.7% over two years (and all T has to do is hold $30 to collect in full so it's got a built-in 11.7% hedge) of we buy 2x worth of T over two years at a 23% discount and THEN we would roll into a similar spread to further reduce the costs. This is, I realize, VERY BORING but, if you invest like this regularly, the returns can be VERY EXCITING over time.

We discuss more on this subject in "Dividend Investing – Giving Yourself and Automatic Edge" but what you have to be willing to give up to be this kind of investor is the excitement of short-term investing. There's nothing exciting about building a portfolio of blue-chip stocks and working your way into long-term, inexpensive entries over time. In fact, what we are taking advantage of by being the sellers of long-term premium, is the IMpatience of others – who would rather pay $4.80 for a 2015 $30 call on T, for the thrill of leverage, than just buy the stock for $34. That $1.80 of premium they pay is what we collect as a bonus for actually being willing to buy the stock and BE PATIENT.

We discuss more on this subject in "Dividend Investing – Giving Yourself and Automatic Edge" but what you have to be willing to give up to be this kind of investor is the excitement of short-term investing. There's nothing exciting about building a portfolio of blue-chip stocks and working your way into long-term, inexpensive entries over time. In fact, what we are taking advantage of by being the sellers of long-term premium, is the IMpatience of others – who would rather pay $4.80 for a 2015 $30 call on T, for the thrill of leverage, than just buy the stock for $34. That $1.80 of premium they pay is what we collect as a bonus for actually being willing to buy the stock and BE PATIENT.

Our advantage is we KNOW, for a fact, that we will collect that $1.80. Whether T goes up, down or sideways. That means that if we ALWAYS own T and we ALWAYS sell that premium, that after 19 sales cycles, we will have collected 100% of the stock's price back in premium. Let's say we had done that with a terrible stock like Yahoo for the past 20 years. Even though it's down from $300 to $18.77 today (and YHOO is no blue-chip!), the bottom line is it's still a free stock by now and we STILL can sell the 2015 $17 calls $4.40. That's money for nothin' (and chicks for free). Is it possible everything we ever needed to know about long-range investing was explained to us by MTV 30 years ago? I guess so…

That ain't workin' that's the way you do it

Money for nothin' and chicks for free

Now that ain't workin' that's the way you do it

Lemme tell ya them guys ain't dumb

Them guys on Wall Street are not dumb. They built these casinos and they charge their fees win, lose or draw and that built up a tremendous Financial Industry in the US. The mistake they made – that many men make – is simple greed. In going public they went from being long-range, goal-oriented investors to short-term gamblers who felt forced to outperform themselves quarter over quarter and we know how that ended – the wealth accumulated over generations of investing squandered in just a few years – gambled away like it was nothing.

It's so easy to get rich. Take $10,000. Put it in an account that makes 6%. Add $1,000 a month. Wait 20 years. $500,000. There – that wasn't hard, was it? Won't inflation wipe it out? NO. Did you have $1,000 a month to put away for the past 20 years? Would $500,000 be nice now? Well, then inflation wasn't an issue, was it?

Keep going for another 20 years and that same plan grows to $2M and, 20 years after that, $7M. Now, go smack your kid in the back of the head and tell him to open up a savings plan – NOW! If you are well off – set one up for each of your children or grandchildren – $10,000 down and $12,000 a year for your baby grandchild and you've given them $1M on their 30th birthday. That's all it takes to be an INVESTOR – is it worth being a gambler when investing pays so well?

Keep going for another 20 years and that same plan grows to $2M and, 20 years after that, $7M. Now, go smack your kid in the back of the head and tell him to open up a savings plan – NOW! If you are well off – set one up for each of your children or grandchildren – $10,000 down and $12,000 a year for your baby grandchild and you've given them $1M on their 30th birthday. That's all it takes to be an INVESTOR – is it worth being a gambler when investing pays so well?

The blue-chip dividend strategy we discussed with T and other stocks we use at PSW to get the best of both worlds can return 15-20% on a fairly regular annual basis. Call it just 12% a year and it's only 20 years to your first million by sacrificing just $1,000 a month to "boring" investments.

I would encourage you to play with the compound interest calculator and think about making an investment plan for your FUTURE – that means not next year, but for the rest of your life. Where do you want to be in 10 years, 20 years, 30 years and how are you PLANNING to get there with your current investments? Let's spend December looking for those long-term opportunities that will be under our tree for many years – not just the poppers that give us a quick thrill and are gone.

Of course there's room for both – but let's all try to build something that will last this year.