Courtesy of Mish.

In a pair of related ideas, the Yen is sinking and the Japanese stock market is on a tear. Today the Nikkei crossed the 10,000 mark once again.

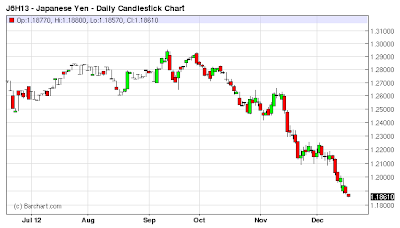

Yen Futures Daily Chart

click on chart for sharper image

Nikkei Futures Daily Chart

Yen Drops to Weakest Level Since April 2011

Bloomberg reports Yen Falls to August 2011 Low Versus Euro on Stimulus Bets.

The yen fell to its lowest level since August last year against the euro on prospects that the Bank of Japan will expand stimulus at the meeting that starts today, its first after the nation’s general election.

Japan’s currency traded near the weakest level since April 2011 versus its U.S. counterpart after data today showed the country’s trade deficit widened in November. The 17-nation euro maintained seven days of gains against the dollar that pushed it to a seven-month high yesterday amid optimism U.S. lawmakers will reach a budget pact, reducing demand for the greenback as a haven.

“Yen-selling is likely to remain intact,” said Koji Iwata, vice president of foreign-exchange trading in New York at Mizuho Corporate Bank Ltd., a unit of Japan’s third-biggest financial group by market value. “The BOJ will probably disappoint the market if it doesn’t boost asset purchases.”

In the race for currency debasement, Japan will soon pass the Fed. Repeating what I said yesterday in Spotlight on Japan

Since Mid-November the Nikkei has been on an upward tear. The Yen has been in decline since the start of October….