Talking About Stacked Decks, This One May Take The Cake

Investing Landscape

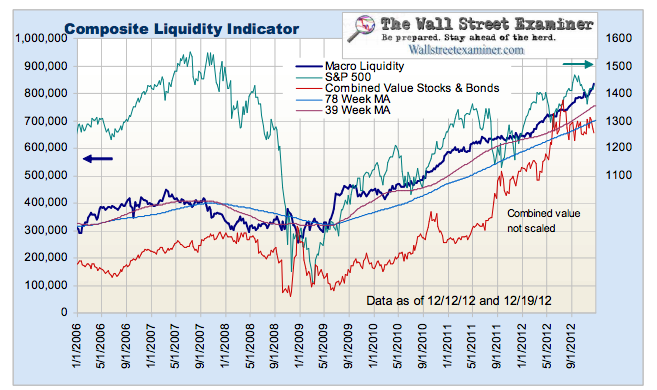

Lee Adler of the Wall Street Examiner talks about stacked decks – stacked for a rally in stocks and commodities. Lee's liquidity indicator is bullish (below). In short, that means there is cash available in the coffers of the Primary Dealers for moving equity and commodity prices higher. We use this signal to confirm our general long-term bullish bias. A change in this indicator would signal caution, and we might use it to take protective measures to perserve our portfolio's value.

Excerpts, courtesy of Lee Adler of the Wall Street Examiner:

The composite liquidity indicator rose sharply last week as the Fed settled the next round of QE3 MBS purchases on December 12th and 20th. The uptrend in market liquidity is not only firmly in place but it is getting steeper and will continue to do so as a result of the Fed pumping cash into the financial markets. Most of the lesser weighted components should have sympathetic upmoves as Fed cash flows through the system. Stocks continue to oscillate within a trend along this wave.

While it hasn’t done so yet, I continue to expect this massive surge of cash into the system to lead to a commodity price boom. First we get the bubble that eventually forces the Fed to stop printing. Then we get the consequences of this reckless policy.

[My emphasis. Note: we haven't gotten the bubble that will burst yet. Before the bubble pops, we need "the bubble."]

The Fed’s purchases from Primary Dealers carry the heaviest weighting and therefore the index will remain bullish until the Fed is finally forced to stop and reverse. Foreign central bank purchases are the second most important weight [in the composite liquidity index]. That too has turned bullish for the time being. The trend of bank net deposit inflows, not from money market funds, remains very bullish. The Fed is now driving that too, taking over from European cash inflows.

Bank trading accounts of non Treasury and Agency issues are bullish. Both of those indicators are also pushed by Fed cash coursing through the system. Bank net purchases of Treasuries and Agencies are essentially neutral, but here again I suspect that QE3 cash flows will also give an upward push to this indicator in the months ahead…

Treasury supply shouldn’t be much of an impediment going forward, because public demand for Treasuries remains high and the Fed will be absorbing the equivalent of 150% of new supply. However, sentiment toward Treasuries should begin to turn more negative as equities, commodities, and economic data show signs of heating up as a result of the massive amounts of Fed cash flooding the system. If there’s a shift in investment preferences and investors actually do begin to liquidate some of their Treasury holdings, that should send even more cash cascading into equities and commodities. A major technical sell signal in bonds would probably be bad news for stock market bears, but could be very bullish in the intermediate term for commodities.

In the meantime, as long as commodities remain soft it will give the Fed a green light to keep printing, to keep stoking the smoldering fires of potential bubbles, booms, and asset price and commodity inflation. If economic data heats up, then no doubt, so will consumer price inflation.

From a bear’s perspective, the next few months are a nightmare scenario—a perfect recipe for a melt-up— but ultimately the Fed is yet again sowing the seeds of financial destruction. I believe that it is only a matter of time, and that technical analysis will provide us with the warning signs when things are about to change.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.