Courtesy of Lee Adler of the Wall Street Examiner

The Labor Department reported that the seasonally adjusted (SA) representation of first time claims for unemployment declined by 12,000 to 350,000 from a revised 362,000 (was 361,000) in the advance report for the week ended December 22, 2012. The number was much batter the consensus median estimate of 375,000 reported by Briefing.com in a survey of economists. Bloomberg reported a median estimate of 360,000. Dow Jones, which uses Econoday, had it at 365,000.

They were all wrong, as usual. It’s not really their fault. The seasonally adjusted estimates are the problem, because they attempt to represent data that is extremely volatile as an idealized smoothed version.

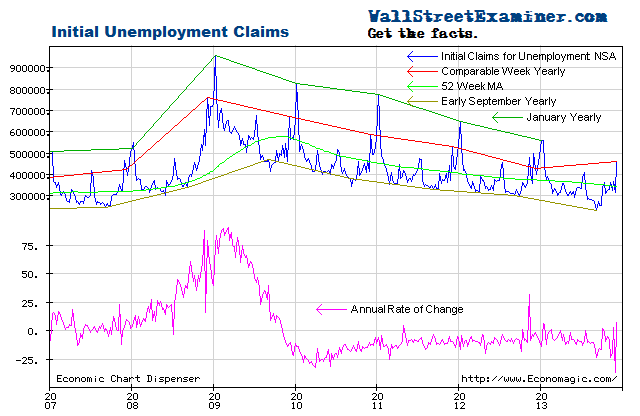

Along with the headline seasonally adjusted data, which is the only data the media reports, the Department of Labor (DOL) reports the not seasonally adjusted data. The actual data was indeed very good for this week of the year. The DOL said in today’s press release, “The advance number of actual initial claims under state programs, unadjusted, totaled 440,887 in the week ending December 22, an increase of 39,458 from the previous week. There were 497,689 initial claims in the comparable week in 2011.” [Added emphasis mine] The year to year decline was at the rate of -11.2%. In the prior week the year to year rate of decline was -4.7%.

Immediately after Superstorm Sandy, there was an extraordinary increase in the data going against a persistent 3 year trend of improvement. That was largely reversed in the week ended November 17. For the next several weeks the rate of year to year improvement slowed. While this may have been partly due to the aftereffects of the storm, it also appeared to be part of a trend of slightly slowing improvement that has been underway since 2011. However, this week’s rate of change was the best since May and among the best of the past two years.

Note: The DOL specifically warns that this is an advance number and states that not seasonally adjusted numbers are the actual number of claimants from summed state claims data. The advance number is virtually always adjusted upward the following week because interstate claims from many states are not included in the advance number. The final number is usually 2,000 to 4,000 higher than the advance estimate. I adjust for this in analyzing the data.

Normally the increase between the advance number and the final number the following week has been around 2,000-4,000. For the past two weeks it has been around 1,000. Accordingly, I adjusted this week’s reported number up by 1,000. The adjusted number that I used in the data calculations is 442,000, rounded. On this basis, the year to year decrease in initial claims was approximately -56,000 or -11.2% versus a drop of 4.7% last week.

Note: To avoid the confusion inherent in the fictitious SA data, I analyze the actual numbers of claims (NSA). It is a simple matter to extract the trend from the actual data and compare the latest week’s actual performance to the trend, to last year, and to the average performance for the week over the prior 10 years. It’s easy to see graphically whether the trend is accelerating, decelerating, or about the same.

The week to week change of an increase of 40,000 was better than usual for the fourth weekly report in December. Over the previous 10 years the comparable week has virtually always had big increases. The average change for the 10 years from 2002 to 2011 was an increase of approximately 69,000. Last year claims increased by 77,000 in that week. 2010 was a little better, however, with an increase of just 30,000. This year was better than 8 of the past 10 years, the only exceptions being 2009 and 2010 when the economy was in a bungee rebound from the worst of the depression.

From mid 2010 through mid October 2012 the annual rate of change in initial claims had ranged from -3% to -20% every week, with a couple of temporary minor exceptions, including the Superstorm Sandy surge. Since mid 2011 the annual rate of change was within a couple of percent of -10% in most weeks. The trend was remarkably consistent.

A second trend has become visible on the annual rate of change graph (bottom of chart below). It shows a channel of slightly higher lows and higher highs indicating a slowing rate of improvement as the trend moved toward zero year to year change. The December 8th week’s annual rate of change at -1.2% was at the upper limit of that channel. The current weekly reading of -11.2% is back within the channel and near the center of the overall range of the past 2 years. For the time being at least, the improving trend continues, recovering to the best pace it has seen in 7 months.

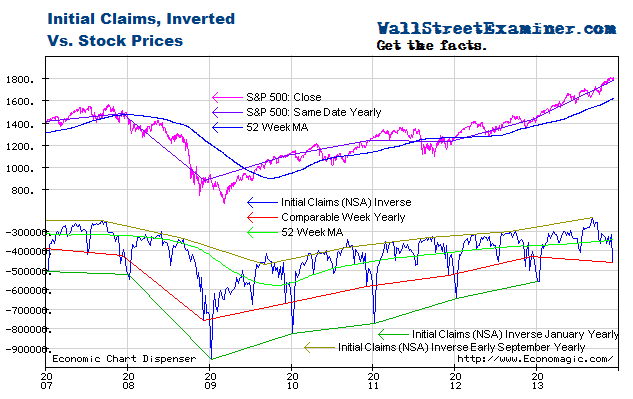

Plotted on an inverse scale, the correlation of the trend of claims with the trend of stock prices over the longer term is strong, while allowing for wide intermediate term swings in stock prices. Both trends are largely driven by the Fed’s operations with Primary Dealers (covered weekly in the Professional Edition Fed Report; See also The Conomy Game, a free report). The chart below has suggested for a while that as long as the trend in claims is intact, the S&P would be overbought at approximately 1450, and oversold at roughly 1220. On that basis it became overbought in mid September.

The market pulled back since then, but the correction has been far smaller than in 2011 when the upper limit of the channel was hit. Given that the Fed’s QE 3 purchases began to settle just in mid November it is unlikely that a correction similar to 2011′s will occur. The expansion of QE now means that the Fed’s balance sheet will now grow by a 38% annual rate sending lets of cash toward the market for the duration of the program. When the market became extended relative to the unemployment claims trend in 2011, the Fed was simultaneously ending QE2, thus starving the monster of its lifeblood. This year, the Fed is intent on fattening the bull.

I expect the Fed to also to attempt to paper over the “fiscal cliff” if it occurs, just as it did with Y2k. I call the prospective anti fiscal cliff money printing, the “fiscal cliff notes” program. The Y2k papering episode helped to trigger the final blowoff of the internet bubble in Q1 2000. If no “Grand Bargain” is reached on the fiscal cliff, I expect Fed policy and the result to rhyme with Y2k in Q1 of 2013.

Some bubble jobs will likely be created in the process. But at the same time, the inflation that should accompany the money printing, whether in asset prices, commodities, or in consumer prices will force the Fed to stop QE. At that point the markets and economy will deal with the hangover from the program.

[I cover the technical side of the market in the Professional Edition Daily Market Updates.]

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.