Wheee, what a ride!

Wheee, what a ride!

U.S. small-cap stocks surged to a record Wednesday as investors turned their focus to U.S. economic improvement and the smaller, nimbler companies that could be best-positioned to benefit.

Russell Investments' index of 2000 small-capitalization stocks rose 2.6% to 871.13 Wednesday afternoon, after hitting an all-time intraday high of 872.28 earlier in the session. Wednesday's rally came on the heels of a year-end surge. The RUT has gained 13% since touching a recent low Nov 15th. The S&P, which tracks larger companies, has added 7.3% over the same period.

"As the U.S. economy gets helped by better housing, small is going to do better," said BAC's Steve DeSanctis in the WSJ. "Then you throw in earnings growth for the first time in a while, and they've had a very nice, strong rally here." Mr. DeSanctis pointed to analysts' forecasts that companies in the Standard & Poor's index of 600 small-cap stocks will report earnings growth of 4.5% for the fourth quarter, compared with 3.5% for middle-sized companies and 1.2% for their larger counterparts. Small-cap companies tend to get a larger share of their revenue from the U.S. than bigger firms, which could help their bottom lines if the housing recovery continues, Mr. DeSanctis added.

"As the U.S. economy gets helped by better housing, small is going to do better," said BAC's Steve DeSanctis in the WSJ. "Then you throw in earnings growth for the first time in a while, and they've had a very nice, strong rally here." Mr. DeSanctis pointed to analysts' forecasts that companies in the Standard & Poor's index of 600 small-cap stocks will report earnings growth of 4.5% for the fourth quarter, compared with 3.5% for middle-sized companies and 1.2% for their larger counterparts. Small-cap companies tend to get a larger share of their revenue from the U.S. than bigger firms, which could help their bottom lines if the housing recovery continues, Mr. DeSanctis added.

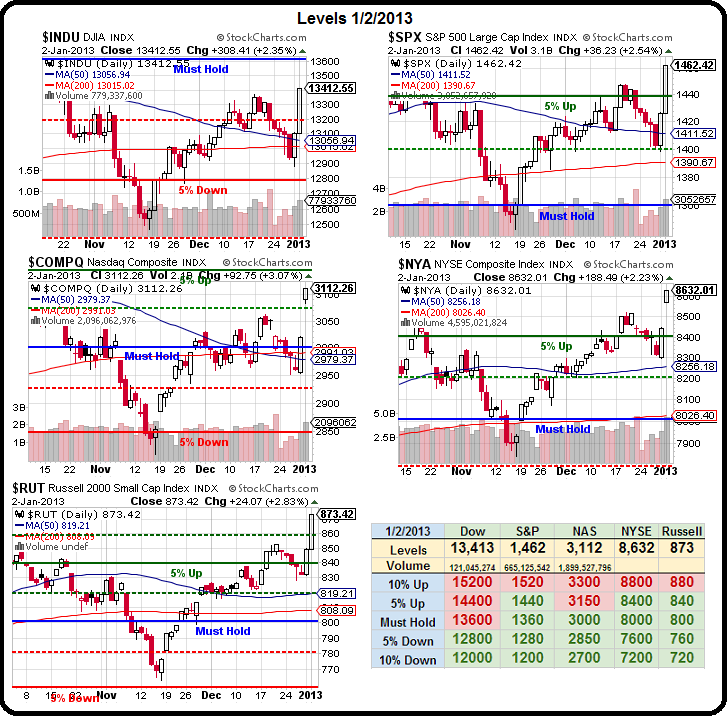

We came right up to the levels we expected and, in fact, the S&P finished the day at 1,452, which was my target for the S&P to finish 2012 (1,450) so it turns out I was one trading session off in the end. In yesterday's Morning Alert to Members, we worked out the short-term 4 and 5% lines we expected our indexes to test during the next couple of days and those were:

- Dow: 13,319 & 13,447 (finished 13,412)

- S&P: 1,442 & 1,456 (1,452)

- Nas: 3,028 & 3,056 (3,112)

- NYSE: 8,580 & 8,660 (8,632)

- RUT: 858 & 866 (873)

As usual, the Nasdaq and Russell are leading us higher but we never got our third breakout to confirm the trend so we did 1/3 covers to lock in some of our bullish gains on some of our positions. Mostly it was a watch and wait day with no new trades but I did put up a new spread entry on AAPL, in afternoon chat, for those who missed the party the first time. In this morning's chat, we discussed the Big Chart and my comment to Members was:

Big Chart looks ridiculous and that's just common sense when you see an unusual pattern you have to be on guard that it will normalize sooner than later BUT, as I pointed out yesterday, it's these unusual breakouts that redraw the charts but the key is here – at the point of break-out – and we should always assume it's more likely a channel will hold than break.

As I said, no additional catalysts expected and that's going to make things tough but the RUT is at new ALL-TIME highs and that's pretty significant and we're only at 1,450 on the S&P, which was my 12/31 target anyway so I don't feel too bad that my 2012 prediction was off by one trading day.

So, value-wise, I don't have any particular reason to be bearish. This is the "right" price for the S&P prior to earnings and then we will have to re-evaluate as we get more data. Our assumption at the moment is that we'll take a hit from retail, as they sold about the same amount of stuff but at steeper discounts so we assume margin compression and also from Finance, because money is not moving, M&A is weak, IPOs were weak and low rates are probably impacting their margins too. On the other hand, Industrials (people who actually make stuff) should be turning up based on Durable Goods and improvements in Asia and the US offsetting Europe, who don't spend like we do anyway (same GDP, 60% more people).

Euro not only failed $1.32 but also failed $1.31 this morning and is now $1.3089 and the Pound failed $1.62 and is now $1.615 so expect the Dollar to climb – especially as the Yen also continues to collapse, now 86.85 to the Dollar after testing 87, which is a 2.5-year low. Essentially what's going on is the Fed is printing a fixed amount of money (they sort of, kind of have a plan with a theoretical limit) while the BOJ, who already print insane amounts of money, just said "you ain't seen nothin' yet." We just did something (albeit something lame) to address our debt while Japan is at 240% of GDP and borrowing more every hour.

One area in which Congress has shown tremendous restraint in is screwing over the Northeast on the promised aid package for the Hurricane Sandy damage – going over 2 months now without approving the appropriations. NJ Governor Christie noted that other regions had been hit by hurricanes and got relief in short order (Katrina was 10 days and people thought that was too slow, Andrew was 17 days for Florida…) – this is 66 days folks!

One area in which Congress has shown tremendous restraint in is screwing over the Northeast on the promised aid package for the Hurricane Sandy damage – going over 2 months now without approving the appropriations. NJ Governor Christie noted that other regions had been hit by hurricanes and got relief in short order (Katrina was 10 days and people thought that was too slow, Andrew was 17 days for Florida…) – this is 66 days folks!

Maybe there is some truth to the assertion that Christie and U.S. Rep. Peter King (R-N.Y.) made Wednesday that lawmakers from other parts of the country have a bias against the Northeast. As Christie noted, New Jersey and New York are net suppliers of money to Washington, not takers. New Jersey gets back around 60 cents, give or take, in federal spending for every $1 in taxes its residents send to the IRS. New York gets back around 80 cents for every $1 its residents send. After adjourning without a vote, the process now has to restart Friday in the House, and with a bill for only $9 billion. An additional $51 billion would wait until Jan 15th for a vote. Just another round of shameful behavior from our Republican Congress.

If it ever is approved, $60Bn will provide a nice boost to the already-recovering Northeast economy, especially the construction sector, and we got more good news from ADP this morning as they showed a year-high 215,000 jobs added in December. Later today we'll get the ISM New York Business Index along with Bloomberg's Consumer Comfort at 9:45 and, at 2pm, we have the always interesting FOMC Minutes along with a peak at the Fed's balance sheet after hours. Tomorrow, we hear from Fed Governors Plosser, Yellen and Bullard and that's always a good market mover, but only after we get the NFP report at 8:30.

If it ever is approved, $60Bn will provide a nice boost to the already-recovering Northeast economy, especially the construction sector, and we got more good news from ADP this morning as they showed a year-high 215,000 jobs added in December. Later today we'll get the ISM New York Business Index along with Bloomberg's Consumer Comfort at 9:45 and, at 2pm, we have the always interesting FOMC Minutes along with a peak at the Fed's balance sheet after hours. Tomorrow, we hear from Fed Governors Plosser, Yellen and Bullard and that's always a good market mover, but only after we get the NFP report at 8:30.

Hopefully nothing exciting happens and we consolidate our gains into the weekend. We're going to be watching our levels carefully as well as the 50 dma on the S&P at 1,422, as noted by David Fry in his S&P chart above. If we hold that, we're in that critical upper channel that gives us a good chance to make progress back to the old highs (1,565 from Oct 2007, after hitting 1,552 in March of 2000 so a 7-year cycle maybe?).

Until we see some earnings over the next two weeks – I am hesitant to predict where 2013 will end up – we also discussed those variables in Member Chat last night but it's a work in progress, for sure.