"I beg of you, don't say goodbye

Can't we give our love another try

Come on baby, let's start a new

'Cause breaking up is hard to do" – Neil Sedaka

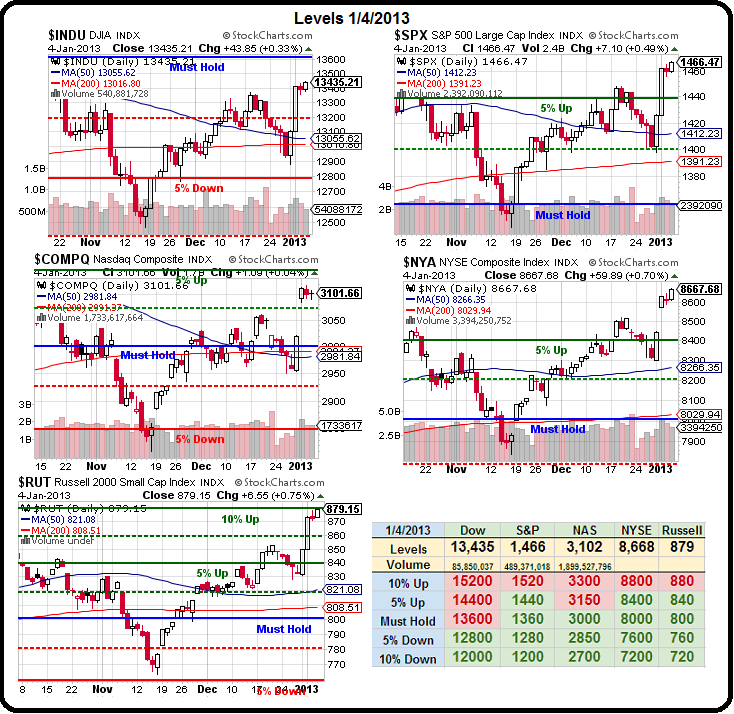

Let's see: We have Dow 13,435 and we predicted 13,447 (off by 12), we have S&P 1,466 (off by 10) and we predicted 1,456, we have Nasdaq 3,101 and we predicted 3,056 (off by 45), we have NYSE 8,667 and we predicted 8,660 (off by 7) and we have Russell 879 and we predicted 866 (off by 13).

So, based on where our futures spiked down at the end of last year, we were able to predict where the 5 major indexes would finish within 87 out of 27,500 total index points – a margin of error of 0.3% – gotta love that 5% rule!

Of course we discuss these levels every day in Member Chat and we even posted some of our levels for free readers in last week's posts – so don't say we didn't tell you so – because we did. Now we're expecting the obligatory 1% pullback and the levels we don't want to fail (aside from the 3 long-term 5% lines on the Big Chart) are Dow 13,319, S&P 1,442, Nas 3,028, NYSE 8,580 and Russell 858. The Nasdaq is our biggest outperformer so far, up 2.35% from it's 4% retrace so the real question for the week is – do we think the Nasdaq will fall 2.5% this week?

If not, we should remain fairly bullish. In order for the Nasdaq to fall 2.5% (Dave Fry's chart), AAPL would have to fall about the same and that's back down to $513. Well, AAPL can do that with it's eyes closed and that's why we covered our AAPL by selling some $525 calls on Friday, after taking profits on the $550 calls we had sold previously.

If not, we should remain fairly bullish. In order for the Nasdaq to fall 2.5% (Dave Fry's chart), AAPL would have to fall about the same and that's back down to $513. Well, AAPL can do that with it's eyes closed and that's why we covered our AAPL by selling some $525 calls on Friday, after taking profits on the $550 calls we had sold previously.

We still think AAPL is worth much more (as does GS, who put a $766 price target on the stock for 2013) but, unfortunately, VALUE is not the same thing as PRICE and people are panicking on price action at the moment. What's most disturbing about AAPL at the moment is they are weak while the rest of the market is strong – although it's possible that either they are being purposely held back so that AAPL can be used to punch the Nasdaq over the top at 3,200 (up 3.2% from here) or that AAPL is simply being sold to allow funds to raise enough cash to buy 20 normally-priced tech stocks for each share of AAPL they trade in.

Nonetheless, we covered because our premise, that AAPL's December weakness was end-of-year tax selling, seems to be blown as we're just as week in the first few days of January. We also covered our QQQ longs in our $25,000 portfolio for the same reason but we haven't yet gone for more severe disaster hedges as we're not expecting a disaster (or the Spanish Inquisition), just a pullback. We have our levels and, if they don't hold – then we worry.

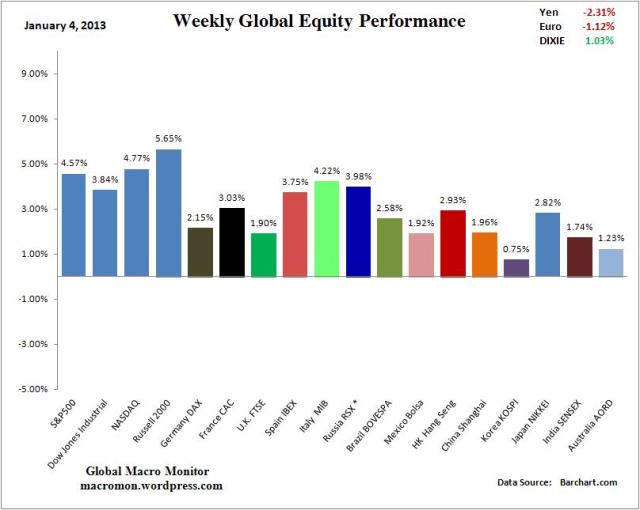

No one was worried last week as US markets led the Global charge to start 2013 off with a bang. As you can see from this handy Barchart chart, in just 4 trading sessions the US indexes flew higher, leaving most of the other Global markets in the dust. What we'd like to see this week is a little more strength from other markets, especially Europe – who had been leading us going into the year's end (as noted often enough, right on this very site as well as in Stock World Weekly – which everyone should subscribe to) – so it was natural and expected that we should catch up a bit.

No one was worried last week as US markets led the Global charge to start 2013 off with a bang. As you can see from this handy Barchart chart, in just 4 trading sessions the US indexes flew higher, leaving most of the other Global markets in the dust. What we'd like to see this week is a little more strength from other markets, especially Europe – who had been leading us going into the year's end (as noted often enough, right on this very site as well as in Stock World Weekly – which everyone should subscribe to) – so it was natural and expected that we should catch up a bit.

In fact, the quote of mine from Member Chat that was used in this week's Stock World Weekly header sums it up quite nicely. Apparently I said:

Let’s start 2013 off doing the responsible thing and locking in some gains – even if it sacrifices gains we may make later.

Also this weekend, we began a review of our Long-Term Income Portfolio, which is up a virtual 11.2% in it's first 7 months and well ahead of it's goal of making 10% for the year. Our Income Portfolio is the most conservative of our active virtual portfolios and the goal of this one is to have a low-touch portfolio that generates a nice income that people with retirement accounts can draw off of without having to touch the principal ($500,000, in this case).

Also this weekend, we began a review of our Long-Term Income Portfolio, which is up a virtual 11.2% in it's first 7 months and well ahead of it's goal of making 10% for the year. Our Income Portfolio is the most conservative of our active virtual portfolios and the goal of this one is to have a low-touch portfolio that generates a nice income that people with retirement accounts can draw off of without having to touch the principal ($500,000, in this case).

As you can see from the chart on the right, pacing at 20% a year puts us in league with America's top hedge funds and, don't forget, they charge you 20% of your gains plus 2% of your total so knock about 6% off those returns to get a real net. I'll stack our system up against any of those…

Notice 3 of the top ten funds, including the top two are Mortgage-related and, of course, BAC was our One Trade in 2012 (and here's me on TV laying it out last January) for the same reason and that trade returned 56% (limited because it was hedged), while the stock itself more than doubled.

Notice 3 of the top ten funds, including the top two are Mortgage-related and, of course, BAC was our One Trade in 2012 (and here's me on TV laying it out last January) for the same reason and that trade returned 56% (limited because it was hedged), while the stock itself more than doubled.

So far, we haven't found one trade we like enough in 2013 to peg it as a "One Trade", which we feel you could put all your money into, rather than waste time playing the markets. It's certainly not the kind of thing you force but we have some runners-up we've been sharing with our Members as we continue to comb through likely candidates. The chart on the left gets back to our Income Portfolio and shows something we illustrated at our conference in Las Vegas in November – when you hedge your positions by SELLING options against them, you get a tremendous increase in profits as those options get closer to expiration – the real trick is learning to manage your own expectations during the volatile middle and, of course, PATIENCE!

We will be practicing both patience and restraint this week as we observe the market action between our 4 and 5% lines. We'd love to get more bullish but first we want to see some evidence that this is the right call and, of course, we'd really like to see some earnings data, with AA kicking off the season tomorrow and we'll be right in the thick of it already next week.

This week, our Government has a lot of bonds to sell so it's a good time for a pullback – let's just hope it's not too severe.