Not ready to go to the mat with lululemon

Courtesy of Paul Price

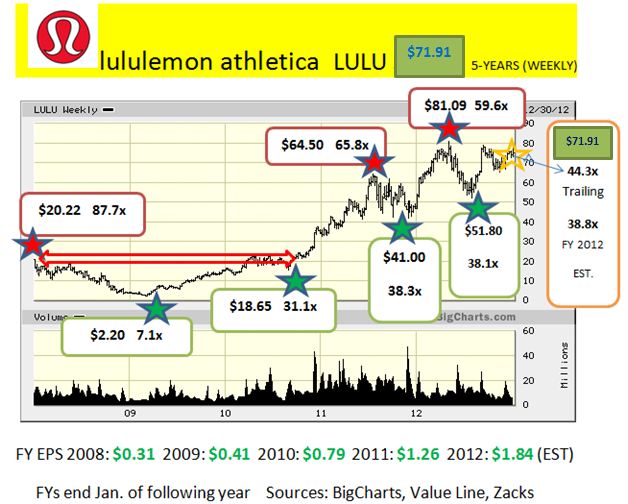

Yoga wear designer Lululemon Athletica Inc. (LULU, $71.10) has been riding booming interest in their field. The company has posted excellent numbers since its 2007 IPO.

During most of the past five years the shares have been too highly valued for me to consider. LULU peaked at $30.30 and a P/E of 132 in late 2007 before crashing along with the overall market to $2.20 in March of 2009. Sadly, I missed getting in when the stock went briefly to a single-digit multiple.

There is much to like. The ancient practice of Yoga has never been more popular. The company is debt-free and building cash. EPS grew right through the Great Recession and is expected to hit an all-time high of $1.84 in FY 2012 which ends this month.

I gave the company a fresh look because an analyst downgrade sent LULU shares down by about 5% on Friday. The stock is about $10 cheaper now than it was at 2012’s peak. Does that make it a buy?

(Click on chart to enlarge)

My value orientation says no. LULU trades for over 44 times trailing earnings and about 39x the current year’s estimate of $1.84 which assumes a pretty good Q4. Lululemon bounced back strongly from P/Es in that range after dipping in 2011 and 2012.

The question is really about the sustainability of its growth rate. At around forty times earnings, there is no margin for error.

I can’t justify buying, yet I’m not tempted to short LULU either.

Sometimes the best decision is to do nothing.

Disclosure: No position

Pic source: Uploaded by user via myHealthyOC on Pinterest