Source: imgfave.com via Leslie on Pinterest

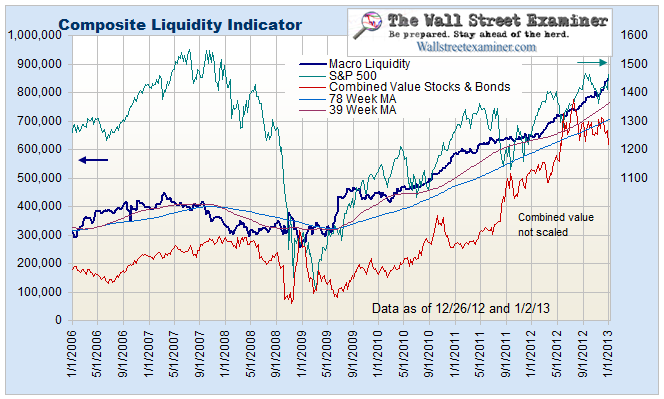

Courtesy of Lee Adler of the Wall Street Examiner

The following is an excerpt from the Executive Summary of The Wall Street Examiner Professional Edition Fed Report.

It has been two weeks since this report was last posted, and in that time almost nothing has changed. The indicators all still point up, thanks to Fed printing— not just printing, but mammoth, monumental printing that’s likely to go on for a while and pulverize, obliterate, every little bear thought that tries to stand in its way. My colleague Russ Winter thinks otherwise, and has ably documented his view on his blog at RussWinter.com and also in his Actionable service and in our Radio Free Wall Street tête-à-têtes but I’ll stand by this analysis until something changes, something that I can’t see yet.

The Fed’s meeting minutes contained a veiled threat that maybe QE might end this year, even at mid year, but I think that that was a bluff and a threat in an attempt to keep speculators off the inflation train. It may work for a little while, but so what. And so what if the Fed does stop the insanity at mid year. At the current rate, it would add over $700 billion to the accounts of Primary Dealers by then. Money talks, and talk, even Fed talk, walks.

I would not be surprised to see the Fed forced to end QE in June or July by a surge of inflation. I also wouldn’t be surprised to see them continue to print through most of the year. I do think that QE will end, probably this year, but that until it does, the leveraged speculating crowd, both the Primary Dealers and their biggest hedge fund customers, will do what speculators do. They will buy crap. They will buy whatever crap makes the most sense to them, and they will mark up their inventories until the Fed stops providing them with the wherewithal to do so.

The composite liquidity indicator rose sharply last week as the Fed bought Treasuries on balance, and bank inflows surged. The uptrend in market liquidity is not only firmly in place but it is getting steeper and will continue to do so as a result of the Fed pumping cash into the financial markets. Most of the lesser weighted components have had and should continue to have sympathetic upmoves as Fed cash flows through the system. Stocks should continue to oscillate along and around this wave.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.