Wheeee! Isn't this fun?

Wheeee! Isn't this fun?

As you can see from Doug Short's S&P chart, we have a classic "cobra about to strike" pattern in the S&P and, while this means absolutely nothing – it's just as valid as any of the other technical BS you'll hear from other analysts.

If you zoom out to a longer-term view of the S&P, what you see is we are near the top of a rising channel that has held firmly in the S&P since early 2009 and has taken us from a spike low of 666 past the 100% gain of 1,332 a year ago and now on the way to 1,500 – which is 100% gain of the consolidation off the great drop and still short of the Oct 9th, 2007 closing high of 1,565.

The only thing holding us down at the moment (other than AAPL), is very low expectations for 4Q earnings, as well as 2013 guidance. BUT, coming through the last couple of months of Fiscal Cliff worries and very negative sentiment numbers from consumers, investors, financial officers and CEOs – isn't it possible that the outlooks we've been getting have been too gloomy and we're in for an upside surprise?

The only thing holding us down at the moment (other than AAPL), is very low expectations for 4Q earnings, as well as 2013 guidance. BUT, coming through the last couple of months of Fiscal Cliff worries and very negative sentiment numbers from consumers, investors, financial officers and CEOs – isn't it possible that the outlooks we've been getting have been too gloomy and we're in for an upside surprise?

I was in the mall last weekend and it was packed. I've been getting reports from our Members, who are a group of very sophisticated investors with high-level backgrounds from all sorts of business sectors, that the economy is picking up and conditions are improving. I'll trust their opinion over the talking heads on CNBC any day!

AA had pretty good earnings and projects 7% demand growth next year. That translates into roughly a 7% growth in Global GDP. Even if you discount the relationship of aluminum to GDP by 1/3, you're still looking 5% global growth and AA forecasts Global demand to double by 2020 – that's a pretty solid long-term trend. WDFC is another good indicator of global health and they say they can do 10% better in 2013 and STX just raised guidance and announced they bought back almost 10% of their shares last quarter as an average price of $28 a share seemed stupidly cheap to them (now $31).

Not only are we seeing some healthy early earnings indicators but M&A activity is picking up and that's the kind of thing that can send the shorts running for the hills because nothing is worse than waking up in the morning and finding the stock you shorted popped 30% overnight as someone made them and offer or, even more annoying, that the stock you shorted popped 10% overnight because someone made on offer on someone else in the sector. This is one of the reason the VIX, which, in part, indicates the demand for puts, has plunged recently.

Not only are we seeing some healthy early earnings indicators but M&A activity is picking up and that's the kind of thing that can send the shorts running for the hills because nothing is worse than waking up in the morning and finding the stock you shorted popped 30% overnight as someone made them and offer or, even more annoying, that the stock you shorted popped 10% overnight because someone made on offer on someone else in the sector. This is one of the reason the VIX, which, in part, indicates the demand for puts, has plunged recently.

Of course, those of you who listen to the Conservative Media probably believe the country is going to Hell in a hand-basket. I myself watched Fox news the other day and found myself wanting to run out and buy some assault weapons before they take away my rights so they can march right into my home and tax me to death. It's a terrifying World Fox viewers live in, no wonder they are so bearish. And, of course, if Fox viewers are bearish then Murdoch's WSJ is bearish and I would challenge you to find any good news on the entire front page. Nothing?

Technically, the 15% recovery in Consumer Credit since 2010 should be seen as a bullish indicator as it shows confidence – especially as it's concentrated in auto loans, which are a huge plus for the economy but it's not spun that way by the Journal. How about the fact that Japan and China rebounded this morning (up half a point), or that the government can save $542Bn in Medicare and Medicaid spending by simply coordinating medical care for seniors and the poor. Well, of course you'll never hear that from the WSJ – that's essentially the whole point of the dreaded Obamacare program…

Technically, the 15% recovery in Consumer Credit since 2010 should be seen as a bullish indicator as it shows confidence – especially as it's concentrated in auto loans, which are a huge plus for the economy but it's not spun that way by the Journal. How about the fact that Japan and China rebounded this morning (up half a point), or that the government can save $542Bn in Medicare and Medicaid spending by simply coordinating medical care for seniors and the poor. Well, of course you'll never hear that from the WSJ – that's essentially the whole point of the dreaded Obamacare program…

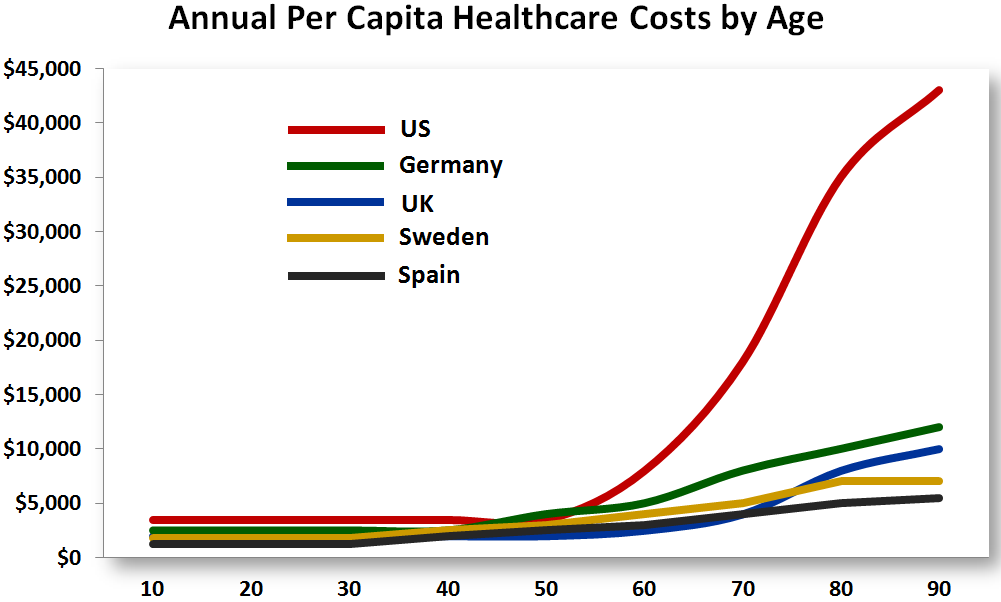

As you can see from the chart on the right, the US spends not 2, not 3 but more than 4 TIMES as much money on health care for the very old than other industrialized nations. What's really sad here is that our outcomes are no better. We spend 18% of our GDP on health care – twice as much as other industrialized nations overall and that means 9% of our GDP, $1.44Tn, is wasted in the system. That's money that could be going back into our economy in more productive ways, making everyone a little more economically secure (except health insurance companies and Big Pharma) and probably leading to less stress and healthier citizens overall.

We'll probably never know because maintaining the status quo, no matter how much it's killing us, is what Congress is all about and we'll have to go back to ignoring that circus if we want to make any bread in 2013.

We'll probably never know because maintaining the status quo, no matter how much it's killing us, is what Congress is all about and we'll have to go back to ignoring that circus if we want to make any bread in 2013.

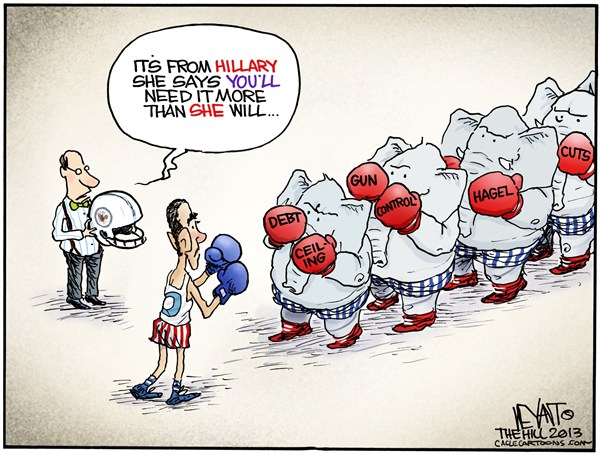

As Paul Krugman points out, all the President has to do to disarm the GOP in the debt ceiling non-issue is to have treasury mint a $1Tn Platinum Coin and we're good for another year. Yes it's a loophole but so is Congress holding America hostage by threatening to force us to default on debts we've already incurred – THAT THEY ALREADY APPROVED. Immature and reckless – we already lost our country's AAA rating last year while the Republicans threw their little temper-tantrum – not this time. As Krugman points out, what's worse, minting a coin to pay our debts or allowing the GOP to crash the economy?

It’s easy to make sententious remarks to the effect that we shouldn’t look for gimmicks, we should sit down like serious people and deal with our problems realistically. That may sound reasonable — if you’ve been living in a cave for the past four years.Given the realities of our political situation, and in particular the mixture of ruthlessness and craziness that now characterizes House Republicans, it’s just ridiculous — far more ridiculous than the notion of the coin.

While the $1Tn coin is essentially Obama's nuclear option against Republican idiocy, that's the entire point of a nuclear deterrent – to force your opposition to come to the table and negotiate responsibly. Should that fail, Krugman (a Nobel Prize-winner, don't forget) believes that this bomb can be detonated without any fall-out while I'm not so sure but that fall-out, if any, will likely be inflation, which is one of our major bullish premises for 2013 anyway.

While the $1Tn coin is essentially Obama's nuclear option against Republican idiocy, that's the entire point of a nuclear deterrent – to force your opposition to come to the table and negotiate responsibly. Should that fail, Krugman (a Nobel Prize-winner, don't forget) believes that this bomb can be detonated without any fall-out while I'm not so sure but that fall-out, if any, will likely be inflation, which is one of our major bullish premises for 2013 anyway.

The Fed's Jeffrey Lacker agrees with me on that point and he feels the Central Bank's current path has us well on the road to inflation already. “We’re at the limits of our understanding of how monetary policy affects the economy,” Mr. Lacker said, “Sometimes when you test the limits you find out where the limits are by breaking through and going too far.” As the economy continues to muddle along, shadowed by the threat of another government breakdown, the crisis of high unemployment is only slowly receding. But in trying to address those problems by suppressing interest rates, the Fed risks the unleashing of speculation and inflation.

“It’s very unfair to think of me as not caring about the unemployed,” Lacker said. “It just seems to me that there are real impediments, that just throwing money at the economy is unlikely to solve the problems that are keeping a 55-year-old furniture worker from finding a good competitive job.”

Perhaps not but I don't see how letting the economy go into free-fall is going to help much either. Keep in mind that Lacker is the lone dissenter on the Fed Board – he's right about inflation, it's coming – but how else are we going to pay off those Trillions in debts?