Courtesy of Mish.

After a somewhat lengthy hiatus, Curve Watcher’s Anonymous is taking a good long look at the US treasury yield curve.

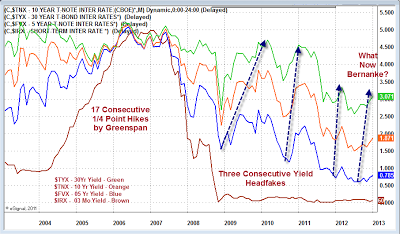

Treasury Yield Curve

click on chart for sharper image

QE Ending in 2013?

There have been three consecutive headfakes higher in treasury yields only to see yields plunge to new lows on repeated QE announcements by Bernanke.

Is the fourth time a charm? Certainly Bernanke is not about to hike interest rates as Greenspan did. But what happens to the long end of the curve if Bernanke simply ends QE later this year?

The question stems from Minutes of the December FOMC Meeting released last week.

While almost all members thought that the asset purchase program begun in September had been effective and supportive of growth, they also generally saw that the benefits of ongoing purchases were uncertain and that the potential costs could rise as the size of the balance sheet increased. Various members stressed the importance of a continuing assessment of labor market developments and reviews of the program’s efficacy and costs at upcoming FOMC meetings.

In considering the outlook for the labor market and the broader economy, a few members expressed the view that ongoing asset purchases would likely be warranted until about the end of 2013, while a few others emphasized the need for considerable policy accommodation but did not state a specific time frame or total for purchases.

Several others thought that it would probably be appropriate to slow or to stop purchases well before the end of 2013, citing concerns about financial stability or the size of the balance sheet. One member viewed any additional purchases as unwarranted.

Extreme Complacency in Face of Bernanke Shift

Steen Jakobsen, chief economist for Saxo Bank in Denmark reflects on the minutes of the latest FOMC meeting in his post on Tuesday Two Ways to Be Happy.

There were two ways to be happy: improve your reality, or lower your expectations ― Jodi Picoult, Nineteen Minutes….