Selling Puts on Value Companies – A New Market Shadows Virtual Portfolio

By Ilene (with Paul Price)

Options are not just for speculation. One excellent use of options involves selling puts on stocks you’d like to own, but at prices cheaper than the stocks are currently selling for. (If you are not familiar with "puts," see the note at the end.)

Our Virtual Value Portfolio is almost fully invested, so we’ve decided to add a separate, virtual account to illustrate opportunities we find using the Put-Selling technique.

Selling a put (aka "writing" or “shorting”) is taking a bullish position. The results will be best if the underlying shares go up or remain flat compared to the stock price at the trade's inception. Once we sell a put, there are only two potential outcomes at expiration.

- If the stock remains above the option’s strike price, the puts will expire worthless. (We keep the money for selling the put.)

- If the stock is below the strike price, we will be forced to buy 100 shares per put or "contract" (one put = one contract).

When puts expire worthless, the seller of those options keeps all premiums received and has no further obligations. We make a maximum profit of 100% of the money received upon settlement of the sale ~ i.e., the price of the put we sold.

Exercises of puts typically occur at or near expiration dates, but they can occur sooner. Timing is at the discretion of the option buyer/owner – not the seller.

Selling puts is similar to placing below-market limit orders to buy. In either case we might, or might not, end up owning shares. If we acquire shares, our entry price will always be lower than had we simply purchased right away.

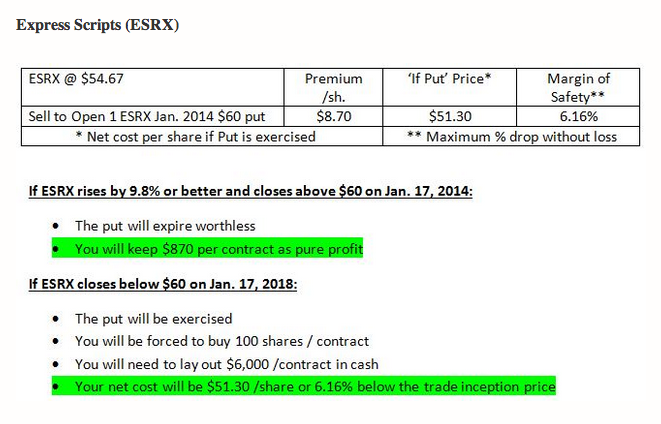

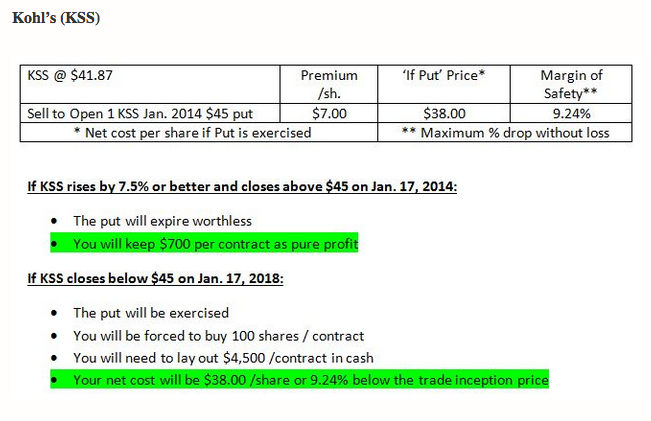

To begin our "Selling Puts Virtual Portfolio," Paul likes selling puts on two stocks in our Virtual Value Portfolio. The shares are now below their prices when we first added them to the Virtual Portfolio. These are Express Scripts (ESRX, $54.86) and Kohl’s (KSS, $41.87). Here’s how these looked on Wednesday (1/9) around midday.

(click on tables to enlarge)

Puts are often less actively traded than stocks. When we sell a put, we always try to get a price in the middle of the bid -ask spread. Mid-range orders almost always get filled and provide better prices than if we simply submitted a market sell order.

We’re going to use January 18, 2014 expiration dates to allow plenty of time for the stocks to hit their strike prices. The raw material we’re selling is ‘time’. Selling a full year costs us nothing except the opportunity to move quickly to the next trade.

Having a one-year time horizon brings in larger initial premiums and lower break-even points than writing shorter expiration puts.

Here is the math on the ESRX and KSS positions:

We’ll initiate our new Selling Puts Virtual Portfolio by selling one of each of the two put options detailed above. In the worst case scenario, we’ll end up owning 100 shares of each stock at lower prices. Best case – both put options will expire worthless, and we’ll keep the $1,570 (total) in premiums received without having to buy anything.

****

Note about Puts

Selling (or "shorting") a put is a bullish position because we are selling someone the right to make us BUY a stock at a certain price (strike price) on a certain date (expiration). The put buyer will only "put" the stock to us (make us buy the stock at the strike price) if it is trading lower than the strike price.

Put options are the opposite of "calls." When we buy a put, we're buying protection against the stock going down – paying someone for the right to sell our stock to them for a higher price. When we sell a put, we are selling someone the right to make us buy the stock. If the stock is above the strike price at expiration, the put will be worthless. The price of a put increases as the underlying stock drops in price.

SELLING a put lets us either buy a stock at a discount to where it is trading when we initiate the trade OR it lets us keep the money from selling the put. We risk being forced to buy the stock for MORE than it is trading for at expiration. A drop in the shares greater than the amount collected selling the put becomes a loss.

.png)