Go small caps, go!

Go small caps, go!

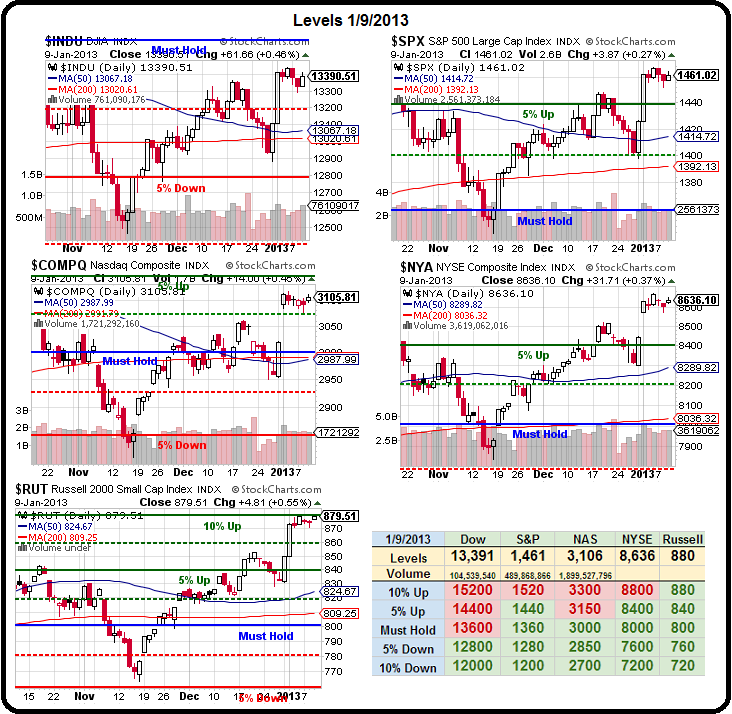

The Russell is bumping right up against our 10% line and it's always a good sign when we have to contemplate drawing the next set of lines on our Big Chart but, let's not get ahead of ourselves as the poor Dow is dragging behind – down 11% from the Russell on our performance measure and down 8% for the year, overall.

As we were discussing in Member Chat this morning – this is not surprising to us as we had done an extensive review of the Dow back on September 25th, where we decided at the time that there weren't enough bullish fundamentals to justify a move over our Must Hold line and that kept us from being bullish at the top of that rally.

Now we're back at about the same place we were then and we'll have to watch those Dow component earnings reports very closely to see if we can justify at least a 1.5% move up past 13,600 (our Must Hold level) and then another 5% to 14,400 (these levels don't base off 13,600 but off the real long-term goal of 16,000 that we're nowhere near yet but were predicted under our 5% Rule way back in 2009).

We got a good start with AA yesterday, not so much boosting AA (but we're long), but easing concerns about a continued Global slowdown. Flat we can handle, slow growth is downright thrilling and, as I said in yesterday's post, sentiment is too negative and we're now climbing that proverbial wall of worry as we put our Trillion Dollar coins to work in the markets.

We got a good start with AA yesterday, not so much boosting AA (but we're long), but easing concerns about a continued Global slowdown. Flat we can handle, slow growth is downright thrilling and, as I said in yesterday's post, sentiment is too negative and we're now climbing that proverbial wall of worry as we put our Trillion Dollar coins to work in the markets.

In addition to the bullish long trade idea I gave you on AA in Tuesday morning's post (we don't need to wait for earnings when we know what's going to happen), which is already up 10% on the short puts and up 24% on the net .70 spread (now .87 and on track to a full 200% gain), we also hit the nail on the head by calling the AAPL bottom at $513 (and back to our $531 bounce target this morning) and our BA prediction is already paying off with those short 2015 $55 puts down from $4.30 back to $3.70 (up 14%) and the $70 puts hitting our $10 target on the nose and now back to $8.55 (also up 14.5%) and YUM's short July $62.50 puts came in right at $4.20 and are back down to $3.70 for a quick 12% gain in 48 hours and the longer short 2015 $50 puts topped out at $4.87 and can still be sold for $4.60 and the Jan $62.50 puts can still be sold for $6 – so I still like those as new trades if you missed it.

And that was just the free stuff in the morning post! In Member Chat, we took full advantage of the morning dip with another bullish BA play in the Morning Alert as well as as a bullish play on SHLD, who also had a nice, quick turnaround off that spike low. Of course, if we fail to hold our 4% lines (see last week's post), we can always cover with TZA longs but holding them kept us bullish this week and now we're back to looking at our 5% lines (short-term, not the ones on the Big Chart) at Dow 13,447 (47 under), S&P 1,456 (5 over), Nasdaq 3,056 (49 over), NYSE 8,660 (24 under) and Russell 873 (6 over).

And that was just the free stuff in the morning post! In Member Chat, we took full advantage of the morning dip with another bullish BA play in the Morning Alert as well as as a bullish play on SHLD, who also had a nice, quick turnaround off that spike low. Of course, if we fail to hold our 4% lines (see last week's post), we can always cover with TZA longs but holding them kept us bullish this week and now we're back to looking at our 5% lines (short-term, not the ones on the Big Chart) at Dow 13,447 (47 under), S&P 1,456 (5 over), Nasdaq 3,056 (49 over), NYSE 8,660 (24 under) and Russell 873 (6 over).

Note Dave Fry's chart above, Russell 880 is key but already over technical resistance (or 5% Rule is not an industry standard but it works for us) – we just need it to confirm but, more importantly, we need the NYSE to get over it's own hump and then we can watch Dow earnings to see if we're willing to ignore that index's poor performance and we might as swaps in the Dow Components can wreck havok with long-term predictions like our Dow 13,600 line. Still, it would be nice to actually hit it….

IBB is one sector having a great run and, in Member Chat yesterday, Zeroxzero noted his "Farmfund", tracking Pharmboy's trade ideas, was already up 27.7% for the year. If we don't get through that $147.50 line on IBB, it may be time to take some profits off the table but, if we do pop over – we'll all be begging Pharmboy for some more Biotech plays! Many of those picks have been, as I noted on Tuesday, summarized in Market Shadows, which comes along with Stock World Weekly and take a look at Pharmboy's write-up on SGEN from the December 17th issue, which has jumped 25% itself since that note as well as IMGN, from the same post, picked at $12.92 and already $14.50 (up 12% in 3 weeks) – you don't even need options when the stocks are making those kind of gains!

GDX and GLD are other ideas we've been pushing lately and gold is bouncing back to $1,670 this morning as the ECB leaves their rates unchanged (as predicted by me in Member Chat) and that's pushed the Euro back over $1.32 and dropped the Dollar to 80.20 so, of course the Markets are jumping. We made a quick .40 shorting oil Futures this morning in Member Chat, from $94.40 to $94 but now we're back at $94.50, which will be perfect for our USO play as we love to short oil when it's goosed by a Dollar drop. Shorting off that $94.50 line in the Futures (/CL) is also a good play as it's way too high given yesterdays massive build in inventories.

GDX and GLD are other ideas we've been pushing lately and gold is bouncing back to $1,670 this morning as the ECB leaves their rates unchanged (as predicted by me in Member Chat) and that's pushed the Euro back over $1.32 and dropped the Dollar to 80.20 so, of course the Markets are jumping. We made a quick .40 shorting oil Futures this morning in Member Chat, from $94.40 to $94 but now we're back at $94.50, which will be perfect for our USO play as we love to short oil when it's goosed by a Dollar drop. Shorting off that $94.50 line in the Futures (/CL) is also a good play as it's way too high given yesterdays massive build in inventories.

AAPL (we may have mentioned them once or twice) is testing our $531 line in the Futures this morning as Tim Cook visits China and, more specifically, China Mobile (CHL), presumably to seal the deal on IPhone distribution in the Middle Kindgdom. CHL is famous for being the only Chinese ADR I would endorse but we're done with them after an almost 50% run from last year. Still, it's good news for AAPL as CHL is a $230Bn phone company that services 650M subscribers – so it effectively doubles AAPL's total global consumer reach with the swipe of a pen. AAPL will also be opening 14 new Apple Stores in China, up from the current 11 total.

AAPL supplier Dialog is on the pink sheets but they jumped 5% this morning as they raised revenue guidance from $225M to $268M for Q4, driven by strong demand for components they supply to AAPL for IPhone 5's and IPad Mini's. Both T and VZ have been hit recently as investors worried they sold so many IPhones that their up-front subsidies may be impacting current profits. Meanwhile Tim Cook is flying first class to China – that's for sure! VZ's 9.8M smart phone activations were up 44% from Q3 and up 29% from last year and 46% of them were IPhones. I certainly hope I don't have to draw any conclusions for you here…

AAPL supplier Dialog is on the pink sheets but they jumped 5% this morning as they raised revenue guidance from $225M to $268M for Q4, driven by strong demand for components they supply to AAPL for IPhone 5's and IPad Mini's. Both T and VZ have been hit recently as investors worried they sold so many IPhones that their up-front subsidies may be impacting current profits. Meanwhile Tim Cook is flying first class to China – that's for sure! VZ's 9.8M smart phone activations were up 44% from Q3 and up 29% from last year and 46% of them were IPhones. I certainly hope I don't have to draw any conclusions for you here…

According to SA's Market Currents: One more reason why a cheaper iPhone could make sense: unsubsidized iPhone prices are often even steeper overseas than in the U.S. The 16GB iPhone 5 sells for $649 unlocked in the U.S. (or perhaps ~$700 after sales tax), but for $840 in China, $735 in Sweden, and a full $955 in Italy. A source tells Bloomberg Apple (AAPL) is weighing prices of $99-$149 for a low-end iPhone, while adding the device "may be smaller than current models." The ever-bullish Gene Munster imagines a $149-$199 price tag, and thinks the device could add $6.5B in annual sales.

I'll be on TV next Tuesday and I'm still considering AAPL as my "One Trade" for 2013. We're already positioned that way with our now-naked longs in the $25,000 Portfolio as wel as our special AAPL Money Portfolio and I've been shying away from it as it's such a sickening ride, but that didn't stop us from playing BAC as last year's "One Trade" and, as with BA – as long as you PLAN to scale into the trade over time – then a dip is only another buying opportunity and, like BAC – this is a ridiculously undervalued stock, trading at a price you may never see again.