Courtesy of Mish.

Bank of Japan to Adopt 2% Inflation Target

Bloomberg reports Yen Falls to Lowest Since 2010 on Stimulus

The yen reached the weakest since June 2010 versus the dollar after Japanese Prime Minister Shinzo Abe’s government said it will spend 10.3 trillion yen ($116 billion) in new stimulus efforts that tend to weaken a currency.

The yen headed for a ninth weekly decline, the longest losing streak since 1989, on speculation the Bank of Japan (8301) is also preparing measures to spur growth.

Japan’s government will spend about 3.8 trillion yen on disaster prevention and reconstruction, and 3.1 trillion yen on stimulating private investment and other measures, the Cabinet Office said in a statement.

The Bank of Japan is set to adopt the 2 percent inflation target advocated by Abe, doubling its existing goal of 1 percent, without setting a deadline for achieving it, according to people familiar with discussions within the central bank. They requested anonymity because the talks are private. The BOJ meets on Jan. 21-22.

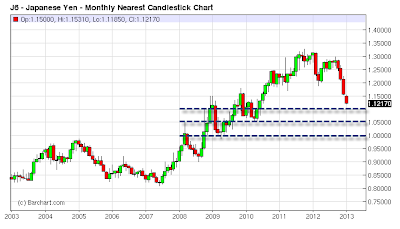

Yen Monthly Chart

click on chart for sharper image

Where to From Here?

From a technical standpoint, there is support at 1.10, at 1.05, and again at 1.00. Short-term, I would expect it to bounce at one of those levels, perhaps all three, as anti-yen sentiment is extreme.

Bear in mind, the ultimate fate of the Yen depends on what Japan does, not what Japan says.

Advocating a 2% inflation target and actually taking measures to achieve that target are two different things. From my perspective, prime minister Shinzo Abe seems determined to do just that. …