Courtesy of Lee Adler of the Wall Street Examiner

Wall Street Journal |

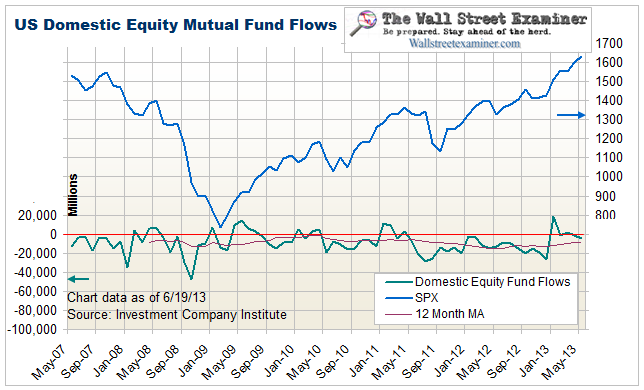

Surge into stock mutual funds is most in 11 years

USA TODAY BOSTON (AP) — The flow of cash into stock mutual funds the first week of 2013 was the largest weekly inflow in more than 11 years. Mutual funds investing in U.S. stocks attracted $4 billion in net deposits during the weeklong period that ended Wednesday, … That Big Inflow To Stocks Ain’t All It’s Cracked Up To BeWall Street Journal (blog) US stock mutual funds gain $7.5 billion, most since 2001: Lipper Reuters |

This story got wide play yesterday afternoon, as the 192 news articles lined above suggest. Some pundits have glommed on to this as being a contrarian sell signal. The truth is that it’s just a reversal of the “beat the cliff” tax selling that reached a crescendo in December as the chart below, based on data from the ICI, shows. Their data is a week behind the Lipper data. What Lipper and none of the hysteria stories mentioned was that selling reached a 4 year record high in December, and at $8.2 billion in net outflows for the week ended January 2, was even at a higher rate than the December average of around $6 billion per week. So I don’t put much “stock” in these stories.

In fact, the only “sentiment” that matters is Primary Dealer sentiment, and the Fed is stuffing their accounts with $120 billion in cash per month. This is as great as the liquefaction of the Primary Dealers that took place under QE 1 beginning in March 2009, and we know what happened then. So I’m not too worried about this ridiculous story about the surge in mutual fund flows.

Using that information as a signal for market direction is like looking at the gamblers’ betting patterns in the casino for a clue as to who will win and who will lose. Obviously, we already know the answer. The House always wins. In this case the Primary Dealers are the House. They own the casino. They are flush with a tidal wave of cash, and will continue to be flush for months to come. I’ll place my bets accordingly. (my emphasis)

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.