Courtesy of Lee Adler of the Wall Street Examiner

This report is an excerpt from the Permanent Employment Charts page, where you can find more charts on the claims data and various other employment measures.

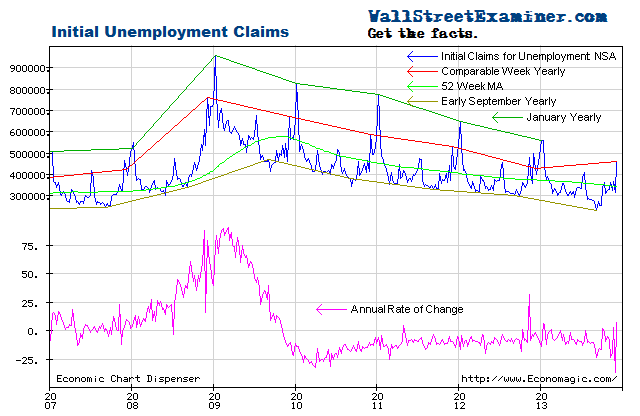

The Labor Department reported that the seasonally adjusted (SA) representation of first time claims for unemployment fell by 37,000 to 335,000 from a revised 372,000 (was 371,000) in the advance report for the week ended January 12, 2013.

The number was far better than the consensus median estimate of 369-370,000 reported by major business media. The seasonal adjustment process remains a haphazard and arbitrary process that always yields a fictitious number. This week, for a change, the reports suggested some concern that the number was wrong. They should recognize that does not only apply to this one week. It’s every week. However, as it turns out, it may not have been as misleading this week as the pundits thought.

The headline seasonally adjusted data is the only data the media reports but the Department of Labor (DOL) also reports the not seasonally adjusted data (NSA). The DOL said in today’s press release, “The advance number of actual initial claims under state programs, unadjusted, totaled 555,708 in the week ending January 12, an increase of 2,360 from the previous week. There were 525,422 initial claims in the comparable week in 2011.” [Added emphasis mine] This year’s filings represented an increase of 6.1% over the referenced week last year versus a decline of -14.3% the prior week. Here’s where it gets complicated. Calendar factors made that misleading.

Claims always peak in the first full week ended in January. This year, that was the most recent week, which ended on January 12. Last year it was the week ended January 7. Because “year-to-year” comparison is actually made versus 52 weeks ago, not exactly a year ago, that’s a problem this year. In its year to year comparison, the government compared the current week with the week ended January 14 last year. Claims always fall sharply in the second week of January, whereas they always rise sharply the first week. Therefore, comparing the current week with the January 14, 2012 week is not an “apples to apples” comparison. In this case, the “like” week would be the one ended January 7, 2012. Comparing the week ended January 12 this year to the one ended January 7 last year, we find a drop of 89,000 claims, or -13.7%. That’s smack dab on the trend this series has been on for the past couple of years. This is a good number, no better and no worse than usual in terms of the recent trend.

So the claims data continues to hew closely to the trend it has been on. Any apparent deviation has been due to statistical flukes or weather events.

Note: The DOL specifically warns that this is an advance number and states that not seasonally adjusted numbers are the actual number of claimants from summed state claims data. The advance number is virtually always adjusted upward the following week because interstate claims from many states are not included in the advance number. The final number is usually 2,000 to 4,000 higher than the advance estimate. I adjust for this in analyzing the data.

I adjusted this week’s reported number up by 2,000, which is at the low end of the typical range. The adjusted number that I used in the data calculations is 558,000, rounded.

Note: To avoid the confusion inherent in the fictitious SA data, I analyze the actual numbers of claims (NSA). It is a simple matter to extract the trend from the actual data and compare the latest week’s actual performance to the trend, to last year, and to the average performance for the week over the prior 10 years. It’s easy to see graphically whether the trend is accelerating, decelerating, or about the same.

From mid 2010 through mid October 2012 the annual rate of change in initial claims had ranged from -3% to -20% every week, with a couple of temporary minor exceptions, including the Superstorm Sandy surge. Since mid 2011 the annual rate of change was within a couple of percent of -10% in most weeks. The trend was remarkably consistent.

A second trend has become visible on the 52 week rate of change graph (bottom of chart below). It shows a channel of slightly higher lows and higher highs indicating a slowing rate of improvement as the trend moved toward zero year to year change. The data spiked outside of that in the current reading to +6.1% due to the calendar factors described above. It should snap back next week. The “like-to-like” week, year to year rate of change of -13.7% is well within both channels.

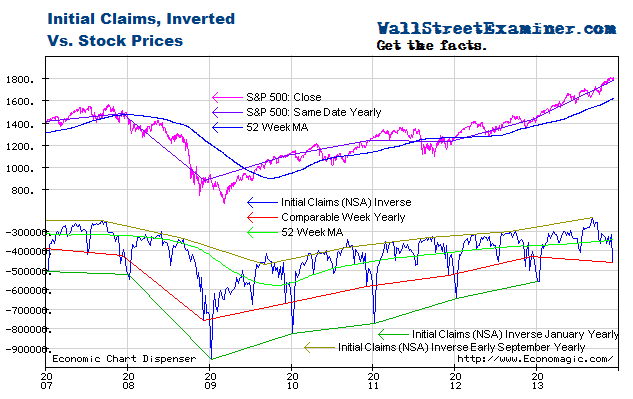

Plotted on an inverse scale, the correlation of the trend of claims with the trend of stock prices over the longer term is strong, while allowing for wide intermediate term swings in stock prices. Both trends are largely driven by the Fed’s operations with Primary Dealers (covered weekly in the Professional Edition Fed Report; See also The Conomy Game, a free report). The chart below now suggests that the market trend will be overbought at approximately 1500, assuming that the trend in claims remains relatively constant. The question is whether additional Fed money printing will cause those trends to tilt more steeply upward.

The expansion of QE means that the Fed’s balance sheet will now grow by a 38% annual rate sending lots of cash toward and through the market with some of it trickling into the economy for the duration of the program. When the market became extended relative to the unemployment claims trend in 2011, the Fed was simultaneously ending QE2, thus starving the monster of its lifeblood. As a result the market pulled back sharply after reaching the top of the channel This year, the Fed is intent on fattening the bull. That would allow the S&P to bump along the top of the channel as long as the jobs trend stays intact.

Some bubble jobs will likely be created in the process. However, the inflation that should accompany the money printing, whether in asset prices, commodities, or in consumer prices, should eventually force the Fed to stop QE. At that point the markets and economy will deal with the hangover from the program.

[I cover the technical side of the market in the Professional Edition Daily Market Updates.]

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.