Courtesy of Lee Adler of the Wall Street Examiner

Retail Sales rose by 0.5% in December (month to month) and were up 4.7% annually, according to the Commerce Department’s December Advance Retail Sales Report released last week. Those are seasonally adjusted idealized estimates. Neither figure is adjusted for inflation. The median forecast of economists was for a monthly increase of 0.2%. This continues the pattern of several months where economic data was better than expected. However, beneath the surface, the actual, unmanipulated data told a far different story. The retail economy stalled.

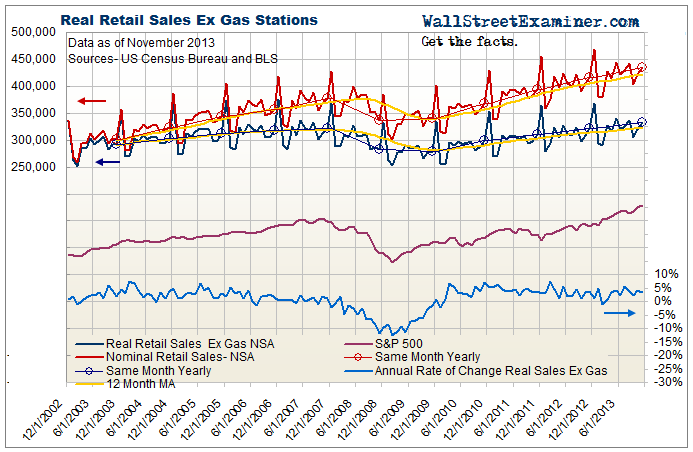

Note: When analyzing retail sales, I’m interested in the actual volume of sales, not the inflation skewed dollar total. To get to the kernel of the matter, I look at the real, not seasonally finagled retail sales, adjusted for top line CPI inflation (not core which normally understates the actual). Then I back out gasoline sales, which are a substantial portion of total retail sales. Gasoline sales distort total retail sales higher when gas prices are rising, when they actually act like a tax on disposable income and reduce non-gasoline sales. On the other hand, when gas prices fall, the top line total retail sales figure will understate any gains in the volume of sales. Gasoline sales typically account for around 12% of total retail sales. By subtracting gas sales and adjusting for inflation, the resulting number represents the actual volume of retail sales.

The year to year change in real retail sales, ex gasoline prices, and adjusted for inflation in December was a decline of 0.26%. This compares with a year to year gain of 2.8% in November, and it ends a string of year to year gains going back to January 2010.

This analysis uses not seasonally adjusted (NSA) data due to the inaccuracy and potentially misleading nature of seasonally adjusted data. In this context, historically, December is always a strong up month versus November. The gain this December was +14.6%. At first glance that looks good, but it was weaker than the corresponding period of 2012 (+17.6%) and 2011 (+18%). It was also weaker than the 2003-2012 December average of +18.5%. The performance of retail sales in inflation adjusted terms, after backing out gasoline sales, was significantly weaker than the headline numbers. In fact, I went as far back as 1992 and could not find a December worse than this one in terms of the gain from November.

The stall could be just a blip, or it could be an advance warning that the economy is on the verge of weakening. Before we get too excited about this number, we should consider that heavy Black Friday promotions, earlier than historically customary store openings on Thannksgiving, and an extra shopping week in November probably stole some sales from December. So far, we have not seen warning signals in other data, in particular the more timely jobless claims. So while this is something that should have our antennae up, it is not something that should raise undue alarm, at least not yet.

Gasoline prices were falling through most of November and December, so the drop in retail sales can’t be blamed on an extra hit at the pump. Rising gas prices are a de facto tax on consumers that cause reduced consumption of other goods and services since demand for gasoline is relatively inelastic. The decline in prices should have given consumers the ability to spend more on other things.

QE3 and 4 runs the risk of stimulating rising gasoline prices, just as its predecessors did. Speculators tend to see crude oil as a money substitute when central banks are engaging in money printing. The Fed’s QE3 securities purchases had only begun to settle in November, and there were offsetting influences at that time. Mid December was the first time that Fed money printing came to bear in full in the markets. That’s when the drop in commodity prices stopped. The impact of QE3 and4 should be be seen in the months ahead as that cash flows into the financial markets.

For December, falling gas prices gave consumers a little extra cash. They did not spend it on other retail items, a sign that they may have begun retrenching in advance of the widely publicized and expected fiscal cliff tax increases in January. Now that those increases have gone into effect, January’s retail sales figures will be of even greater interest.

In the big picture, the current “recovery” has been weak relative to the past when “growth” was driven by seemingly endless expansion of debt.The real rate of growth has usually been in the vicinity of 2%-3.5% on average recently, until last month. In a more balanced economy not driven by growing debt, in a nation where population is growing at slightly less than 1%, that is probably the best the can be expected. The Fed has resorted to money printing in an effort to drive growth at an above trend rate, in an effort to spur job growth.

Past rounds of QE suggests that this one will result in the unintended consequences of a cost squeeze on business profits and inflation pressure on middle income consumers that could choke off the recovery in a few months. The recent decline in input costs reflected in weaker commodity prices, particularly energy, took the pressure off temporarily. I believe that that decline was due to the fact that QE3 had not really started yet. TheQE3 cash really began to flow in December, with the added cash of QE4 hitting the market in January. The effects should be seen in commodity prices within a few months. Coupled with tax increases, rising energy costs would then probably further depress retail sales again. Those two forces could spiral into a vicious cycle of rising costs, reduced retail sales, and job cuts, the exact opposite of what the Fed is seeking to gain by printing money.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.