Reminder: Pharmboy is available to chat with Members, comments are found below each post.

Well, well, well….it is good to know that there are others in the scientific arena who believed that YMI Bioscience's data (cough – Gilead) is a better drug than Incyte's Jakafi. Now, the definitive data are still unknown, but there was enough evidence from a Phase 2 trial to take a small risk for a huge reward. So, let's forget about Apple (AAPL), and do nothing but biotechs from now until Congress passes universal health care coverage for prescriptions….and drive the prices down so that research and development is no longer feasible to conduct in the US. Even Seattle Genetics (SGEN) has been on a tear as of late, and I expect more from it in the future. Its future may be short lived, as it is my premise that it will be bought out for its technology and pipeline.

At PSW we continue to sell premium against a position. We have been doing this for many months, especially against a basket of biotechs that we have been buying and holding (CRIS, PLX, EXEL, and others).

Let's take a look at a few other companies pipelines, and see if they are worthy of our funds.

Merrimack Pharmaceuticals (MACK) – the company was founded in 2000 and went IPO at the end of March 2012 for $7. The IPO, in which all outstanding shares of Merrimack's convertible preferred stock were converted into 66,255,529 shares of common stock and in which Merrimack issued 15,042,459 new shares of common stock, yields a market cap of $591M. Cash and equivalents on hand were about $80M, and a loan guarantee they note should get them into 2014, but raising money is something that Biotechs do on a regular basis. So, we will not hold our breath. In the last six months, insider ownership has increased by 2.8%, while institutional ownership has increased by a staggering 34% (here).

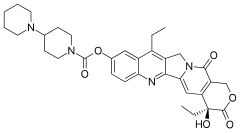

The company's lead drug is MM-398, which is a nanoliposomal encapsulation of the conventional chemotherapy Camptostar (irinotecan; Pfizer).

is put in

is put in  to make it last longer in the body as well as potentially attain drug concentrations required for optimum therapeutic efficacy in the target site while minimizing adverse effects on healthy cells and tissues.

to make it last longer in the body as well as potentially attain drug concentrations required for optimum therapeutic efficacy in the target site while minimizing adverse effects on healthy cells and tissues.

In the target tissue, Camptostar is converted to SN-38 (cuts the carbamate linkage), which is a topoisomerase 1 inhibitor. This enzyme is important for cell functions including: to remove DNA supercoils during transcription and DNA replication; for strand breakage during recombination; for chromosome condensation; and to disentangle intertwined DNA during mitosis. Camptostar is used in several different cancer indications, but is approved for colon and rectal cancers.

The FDA granted MACK an orphan drug for MM-398 in August 2011 for pancreatic cancer that was Gemzar (gemcitabine) refractory (in other words, it does not work). In late 2011, MACK's Phase 2 studies (40 patients) showed in metastatic pancreatic cancer, 75% of patients achieved the primary endpoint of 3-month survival rate, exceeding the targeted statistical threshold, with acceptable safety. The study found some patients had survived six months or longer. Researchers also found that 20% of the patients survived for more than one year (here).

Now, MACK is finishing up its pivotal Phase 3 clinical trial coined NAPOLI-1 (NAnoliPOsomaL Irinotecan) of MM-398 for the treatment of patients with metastatic pancreatic cancer who have previously failed treatment with gemcitabine. The trial is a global, randomized, open label Phase 3 study with a total enrollment of 405 patients equally randomized across the three arms: MM-398 as a monotherapy and MM-398 in combination with 5-fluorouracil (FU)-leucovorin (LV) (5-FU/LV) compared with the shared control arm of 5-FU/LV. Data are due out buy late 2013. Refractory metastatic pancreatic cancer is a beast to treat, as there is nothing for these patients to take after gemcitabine….so there are high hopes for it to work based upon the limited numbers of patients in trial data. We will play the chances accordingly – so stay tuned in chat for our entries and exits.

In other trials that are in the plans with MM-398, the drug should work, especially in colorectal cancers, as well as lung and brain cancers. These studies are a ways out.

Other pipeline gems include monoclonal antibodies, MM-111, MM-121, and MM-151.

MM-111 is a bispecific antibody designed to target cancer cells that are characterized by overexpression of the ErbB2 cell surface receptor, also referred to as HER2. In the figure below, MM-111 binds to either of the below monomers (ErbB2 or 3), and then reaches out and brings them together, shutting them down. This is useful, because some cancers become refractory to HER2 treatments (Herceptin for example), and then ErbB3 becomes overactive. MM-111 will be a double whammy to that pathway. The Phase 1 study comprised 46 patients with documented advanced HER2+ cancer. Researchers found that MM-111 was tolerable and could be safely combined at full dose with lapatinib / trastuzumab and paclitaxel / trastuzumab regimens. The capecitabine containing arm required dose reduction of capecitabine. The toxicity profile of the MM-111 combinations was consistent with that generally observed in patients receiving the underlying HER2 therapy. A Phase 2 study is underway.

MM-121 is a fully human monoclonal antibody that targets ErbB3 (see figure above). With Sanofi (SNY), who paid $60M upfront, MM-121 is being evaluated several Phase 2 studies in advanced ovarian cancer, hormone sensitive breast cancer, non-small cell lung cancer (NSCLC) and HER2 negative neoadjuvant breast cancer. If one notices, both MM-111 and MM-121 are targeting ErbB3, with MM-111 being bispecific. IF MM-121 fails, it does not mean that MM-111 does, but MM-121 should help validate MM-111 when it is mixed with drugs (ie, Herceptin?) that hit ErbB2. Confusing, but overall, this could be a great thing for MACK, and make SNY pony up!

MM-151 is a oligoclonal therapeutic consisting of a mixture of three fully human monoclonal antibodies designed to bind to non-overlapping epitopes of the epidermal growth factor receptor, or EGFR (ErbB1). There are many therapeutic approaches are aimed at the EGFR including, and many of the  monoclonals are blocing the extracellular ligand binding domain cetuximab and panitumumab, zalutumumab, nimotuzumab, and matuzumab. With the binding site blocked, ligands can no longer attach to the receptor and activate the tyrosine kinase.

monoclonals are blocing the extracellular ligand binding domain cetuximab and panitumumab, zalutumumab, nimotuzumab, and matuzumab. With the binding site blocked, ligands can no longer attach to the receptor and activate the tyrosine kinase.

Another method is using small molecules to inhibit the EGFR tyrosine kinase activity, which is on the cytoplasmic side of the receptor. Without kinase activity, EGFR is unable to activate itself, which is a prerequisite for binding of downstream adaptor proteins. Ostensibly by halting the signaling cascade in cells that rely on this pathway for growth, tumor proliferation and migration is diminished. Gefitinib, erlotinib, and lapatinib (mixed EGFR and ERBB2 inhibitor) are examples of small molecule kinase inhibitors.

MM-151's mechanism of action is to bind the ErbB1 receptor at distinct non-overlapping epitopes. Inotherwords, it coats the receptor like ants on a lolipop (like that analogy??)! This gives MM-151 a complete blocade, where monoclonal EGFR targeted therapeutics, such as cetuximab and panitumumab, as well as oligoclonal inhibitors similar to MM-151, show weaker or even no effect on ERK signaling under similar conditions (abstract here). MM-151 is early on, but it will be interesting to see how things progress.

Lastly, utilizing their nanoliposomal encapsolation technology, (MM-302) doxorubicin is being investigated in breast cancer. Again, early on, but data should be encouraging.

Other notable biotechs that have data forthcoming:

Zalicus (ZLCS) – a wonderfully awful article here, so we will be continuing our hold on this company. Yes, biotech CEOs are sometimes not the smartest tools in the shed, but the scientists should know, inpart, what they are doing. Investing in ZLCS is only for Z160, its first-in-class, oral, state-dependent, selective N-type (Cav2.2) calcium channel blocker for the potential treatment of chronic neuropathic pain. Preclinical data are robust, and data are due later this year on two Phase 2a clinical trials for neuropathic pain including lumbosacral radiculopathy (LSR) which began in the third quarter of 2012 and postherpetic neuralgia which began in the fourth quarter of 2012. Top line data from both studies are expected to be available late in the second half of 2013. Buy the dips, sell the rips….that is how to play penny stocks.

Trius (TSRX) – well, the company just sold 6M shares at $4.75 (good article here about it). That was unexpected, but we should not be surprised…biotechs do this! Overall, top line data are due from their second Phase 3 trial in a few months. If it is works in MRSA (methicillin-resistant Staphylococcus Aureus), the company could be gobbled up very quickly…..SNY, Cubist and PFE are likely suitors. Currently, we are in at a higher price, so it is a good time to start.

Alkermes (ALKS) – Cramer has been pumping this stock for some time. What has caught my attention is this: ALKS-5461. This drug is a combination of buprenorphine and ALK-33 (Samidorphan). Come on….a mixed opioid agonist with a mu opioid antagonist! Well, it worked, and it worked well in a small subset of patients. Even Fox News is in on it! We will look for entries in Chat.

Thanks for reading, and we will continue to look for opportunities!