Courtesy of ZeroHedge. View original post here.

Submitted by EconMatters

Not a Bear in Sight

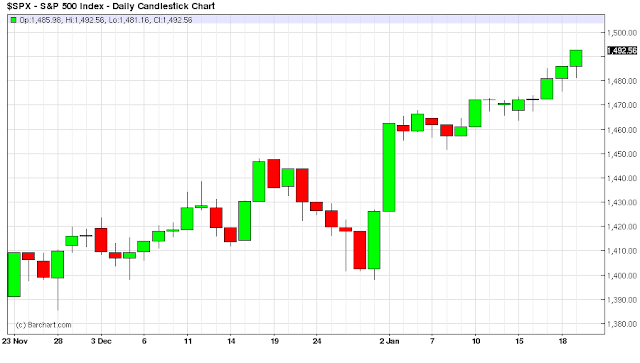

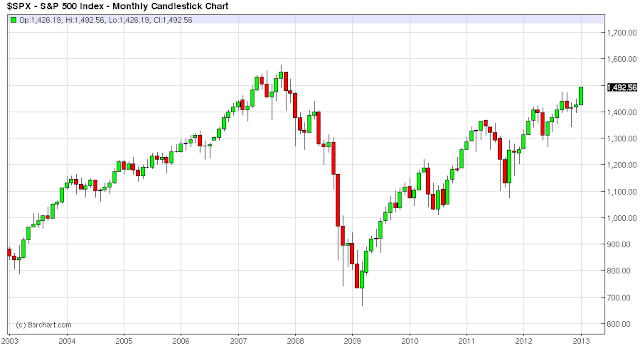

Everybody and their uncle is long this market right now, and equities have had a nice run with no pullbacks. The smart money will be selling into the rally to maximize profits by getting out when there is plenty of buying volume to eat up the sizable positions. It is the best time to sell because fund managers can liquidate large positions much easier without having to worry as much about creating complex Algos to maintain an overall high average price for the exiting position.

Bag-Holders

The S&P will be up around 5% just in January alone, not to mention the run-up from about this time last earning`s cycle when the benchmarks all sold off during the second half of earning for the third quarter. Tomorrow is close enough as good as it gets for a while, and traders will try to push up the S&P to 1500 if they can, but the smart money has such large positions that they will start selling into any rally tomorrow, watch for redistribution going on in your favorite stock. The smart money will be handing off to the bag holders looking to get in at the last moment. The smart money never chases, they always wait for a pullback to get into a trending market.

Further Reading – The Japanese Yen Trade Is Exporting Inflation To China

Getting a Good Price

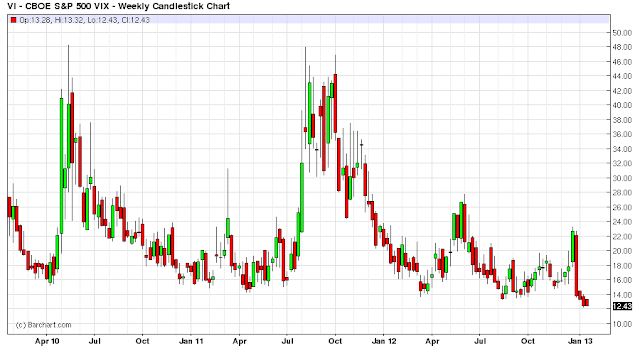

The reason why the large funds don`t wait until an exact top is put in is because once everybody realizes the gig is over, and the selling commences, everybody runs for the exits at the same time trying to protect profits, and buying puts to protect portfolios, which just makes the selloff worse because the VIX spikes even more, and forget about getting a good price for your exit. This is why you sell into rallies to maximize profits on the exit.

Buying Exhaustion & Market Timing

And when everyone is this bullish, and most of wall street cannot beat the S&P 500, the sheep get slaughtered when the buying reaches an exhaustion phase, i.e., there is no one “dumber investor” than you who buys after you, thus enabling you to have a nice profit. Making money on Wall Street is all about market timing, what do you think the market is going to have a 12×5% for a 60% annual return in 2013? This is why the smart money and those fund managers who outperform the S&P 500, perfect the art of timing the market, and selling into bullish rallies to maximize gains.

Further Reading – High Margin Requirements Are Killing The Silver Market

Always enter Trending Markets on a Pullback

They will be back after we have our first pullback in 2013, but they will be market timing the entire year with strategic buys and sells, this is how you beat the S&P 500, and attract higher assets under management. So be smart like the pros, and sell into the rally tomorrow, so that you aren`t waiting for a huge announcement like the rest of the sheep on Wall Street that it is time to sell. As when everybody realizes it is time to sell it is too late to maximize gains, equities will gap down 30 S&P handles, and your entire holdings gap down as well before the market opens.

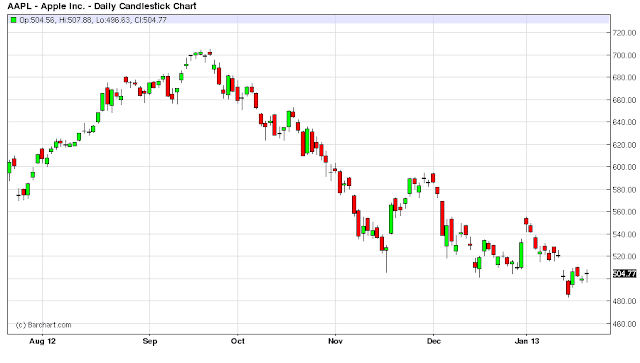

Be Dumb like Apple Investors – Wait for an engraved invitation to sell

The other option of course is just to stay invested like Apple investors did at $700 a share, remember how bullish all the talking heads were on all the shows. There wasn`t one analyst that said it is time to sell after apple reached a larger market cap than 3 top 10 fortune blue chip powerhouses of industry. Not one pundit, critic, trader on Fast Money, everyone was so bullish when Apple was at $700 a share; it was guaranteed to go to $800, $900 and a $1,000. Just a thought to remember, when everybody else is so bullish, who is left to buy from you?

Most Wall Street pundits just follow the crowd, so when markets are up, everyone talks bullish. But after three days of selling, these same pundits will be telling you it is the end of the world, and the top is in for the year, and all the same bearish clichés. Always look for good entry and exit points, never chase, and believe in market timing. It is one of the best ways to become a smart investor. So watch tomorrow for distribution going on in your favorite equities, as many will be taking profits by selling into the rally as discreetly as possible, and so should you!