Apple: Taking a Bite

Selling longer-term duration options can be an attractive way to invest in a company while gaining an edge similar to that of the House at a casino. The odds are always in the House's favor. We’re going to do this by selling 1 AAPL put in Market Shadow’s Selling Puts Virtual Portfolio.

Adding to the Selling Puts Virtual Portfolio on 1/23/13: SELL 1 April 2013 AAPL $500 Put for approximately $31.00.

Note: The price of AAPL shares were up after hours on Jan 22, and if AAPL opens higher on Jan 23, put prices will be lower.

Many Ways to Bite

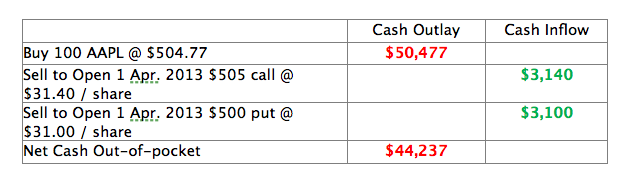

Another idea for a long-term option play on AAPL is a buy-write. It requires a large portfolio because AAPL shares are trading at around $500. To write (sell) a “covered” call on AAPL, we need $500 X 100 shares of AAPL, which costs $50,000, just for that one portion of one position. (A covered call would be buying 100 shares of AAPL and selling one call. A buy/write is the covered call plus selling one put. It's more bullish due to the sold put.)

Using a buy/write with AAPL, we can illustrate how the trade works. The chart below uses closing prices on Jan. 22, 2013.

If AAPL closes above $505 on April 19, 2013:

- The $505 call would be exercised and the $500 put will expire worthless

- We sell our shares for $50,500

- We will have received at least $265 in dividends

- Our final position will be no shares and $50,765 in cash

The net profit would be $50,765 – $44,237 = $6,528.

That best-case scenario cash-on-cash return would be 14.8%, achieved in just three months.

If AAPL closes between $500 and $505 on April 19, 2013:

- Both the $505 call and the $500 put will expire worthless

- We will still hold 100 shares of AAPL worth between $50,000 and $50,500.

- We earned at least $265 in dividends

- Minimum gain of $50,000 – $44,237 = $5,763

If AAPL closes below $500 on April 19, 2013:

- The $505 call expires worthless

- The $500 put gets exercised

- We need to buy another 100 shares of AAPL for $500

- We need to lay out an additional $50,000

- We will have earned at least $265 in dividends

- Our final position will be 200 shares of AAPL plus $265 in dividends

Our total cost = $44,237 + $50,000 – $265 = $93,972 / 200 = $469.86 /share.

Apple could fall by almost $35 (or -6.9%) per share without causing a loss. AAPL has not traded below our break-even price ($469.86) since Feb. 7, 2012.

We can make around 15% if the shares remain unchanged or rise. A 15% gain in three months represents an annualized rate that would double our net worth in 1.2 years!

Because we are SELLING option premium, we can absorb a moderate hit to the price of AAPL and still be ahead.

Apple reports earnings in the afternoon and the shares often move dramatically after earnings. This makes for a great a buy/write combination if we have a large enough bankroll to play with a $500+ stock.