Paul Price of Market Shadows likes this company; we have it in the Value Stock Virtual Portfolio.

4 reasons to buy ABM stock

Small-cap manager Andrew Baumbusch believes that building-maintenance specialist ABM Industries will rebound.

Small-cap manager Andrew Baumbusch believes that building-maintenance specialist ABM Industries will rebound.

By Ryan Derousseau, contributor

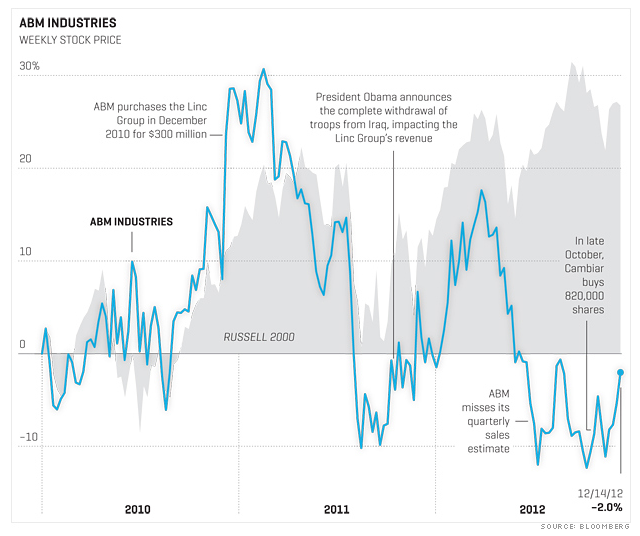

FORTUNE — Andrew Baumbusch looks for companies with hiccups. The lead manager of the Denver-based Cambiar Small Cap Fund (CAMSX) likes to invest in great businesses that have suffered short-term setbacks. The approach has proved profitable. Over the past five years, his fund has averaged a 6.3% return, vs. 2.4% for the Russell 2000 small-cap index. Recently Baumbusch spotted an opportunity in building-maintenance specialist ABM Industries (ABM).

1. ABM isn't big, but it has a long track record

Investors who specialize in small-caps must have a higher tolerance for volatility than those who buy larger, more stable companies. Baumbusch likes to mitigate that volatility by owning some mature businesses. The 103-year-old ABM handles security, parking, janitorial, and other services for offices and hotels — consistent businesses that aren't roiled by innovation. And, says Baumbusch, investors have seen how the company, with $1 billion in market cap, "will perform in good environments and bad."

2. It's recovering from a poor acquisition

ABM has missed sales and profit estimates several times in recent years, in part because of its ill-timed $300 million purchase in 2010 of the Linc Group, a contractor that ran barracks in Iraq. When troops began coming home in 2011, Linc faltered…

Keep reading: 4 reasons to buy ABM stock – The Term Sheet: Fortune's deals blogTerm Sheet.