Up, up and away!

Up, up and away!

It’s Super Market! Strange index from another reality, who ignores bad news and achieves p/e multiples far beyond those of rational markets. Super Market, who can break resistance on low volume, move higher without consolidation and who – disguised as a genuine Price Discovery Mechanism, an actual indicator of the true-value of listed companies – Instead fights a never-ending battle with rational thinking and negative data because, in America, the market is only allowed to go one way!

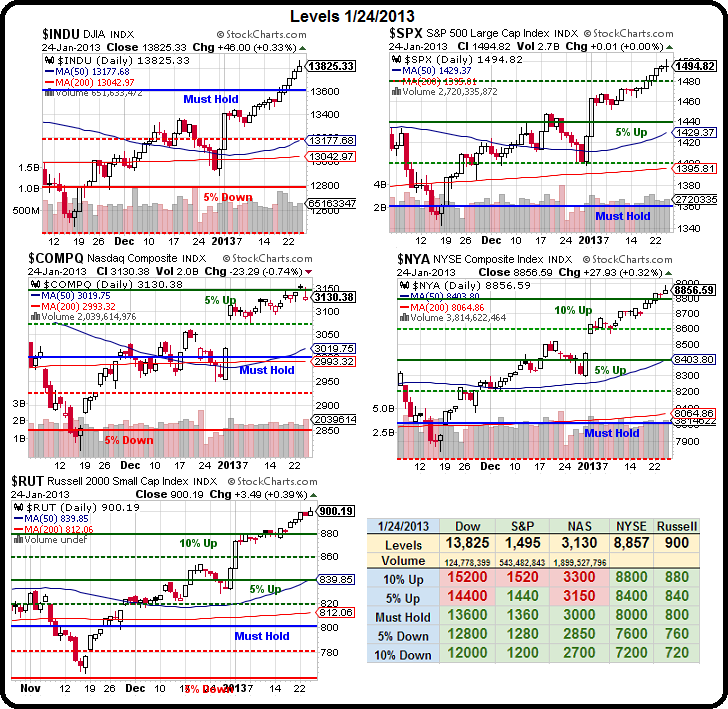

OK, I got that sarcasm off my chest, now we can cheer-lead. Go Russell 900 go! Is today finally the day? Will we hold 1,500 on the S&P, 13,800 on the Dow and 900 on the Russell? If we can also get back over 3,150 on the Nasdaq – we'll even have to consider, for the first time in two years, moving that "Must Hold" line on our Big Chart up 5%, finally leaving all of our old Must Hold levels in the dust.

With the 5% rule, the numbers don't change – these are the same levels we've been predicting since the '08-09 crash. What changes is where we target our range and a rally like this makes us believe we can finally look for higher lows than we've had before as we look up to the next set of higher highs, which should take us back to those 2007 levels.

So rah, rah, rah – go markets but – is it JUSTIFIED? SHOULD we be back at 2007 highs? Well, no, not really. That's the problem I've been having this week and now AAPL is tied like a lead weight around the neck of the Nasdaq and this morning we noted in Member Chat that the UK economy (as one of many examples) is STILL 3.3% SMALLER than it was in 2008 (chart left).

So rah, rah, rah – go markets but – is it JUSTIFIED? SHOULD we be back at 2007 highs? Well, no, not really. That's the problem I've been having this week and now AAPL is tied like a lead weight around the neck of the Nasdaq and this morning we noted in Member Chat that the UK economy (as one of many examples) is STILL 3.3% SMALLER than it was in 2008 (chart left).

That makes this the worst recovery – EVER – or, as RBS puts it: "2008-12: the weakest four years of #GDP performance outside post-war demobilisations since at least the 1830s – fall was bigger than any since before Victoria ascended the throne." No wonder Scots don't get invited to many parties…

One guy who does get invited to a lot of parties is George Soros, but guests are advised to check their wallets before he leaves. Soros is partying in Davos this week, with all the World's top Financial people and the mood is generally upbeat and Soros is on the inflation bandwagon, agreeing with my prediction that rates will spike very sharply once the economy picks up as the massive supply of money begins to gain some velocity.

One guy who does get invited to a lot of parties is George Soros, but guests are advised to check their wallets before he leaves. Soros is partying in Davos this week, with all the World's top Financial people and the mood is generally upbeat and Soros is on the inflation bandwagon, agreeing with my prediction that rates will spike very sharply once the economy picks up as the massive supply of money begins to gain some velocity.

Now that we have discussed the bullish premise, which is A) Inflation B) An improving economy and C) The Psychotic Fear Global Governments Have of Letting the Markets Decline and we have discussed (in the links) dozens of long-term upside trades that will make HUGE money if the market go up – we can move on and discuss a few shorter-term downside hedges and why I think we still need them.

The above levels are very impressive but also represent key psychological levels that may offer some resistance. We have essentially run straight up from S&P 1,360 (our Must Hold line) to 1,480 (our +7.5% line) with just one pullback at 1,440 (our 5% line) back to exactly our 2.5% line and now we are, in theory, heading up to our 10% line at 1,520 (Dave Fry chart) but it's almost a certainty that we'll get at least a 20% retrace of the 160-point run of 32, back to 1,488 or pretty much right back to our 7.5% line at 1,480. So, since we are now over 1,480 on the S&P, it seems logical to make a bearish bet, doesn't it?

The above levels are very impressive but also represent key psychological levels that may offer some resistance. We have essentially run straight up from S&P 1,360 (our Must Hold line) to 1,480 (our +7.5% line) with just one pullback at 1,440 (our 5% line) back to exactly our 2.5% line and now we are, in theory, heading up to our 10% line at 1,520 (Dave Fry chart) but it's almost a certainty that we'll get at least a 20% retrace of the 160-point run of 32, back to 1,488 or pretty much right back to our 7.5% line at 1,480. So, since we are now over 1,480 on the S&P, it seems logical to make a bearish bet, doesn't it?

SDS is an ultra-short on the S&P and is currently at $49 and you can pick up the March $48 calls for $2.20 and sell the March $51 calls for $1.15 for net $1.05 on the $3 spread that's already $1 in the money. That can be paired with a short sale on an inflation-fighting hedge like DBA, which has gone nowhere in this rally at $27.62, and we can sell the Jan 2014 $26 puts for $1.

So we are effectively promising to buy DBA for net $26 (6% off the current price) and taking the $1 they pay us for that and using it to net .05 on the $3 spread for S&P protection. If we have a $100,000 portfolio and we're willing to allocate $50,000 of our $200,000 in margin to owning DBA, then we can sell 40 of those puts for $4,200 and buy 40 of the SDS spreads and now we will get $12,000 if the S&P is down 2% (causing a 4% rise in SDS to $51) at March options expirations.

If the S&P is up, it's very likely DBA will go up and our short puts may expire worthless and our net cost for the quarterly insurance will be $200. Keep in mind that we WANT to own DBA long-term. That's the key to any put-selling premise.

If the S&P is up, it's very likely DBA will go up and our short puts may expire worthless and our net cost for the quarterly insurance will be $200. Keep in mind that we WANT to own DBA long-term. That's the key to any put-selling premise.

TZA is a more exciting form of protection and one we are already using in our Income Portfolio with a July spread but an aggressive play for a short-term pullback, with TZA at $11.26 is the March $10 calls at $1.40, offset by the short sale of the the same DBA short puts or, if you want to play with tight stops, the short sale of IWM Feb $90 calls at .85, which drops the cost of the March $10s to net .55 and we're just playing for a quick rejection of the Russell at 900 – NOT a long-term hold! If the Russell is over 900 and joined by the S&P 1,500 and the Dow at 13,800 – it's time to get out of this trade so we're really protecting against the rejection we expect at these levels but this spread does offer unlimited upside so it's lots of fun for aggressive traders.

We HOPE (not a valid investing strategy) that we lose money on these hedges. Like life insurance or health insurance, you don't really look forward to collecting but it's good to have – just in case. Statistically, we are likely to get at least a pullback off these highs and, if we don't – we take our losses and redraw our lines and look for the next uninterrupted 5% move in the markets and, the more that sounds unlikely to you – the more you probably should get some insurance!

Have a great weekend,

– Phil