Wheeeee, what a ride!

Wheeeee, what a ride!

We expected to flatline this week with my Monday outlook for our Members being: "Very tight ranges – possibly setting up to flatline into month's end. Which will make for a boring few days ahead." Amazingly, even a nasty headline number on the GDP yesterday couldn't take us down (and the numbers were actually fine – see yesterday's post for commentary as well as Dave Fry's telling copper chart) nor could the Fed following it up by sitting on their hands do any real damage.

We did get a dip in the Russell below 900 and that did trigger the TZA hedges we discussed last Friday but they are backed with the so far, so great DBA longs and we'll be happy to take a quick loss if the RUT recovers – but not until after the weekend. In Friday's post, the trade idea was to sell the DBA Jan 2014 $26 puts for $1 (now .75) and buy the TZA March $10 calls for $1.40 (now $1.50) so that net .40 trade can already be cashed for net .75, which is a nice 87.5% gain on a 1% drop in the Russell and that's how our option hedges are supposed to work – you can commit a very small amount of capital to hedge protection and get a huge payback to mitigate your losses when and if the market turns.

Even better, we only need these hedges to cover our assets while we dump our positions and scramble back to cash IF our levels break down. As I mentioned at the top of last Tuesday's post, these are silly gains for a month and, when you make 1/2 of your investing gains in the first month of the year – it's more than prudent to get back to cash – because, statistically, it is far more likely that the next 6 months will disappoint you.

Even better, we only need these hedges to cover our assets while we dump our positions and scramble back to cash IF our levels break down. As I mentioned at the top of last Tuesday's post, these are silly gains for a month and, when you make 1/2 of your investing gains in the first month of the year – it's more than prudent to get back to cash – because, statistically, it is far more likely that the next 6 months will disappoint you.

Fortunately, we only set stops and our stops have not been breached but we're also raising those stops and adding some hedges – happy to give up a little of the additional, future, POTENTIAL gains in exchange for locking in what we already have. We're also getting an opportunity to pick up some new entries in stocks that are taking a dip. Even in "the stock we no longer talk about" because the low VIX is giving us such great opportunities to go long on stocks that have taken a beating (as well as inflation-protection ETFs like DBA and GDX).

Just this morning I pointed out that we have another opportunity on ALU as they have pulled back from $1.79 on Monday to $1.56 as investors take profits ahead of earnings. We've been in ALU since $1 and it's in our Income Portfolio but, we're very excited about their new 100G fiber cables that are already up and running in Moscow and now ALU is working a 17,500 km contract with AMX that will ad almost 20% to ALU's existing network. And, don't forget, ALU gets to maintain those lines as well!

Just this morning I pointed out that we have another opportunity on ALU as they have pulled back from $1.79 on Monday to $1.56 as investors take profits ahead of earnings. We've been in ALU since $1 and it's in our Income Portfolio but, we're very excited about their new 100G fiber cables that are already up and running in Moscow and now ALU is working a 17,500 km contract with AMX that will ad almost 20% to ALU's existing network. And, don't forget, ALU gets to maintain those lines as well!

Like the stock we no longer talk about, ALU is a long-range growth story and the scope of their projected are beyond both the patience and imagination of most analysts and investors, so they don't get the props they deserve. They also have some pretty good options premiums so a new entry we like on ALU would be buying the 2015 $1/2 bull call spread for .40 and selling the Jan $1.50 puts for .35, which puts you in the $1 spread for .05, with a .95 (1,900%) upside on net cash if ALU makes it to $2 in Jan 2015 against no more than .75 in margin that only lasts this year if ALU holds $1.50 with the break-even way down at $1.30 (down 16%) so we have a built-in hedge and a huge upside AND it's margin-efficient.

Like the stock we no longer talk about, ALU is a long-range growth story and the scope of their projected are beyond both the patience and imagination of most analysts and investors, so they don't get the props they deserve. They also have some pretty good options premiums so a new entry we like on ALU would be buying the 2015 $1/2 bull call spread for .40 and selling the Jan $1.50 puts for .35, which puts you in the $1 spread for .05, with a .95 (1,900%) upside on net cash if ALU makes it to $2 in Jan 2015 against no more than .75 in margin that only lasts this year if ALU holds $1.50 with the break-even way down at $1.30 (down 16%) so we have a built-in hedge and a huge upside AND it's margin-efficient.

That's how we like to set up long-term trades at PSW but we're also having a great time amusing ourselves with short-term trades while we wait – especially around these earnings reports. And we've had great fun sharing our trade ideas in the morning posts – as we do each quarter during the first month. Tomorrow, we go back to our regularly scheduled programming, with more focus on the global fundamentals in the morning posts.

That's how we like to set up long-term trades at PSW but we're also having a great time amusing ourselves with short-term trades while we wait – especially around these earnings reports. And we've had great fun sharing our trade ideas in the morning posts – as we do each quarter during the first month. Tomorrow, we go back to our regularly scheduled programming, with more focus on the global fundamentals in the morning posts.

In yesterday's post, we discussed shorting oil and now we're ranging from $98 to $97.50 in the Futures (/CL) but still a good chance to pick up SCO or the USO puts we had talked about until we finally break below the $97.50 line (about $35.30 on USO and $36 on SCO and a great place to go short again on /CL if you missed $98). Yesterday's inventory report was no reason for $100 oil and the Fed was no help and we THINK the Dollar is finding a floor at 79.20 and should be back over 79.40 today, maybe even 79.50 (dare we dream?).

I mentioned our NFLX bear put spread in Tuesday's post and that actually gave a cheap entry once again yesterday as NFLX poked back up over $170 but now it's calming down again and hopefully we'll collect the full 66% on that one.

I mentioned our NFLX bear put spread in Tuesday's post and that actually gave a cheap entry once again yesterday as NFLX poked back up over $170 but now it's calming down again and hopefully we'll collect the full 66% on that one.

In yesterday's Member Chat we took the opportunity to grab GLD as it retested $160 (we already had long positions in our Income Portfolio) but, around lunch-time, we found 3 earnings plays we liked, which were:

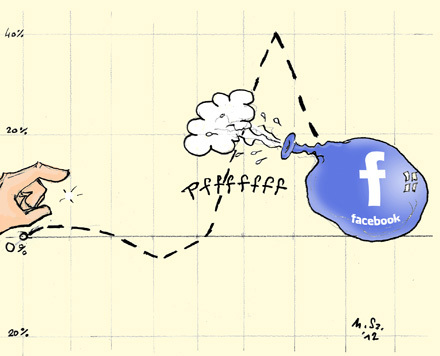

Earnings trade/StJ: Here's a fun way to play FB on earnings:

- Buy the April $31/35 bull call spread for $1.50

- Buy the April $31/27 bear put spread for $1.25

- Sell the weekly $31 puts and calls for $3.35

That's a net .60 credit on the spread and FB would have to move more than 10% to put you in trouble but it's still rollable and you also should be able to recover some of the losing side on the April verticals. Seems like a fun play to do 5 of in the $25KPA to see how it plays out.

On this trade we're taking advantage of pumped up earnings premiums AND the low-VIX longer premiums.

JDSU/StJ – Lack of faith makes March $12/13 bull call spread just .53 with almost 100% upside and no premium. All they have to do is show well and this will be the last time we see $13 on this stock and, if they miss – it can be converted by selling puts into the sell-off. The Jan $12 puts, for example, are currently $1.70 so net $1.20 even if you do lose the entire spread and, if you lose the spread, then you'll get more than $1.70 for the short puts.

LVS can be played to go up but not too far up by taking the June $52.25/60 bull call spread for $2.45 and selling the Feb $52.50s for $1.75 for net .70 on the $7.75 spread. Would take a 15% (2x normal) move in LVS to blow you out and plenty of time to roll.

Looks like we'll be 3 for 3 this morning as FB is down to $29.20 pre-market and that means we'll owe back (if we don't roll) the weekly $31 putter $1.80 back ($900 in our virtual $25,000 Aggressive Portfolio) but our $31/27 bear put spread will be worth at least $2 ($1,000 for 5 contracts) so that's another net $100 on top of the $300 credit we got for setting up the spread AND we are likely to have at least $250 more Dollars left on the bull call spread, free and clear now. Not bad for a day's work!

Looks like we'll be 3 for 3 this morning as FB is down to $29.20 pre-market and that means we'll owe back (if we don't roll) the weekly $31 putter $1.80 back ($900 in our virtual $25,000 Aggressive Portfolio) but our $31/27 bear put spread will be worth at least $2 ($1,000 for 5 contracts) so that's another net $100 on top of the $300 credit we got for setting up the spread AND we are likely to have at least $250 more Dollars left on the bull call spread, free and clear now. Not bad for a day's work!

JDSU hit it out of the park and we can look forward to the full 88.6% gain now, as long as they don't fall over $1 from their pre-market $14.20 and LVS did, indeed go up, but not too far at $54.50 pre-market so potentially giving $2 back to the short caller but the spread is well on track for a nice gain and, of course, we don't give our callers nothin' unless we have to and we have plenty of room to roll this one…

We also added spreads on GMCR and GLW to our Income Portfolio, which I imagine will close out the month with ridiculous gains as it was already up a virtual 19.7% on our Jan 21st review and we had decided to stay bullish what is now 400 Dow points ago. So busy, busy to close out the month and hopefully this is a pause that refreshes this week and not a move that pushes us back to cash but NO WAY do we let these gains slip through our fingers – we can always find something to trade tomorrow if we find ourselves in cash!

In the meantime, we'll watch our levels closely as it's been a great year already.