It's not the things you do that tease and hurt me bad

but it's the way you do the things you do to me.

I'm not the kinda girl who gives up just like that, oh no.The tide is high but I'm holding on. – Blondie

We passed our first major test yesterday.

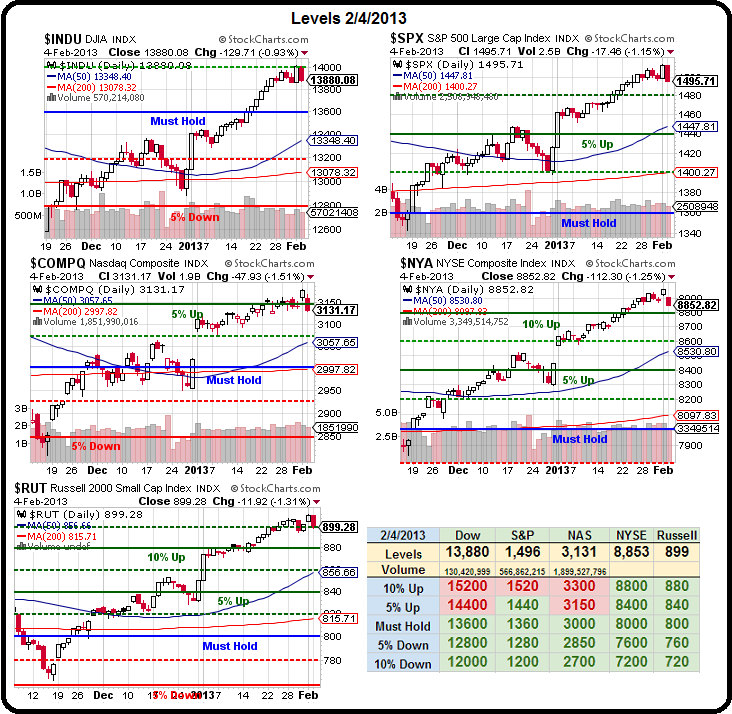

I set levels for the expected pullbacks back on the 1st and yesterday, in our morning Alert to Members, I reminded our subscribers that it would take more than a 1% drop in our indexes before even our closest (the Nasdaq) was in trouble and that index is being dragged down unrealistically by a single stock (which will remain nameless) – so we cut them a little slack. Our target levels were:

- Dow 13,600 (finished at 13,880 +2%)

- S&P 1,480 (finished at 1,495 +1%)

- Nasdaq 3,150 (finished at 3,131 –0.6%)

- NYSE 8,800 (finished at 8,852 +0.6%)

- Russell – 880 (finished at 899 +2.1%)

This is why we have our 3 of 5 rule – one index breaking a bit below is no reason to go bearish. Especially when a single stock that makes up 20% of the index drops 2.5% and causes 0.5% of the drop by itself. The Dollar also ROSE 0.6% yesterday, so half of the losses for the day were nothing more than a currency adjustment and my comment to Members at the open was:

This is why we have our 3 of 5 rule – one index breaking a bit below is no reason to go bearish. Especially when a single stock that makes up 20% of the index drops 2.5% and causes 0.5% of the drop by itself. The Dollar also ROSE 0.6% yesterday, so half of the losses for the day were nothing more than a currency adjustment and my comment to Members at the open was:

it would take more than a 1% drop in our indexes before even the Nasdaq gets in trouble and, since we need to see 3 of 5 levels fail, it's 2.3% to S&P 1,480 that we need to watch closely. Other than that – how can we be bearish? As Josh Brown pointed out on the weekend regarding our Market Euphoria chart and as I noted this morning, we're more likely just in the Optimism/Excitement phase of the trend than already past Thrills and Euphoria. That puts us halfway through a massive rally, rather than at the very top of a medium rally.

Still, even massive rallies have pullbacks and we'd love to miss one if it comes so we will be raising our stop lines (assuming they don't trigger) along with the market – but only after we get proper moves up, not one or two-day spikes. Another reason to be bullish is a bottom on the stock which must not be named: If AAPL refuses to go lower than $450ish, how is the Nasdaq going to have a proper sell-off?

During the day, I tweeted out some new hedges we could take if the Russell failed to hold 900 as well as earnings plays on CMG and EXPE from our Member Chat while in Member Chat we had additional trade ideas for FB and AAPL and, on the whole, we ended up staying bullish for another day and this morning, we already had a long discussion about our overall outlook, which is still bullish:

During the day, I tweeted out some new hedges we could take if the Russell failed to hold 900 as well as earnings plays on CMG and EXPE from our Member Chat while in Member Chat we had additional trade ideas for FB and AAPL and, on the whole, we ended up staying bullish for another day and this morning, we already had a long discussion about our overall outlook, which is still bullish:

Obviously, values in 2000 were just silly but values in 2007 were not – in light of what we believed was a growing global market. That, ultimately, is the future and unless anything in particular is going to disrupt that future – we can expect pretty steady growth (see "The Worst-Case Scenario: Getting Real With the Global GDP!" which I wrote to substantiate my bullish premise for Members to start buying in the "crash" of June 2010).

On the whole, the tide is coming in and the bears hate the water and every time a wave comes up short they shout: "See, I told you the water would never reach this part of the beach" but rationally, we can see the high water-line (2007) and we KNOW that the water has gone that high before and the tide has clearly turned so why would we bet that that part of the beach will never get wet again – even as the water is clearly climbing and has been for 3 consecutive years? Oh yes, and there's the Fed. And what are they doing? Adding more water to the Ocean at a rate of $85Bn a month, which may not sound like much in a $16,000Bn ocean but they've been adding it for 3 years and that's about $2,500Bn more dollars floating around while the bears sit on their chairs under the high-water mark and tell you it will never get wet again this far from the shore-line.

Our Big Chart is either toppy (and even a 5% pullback here would not be bearish – we haven't moved our Must Hold lines yet – as long as 13,600 holds, all is well) or we're now consolidating 5% higher than the last time we consolidated and we'll know that the same way we knew last time – the pullback won't violate our stops.

Our Big Chart is either toppy (and even a 5% pullback here would not be bearish – we haven't moved our Must Hold lines yet – as long as 13,600 holds, all is well) or we're now consolidating 5% higher than the last time we consolidated and we'll know that the same way we knew last time – the pullback won't violate our stops.

That's what kept us bullish in December and we called an audible and ignored the low volume spike down into Christmas (but we had very good reason with cliff nonsense scaring the sheeple) and yesterday we ignored the move down because it was Dollar-driven but we don't just go around trying to find excuses for the market – we need to not care whether the market goes up or down and the best way to do that is to have a PLAN for exiting that's just as good as your plan for staying – then you won't care which plan goes into effect, right?

We're over halfway through earnings season and, so far, we're looking pretty good – with just 21% of the S&P 500 companies failing to beat either earnings, sales or both. Of course, as we noted before the season began – expectations were set so low, it wasn't a big leap of faith for us to believe this quarter would come in BTE. Guidance has also been soft (but forgiven, for the most part) and that sets us up for an easy beat of low-bar expectations again next quarter.

We're over halfway through earnings season and, so far, we're looking pretty good – with just 21% of the S&P 500 companies failing to beat either earnings, sales or both. Of course, as we noted before the season began – expectations were set so low, it wasn't a big leap of faith for us to believe this quarter would come in BTE. Guidance has also been soft (but forgiven, for the most part) and that sets us up for an easy beat of low-bar expectations again next quarter.

Another thing that may give the markets more fuel is an increase in M&A activity, highlighted by DELL's expected $25Bn deal. With that kind of cash looming to suddenly be injected into the markets – how can you bet against things? $25Bn is over $10Bn more than DELL was trading at in November. It's easy now to say that people who panicked out of DELL in November were fools who didn't know how to value a company but the same can be said for another now-$415Bn company I can think of…

Meanwhile, our plan is to continue hunting for sea-shells as we walk along the shoreline. Our general plan is to try not to get wet but we're not too worried as we already have our stuff secured and we're ready to move to higher ground if the water comes in or quit the beach altogether if we don't like the look of the waves but plenty of time to have fun in the sun while we watch the bears scurry around trying not to get soaked.