Monday morning you sure look fine

Friday I got travelin on my mind

First you love me, then you fade away

I can't go on believin' this way – Fleetwood Mac

What an exciting week we have in store!

First of all, it's options expiration on Friday and we have a holiday weekend in the US (and Happy Year of the Snake to our friends in China, who are closed this week) along with plenty of earnings but, most importantly this week – we have FED SPEAK!

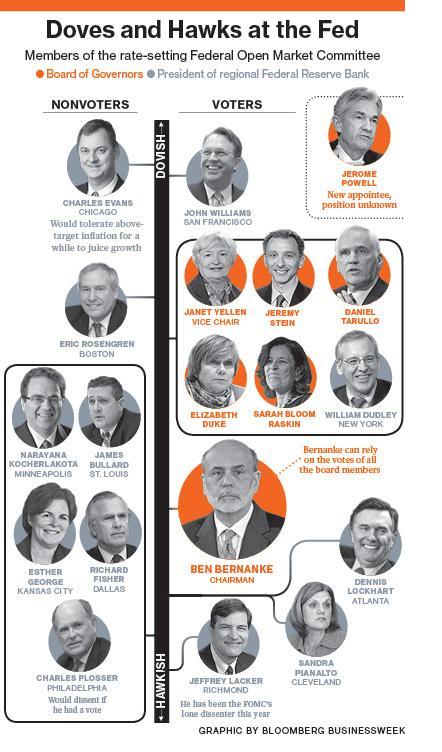

That's right, this week we'll hear from Esther George tomorrow at 11:30, Charlie Plosser at 7:30 with Jimmy Bullard speaking Wednesday at 11:10 and, oddly enough, at 12:50 on Thursday as well and Sandy Pianalto takes us home Friday morning at 9:50.

Sandy is the "dove" of the group and even she is pretty far down the hawk ladder while the others are all reliable Fed hawks with Bullard only exceeded by Fisher in his hawkishness but they used Fisher last time they had notes to sell so this time it's up to Bullard to scare investors into bonds – strategically placed just ahead of both the 10-year and 30-year auctions.

That places a bit of a downside risk on the markets this week as the Fed will have to walk that fine line between keeping those long-term rate expectations low while keeping people believing that it's safe to go out and risk their assets in the markets, homes, cars, durable goods, equities, etc.

Keep in mind that, on this Bloomberg Chart – Ben Bernanke is considered moderately hawkish. If moderately hawkish is printing $2.7Tn in 5 years – I wonder what would happen if the Doves ever took charge?

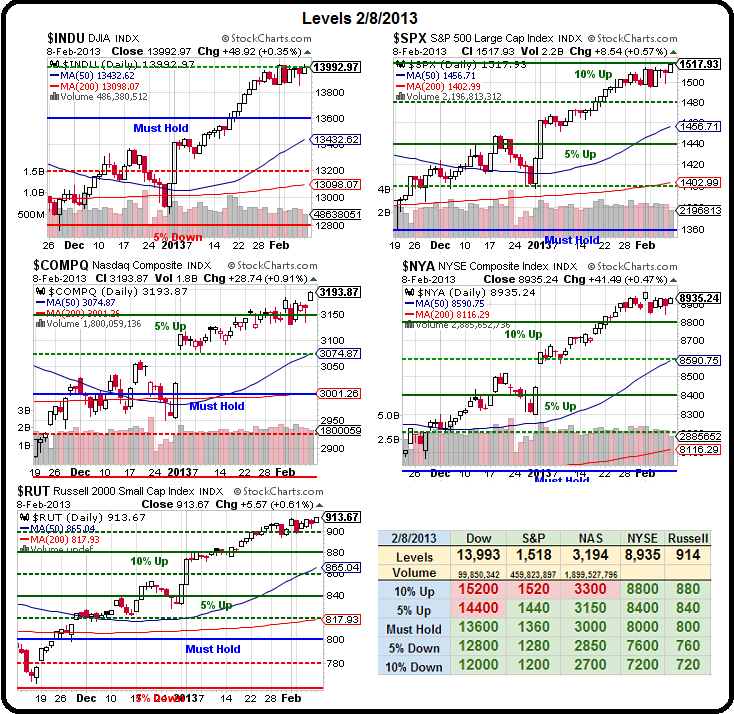

Mo' free money has been our rally cry since 2009 and, as you can see from our Big Chart – it's certainly working well enough as we enjoy what is shaping up to be a 20% run in the markets since Thanksgiving. "First you love me, then you fade away" is how the song goes and we certainly hope the market doesn't do the same but our 5% Rule SCREAMS for a 20% correction (of the run) at 20% so we're looking for any excuse to take a 4% dip now and we still won't be bearish until we lose those lines.

Mo' free money has been our rally cry since 2009 and, as you can see from our Big Chart – it's certainly working well enough as we enjoy what is shaping up to be a 20% run in the markets since Thanksgiving. "First you love me, then you fade away" is how the song goes and we certainly hope the market doesn't do the same but our 5% Rule SCREAMS for a 20% correction (of the run) at 20% so we're looking for any excuse to take a 4% dip now and we still won't be bearish until we lose those lines.

So, before our November lows fall off the chart this week – let's contemplate our runs and what kind of pullbacks we can expect as a "healthy" correction:

- The Dow is up from 12,800 to 14,000 (1,200 points) so giving 240 points back (20%) takes us back to – 13,660.

- S&P 1,360 to 1,520 (160 points), 32 back takes us to 1,482 but we round to 1,480 as that's the 2.5% line on the nose.

- Nasdaq has been held hostage by AAPL and must lead us higher now if we are to break out (AAPL is now down to 16.6% of the index as it's lost 35% of its value). The Nas has struggled from 2,850 to 3,200 (350) and giving back 75 (20%) takes us back to 3,125 – just below the 5% line.

- NYSE marched from 7,850 to 8,950 for 1,100 points and giving back 220 takes us back to 8,730 and that's barely under the 10% line so, if that holds – we'll be very impressed.

- Russell has flown from 760 to 915 (155) for a neat 20% run and a just as neat 20% pullback of 30 points drops us back to 885 and the 10% line is 880 so it's the RUT and NYSE we'll be watching very closely because – if the bears can't get them to back off their 10% lines – what hope do they have on taking down the rest?

As Dave Fry so aptly notes: "Seeing that we’re long I shouldn’t complain too much. The game hasn’t changed. On one side are very smart and experienced people who are raging at the machine. Most are gray-haired veterans who think they’ve seen it all. (The truth is, they haven’t). The other side are the money printing central banks and ZIRP that make any choices beyond stocks seem dumb. That’s it."

As Dave Fry so aptly notes: "Seeing that we’re long I shouldn’t complain too much. The game hasn’t changed. On one side are very smart and experienced people who are raging at the machine. Most are gray-haired veterans who think they’ve seen it all. (The truth is, they haven’t). The other side are the money printing central banks and ZIRP that make any choices beyond stocks seem dumb. That’s it."

Dave's TLT chart makes our play of the week obvious – LONG TLT! As I said to our Members over the weekend, it's no coincidence that the hawks are on parade this week – the Treasury can't AFFORD to have a bad auction, not when they are rolling over almost $5Tn worth of debt this year (AND adding another $1Tn to the pile).

So we can expect that $117 line on TLT to be well-defended and the Feb (Friday expiration) $116.50 calls closed at $1.03 on Friday, which was just .41 in premium and if TLT simply goes back to $120 on bearish Fed speak – those calls should be good for at least $3.50, which would be a profit of 240% in less than 5 days. We'll certainly be looking to play this in our short-term virtual portfolios as it's very easy to pull out if our premise is blown and TLT does not hold that $117 line which means the risk is relatively light compared to the possible reward.

Long-term, we're bearish on TLT because clearly the Emperor has no clothes but, as long as people keep believing the BS the Fed is spinning – he can still parade around from time to time without too much fear of ridicule. Of course, clever little boys and girls that we are at PSW, we took the opportunity on Friday to add a few aggressive hedges against what is likely to be a slight (at least) market downturn. We added plays in our $25,000 Portfolios AND the Income Portfolio early in the morning but that didn't stop us from finding some bullish ideas on NUAN, who got whacked on Friday and made for a good entry under $20, as well as MT, WFR and ALU, with CCJ as our newest earnings play in Member Chat at 2:41:

CCJ/Deano – As I noted, we already have them in the Income Portfolio a bit lower than here for 2015 so I certainly like them long-term but tough to call any individual earnings Q. I'd base a new entry on the premise that they don't go below $20 but, if they do, we don't mind owning them so 2015 $20 puts can be sold for $3 against a $17/25 bull call spread at $3.70 for net .70 on the long spread and then you can sell 1/2 the March $21 calls for $1.10 for net .20 on the $7 spreads that are $4 under the calls with a 2:1 advantage so almost no upside harm, a net .20 entry at $17 and worst case is owning the stock at net $20.20 but the break-even, with the $17 calls, is $18.60, 13.5% off the current price and, of course, 7 more quarters to sell.

Over the weekend, we had a great conversation about establishing an entry into a position like this (with ALU as our example) and, this morning, we decided we were thrilled with our oil shorts as the /CL Futures failed the $95.50 line this morning – right on schedule for our short positions and still in line with our "stronger-dollar" premise for the week, thanks to the Fed hawks. We also noted that TSLA was savaged in a NYTimes article but that's fine with us as it brings the price back in line with our prediction – as the stock had gotten ahead of itself, forcing us into a short position – even though we like them long-term (see BNN interview 1/15).

Over the weekend, we had a great conversation about establishing an entry into a position like this (with ALU as our example) and, this morning, we decided we were thrilled with our oil shorts as the /CL Futures failed the $95.50 line this morning – right on schedule for our short positions and still in line with our "stronger-dollar" premise for the week, thanks to the Fed hawks. We also noted that TSLA was savaged in a NYTimes article but that's fine with us as it brings the price back in line with our prediction – as the stock had gotten ahead of itself, forcing us into a short position – even though we like them long-term (see BNN interview 1/15).

On Friday, right in the morning post, I mentioned our earnings play on CSTR and the 5 short Feb $55 calls fell quickly to .10 ($50) just one day after we collected $950 for selling them in our virtual portfolios while the 10 April $55/57.50 bull call spreads we paid .80 for ($800) finished the day at .40 ($400) so we were able to close the trade out at net $350 AND keep the original $150 credit from the original spread for an instant $500 profit but I called an audible during Member chat and we're letting the short calls expire worthless on Friday and then we'll decide what to do about the long spread.

Another play we discussed Friday was our last Twitter Trade of the Week, where we selected the DIA March $140 calls at .15 on Thursday and officially cashed them in Twitter for .60 on Friday for a nice 300% gain in a couple of hours' trading. That comment was, in fact connected to our new trade idea (at the time) on CSTR so probably one of my best tweets of the week!

This morning we have a nice Futures opportunity to play oil (/CL) for a bounce off the $95 floor that has held so well and gold (/YG) off the $1,650 line. Those should be good as the Dollar tests 80.50 but tight stops on all those lines but hopefully we can get a little bit of a bullish bounce in before it's time for the Fed to begin talking the markets down tomorrow through Thursday.

This morning we have a nice Futures opportunity to play oil (/CL) for a bounce off the $95 floor that has held so well and gold (/YG) off the $1,650 line. Those should be good as the Dollar tests 80.50 but tight stops on all those lines but hopefully we can get a little bit of a bullish bounce in before it's time for the Fed to begin talking the markets down tomorrow through Thursday.

The MSM is finally catching up with our 1/31 report on the iWatch – we'll see if that lifts AAPL and GLW (who make the curved glass), who we also, of course, mentioned in that post at a very opportune $11.75 (now $12.50). Of course, if we're not at least 2 weeks ahead of the curve then we must be slipping. right?

It's going to be a very exciting week – I hope you're ready!