What a rally!

What a rally!

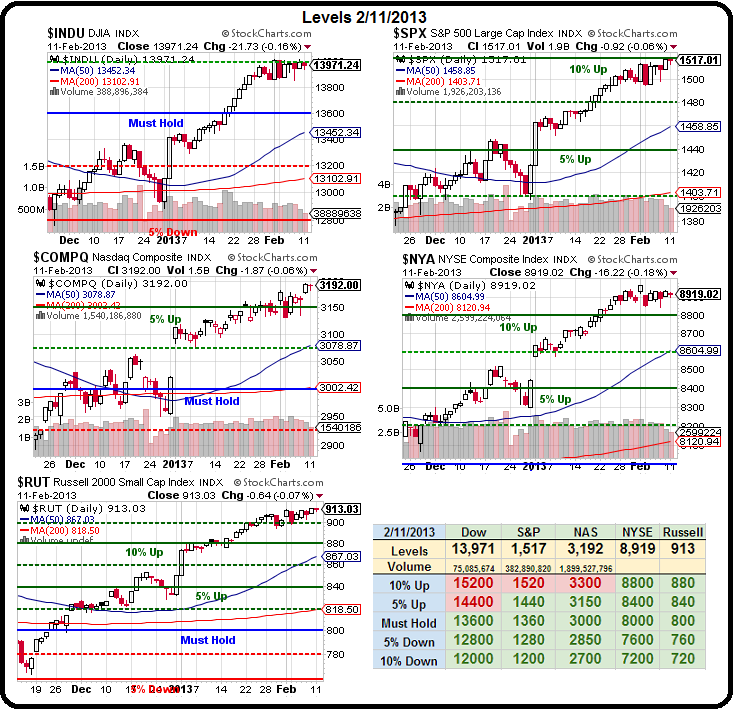

We're sort of betting against it now (through Friday) but – WOW! – what a rally! We were super-impressed with yesterday's action as our indexes stayed aloft despite the Dollar poking over the 80.50 line and, this morning, the strong Dollar knocked the Yen down (up) to 90.40 and now the Nikkei jumped 2% to 11,440 and – WOW! – that is high – up 33% since mid-November.

WOW!

So, here's the question – are markets now grossly over-priced OR – WERE the markets grossly under-valued for most of the last 5 years. That then begs the question of whether the markets were correctly valued in 2007 – as that's about what we're up to now – and I guess that makes us then ask the next question, which is: Were the markets correctly priced in 2000?

That's right, the S&P 500 was at 1,550 in 2000 and 1,550 in 2007 and now, in 2013, we're back around 1,550. While values may have gotten ahead of themselves in 2000 and maybe we were too enthusiastic in 2007 – because we failed to take into account the dangers that faced the Global Economy – this time we're going back to the well for the third time with our eyes wide open – albeit hopped up on tremendous amounts of monetary stimulus.

And there's the rub. None of this is real, is it? It's all one tremendous financial adrenaline shot that would make the proverbial dead parrot go VOOM, but that also makes it very difficult to judge the true value of our economy and, therefore, the companies that populate it.

And there's the rub. None of this is real, is it? It's all one tremendous financial adrenaline shot that would make the proverbial dead parrot go VOOM, but that also makes it very difficult to judge the true value of our economy and, therefore, the companies that populate it.

Well, that's the short-term take, but the big picture is that the World Economy has indeed gotten bigger in the past 13 years – much bigger actually. We do know China's GDP has more than doubled in the past decade but so had India while the economies of India, Russia, Brazil, Argentina, South Africa, South Korea and Turkey have all grown 50% with Mexico and Australia up 25% and the US, the EU and Japan have been bringing up the rear with average growth rates of "just" 1% a year.

BUT – if none of us are going down and some of us are going up – isn't the Global Economy getting bigger? Of course it is! On the right is a slide from an IBM Investor Briefing that has lots of cool stuff but what I thought worth mentioning here is this little nugget.

BUT – if none of us are going down and some of us are going up – isn't the Global Economy getting bigger? Of course it is! On the right is a slide from an IBM Investor Briefing that has lots of cool stuff but what I thought worth mentioning here is this little nugget.

AFTER growing from $33Tn to $60Tn between 1999 and 2009 (80%), IBM is projecting just $12Tn of additional (real, non-inflationary) growth between 2009 and 2015, with 55% of it coming in urban cities (the point of this slide). In short – since 1999 and through 2015, we're essentially adding an entire World to the Global GDP.

So now I'll ask you – does it make any sense at all for stocks to be priced the SAME in a World with a $70Tn GDP as they were when the Global GDP was "just" $30Bn? Who's irrational now? The Economist projected 1-year (yes ONE YEAR) GDP growth of $10Tn from September 2012 to September 2013 and you can wring your hands all you want and complain about how it's debt-fueled or borrowed or printed or painted or whatever but IBM has it right because they focus on THE MONEY – and how to get their share of it.

While some stocks may win (IBM was priced at $110 in 1999, now $200) and some stocks may lose (GE was $50 in 1999, now $22.50) – the overall market, the S&P listing of the World's top 500 companies and the NYSE's broad index of 4,000 stocks or the self-counting Wilshire 5,000 Index – should NOT be down at 1999 levels – even if those 1999 levels were, indeed, ahead of themselves.

You already KNOW Corporate Profits are at record highs, don't you? But have you thought about what that means? Per current Q4 reports, we're blasting over $1.6Tn in NET profits for US Corporations – that's after paying an average tax rate of 12% (I know, but that's a topic for another day..) and AFTER deducting the losses of the underperformers and start-ups and AFTER deducting "Inventory Valuation Adjustments and Capital Consumption Adjustments".

In other words, if the people ever got a proper look at how much money US Corporations are REALLY making – there would be an immediate revolution but even $1,600,000,000,000 per year is impressive as it's still more than the TOTAL GDP of all but 11 countries on Earth (Australia is #12 with $1.5Tn).

But, from our perspective as investors – good for them! Again, we can see from Yardeni's chart that overall Corporate profits are also up over 100% since 1999 and those were up 100% from 1990. So, perhaps we were a little ahead of ourselves in 1999, pricing the S&P 500 at 1,550 but I hardly think the same can be said for 2013, when those same 500 companies (more or less) are making 100% more money.

What is being priced in now is risk – risk that we will succumb to another shock like the one we had in 2008, which dropped those profits by 50%. But, as noted by Zippy above – we bounced back very quickly and happy days are hear again – at least until we either stop printing money or have to recognize the debts we already ran up. Either way though – we sure aren't going back to those 2000 levels – if nothing else, the crash of 2008 proved that because the Financial World almost ended and we STILL held up above the previous highs.

Isn't this then, a market you WANT to be invested in? Even more so – isn't this then, a market you NEED to be invested in? What if the worst-case doesn't happen and these foolishly LOW levels of market valuation don't last? What if some of IBMs $6.3Tn of urban spending growth goes towards IPads and IPhones and IWatches?

Isn't this then, a market you WANT to be invested in? Even more so – isn't this then, a market you NEED to be invested in? What if the worst-case doesn't happen and these foolishly LOW levels of market valuation don't last? What if some of IBMs $6.3Tn of urban spending growth goes towards IPads and IPhones and IWatches?

Suddenly AAPL seems pretty reasonable at $450Bn in market cap with $156Bn in sales and $42Bn in profit – doesn't it? Just 1% of that $6.3Tn in new money heading AAPL's way can add 50% to their bottom line over 5 years. But it's not just AAPL – it's 100M new people a year who want to eat (MCD, DBA), watch movies (IMAX), go shopping (JWN, M), go on-line (CSCO), etc.

The problem with US investors is we tend to think the US is the most important thing on the planet but 100M people a year in growing urban population is NOT in the US and, every 3 years – it's the equivalent of the ENTIRE US growing somewhere else. This is not a train you want to be missing folks. We may have a bumpy ride ahead of us but, on the whole, the direction of the tracks is certain – up the hill we go.

See you at the top!