Dow 17,000 anyone?

Dow 17,000 anyone?

It's only 20% up from here and it's now officially Jeremy Siegel's prediction for 2013 but, of course, Jeremy Siegel is always bullish but, as I noted in yesterday's post, always bullish is usually right in the markets. In fact, maybe we're all not bullish enough. Yesterday afternoon, in Member Chat, StJeanLuc brought up this Inflation-Adjusted Chart of the Dow from IntelligentBear and we can that, clearly, we're only about halfway into a real rally.

At 14,000 we are exactly in the middle between Siegel's 17,000 prediction and the red support line on that chart at 11,000, that would make for a bearish correction of that same(ish) 20%. So who should we listen to? According to William Sherdon (from Barry), author of “The Fortune Sellers: The Big Business of Buying and Selling Predictions,” the answer is NO ONE!

That's right, they are ALL idiots. And, by THEY, I mean anyone who tells you they know what the market is going to do. As Barry notes, Sherden decided to test the accuracy of leading forecasters over a multidecade period. His conclusion: Forecasters stink! His findings are summarized by Paul Farrell as follows:

1. Economists’ predictions are no better than guesses

2. Government economists often worse than guesses

3. Long-term accuracy is impossible

4. Turning points cannot be predicted

5. No specific forecasters are better than the rest of pack

6. No forecaster was more expert with specific statistics

7. No one ideological orientation was better

8. Consensus forecasts do not improve accuracy

9. Psychological bias distorts forecasters and their forecasts

10. Increased sophistication does not improve accuracy

11. No improvement over the years

This is why, at PSW, we teach our Members to BE THE HOUSE – not the gambler. The only sure thing in this market is SELLING premium to other suckers who THINK they know what's going to happen next. Since even the best of them are really no more accurate than a coin flip – the best thing to do is step on over to the other side of the table and SELL THE RISK to other people. One thing we never run out of – in any kind of market – is more suckers to sell premium to.

This is why, at PSW, we teach our Members to BE THE HOUSE – not the gambler. The only sure thing in this market is SELLING premium to other suckers who THINK they know what's going to happen next. Since even the best of them are really no more accurate than a coin flip – the best thing to do is step on over to the other side of the table and SELL THE RISK to other people. One thing we never run out of – in any kind of market – is more suckers to sell premium to.

That's why we love options – not for leveraging our own bets – although we do have fun occasionally, but for our ability to sell that leverage to others because there's always some fool analyst on either side of any bet, trying to convince the fools that follow them to pay us money to take more risks.

Take BWLD, for example. As you know, we've been killing it on earnings plays this quarter and, on Monday, QCMike asked during chat if I had a good trade idea ahead of BWLD's earnings. My response was:

BWLD/QC – Too tricky to call in a bad spot. Nervous investors have cleared out but maybe for good reason. Nonetheless, you can sell the June $65 puts for $2.35 and that's a nice entry and you can sell the March $80 calls for $2.85 and just cover those up with the Jan $80/85 bull call spread at $1.90 and you've got a nice net $3.30 credit plus a free $5 spread to play with and your worst-case is an assignment way down at net $61.70 (20% off).

Did I "predict" what BWLD would do? Not really, we don't care. What we did was find a range, between $65 and $85 on the then $77 stock, that allowed us to SELL PREMIUM to suckers who wanted to bet that the stock would move MORE than 10% on earnings. COULD BWLD move more than 10% on earnings? Sure it can – and you can also hit "00" on the roulette wheel and make 36:1 but, most of the time you don't and the house wins. In fact, the house wins at roulette 37 times for each one time you win so, with a 2/38 advantage over you on every spin – you are effectively losing 5% of your bet every time you spin the wheel.

Did I "predict" what BWLD would do? Not really, we don't care. What we did was find a range, between $65 and $85 on the then $77 stock, that allowed us to SELL PREMIUM to suckers who wanted to bet that the stock would move MORE than 10% on earnings. COULD BWLD move more than 10% on earnings? Sure it can – and you can also hit "00" on the roulette wheel and make 36:1 but, most of the time you don't and the house wins. In fact, the house wins at roulette 37 times for each one time you win so, with a 2/38 advantage over you on every spin – you are effectively losing 5% of your bet every time you spin the wheel.

That means if you have $100 and you bet $5 20 times, it is extremely likely you will go broke before you get a win. If you do happen to get a win, then all the House has to do is pay you and keep playing because, while you may get $180 back on one spin and feel like a big winner – we're playing that game with 37 other suckers who aren't so lucky and, over time, statistics tend to prove out in our favor.

Selling options is no different for us. Sure BWLD could have blown up or down on earnings but we can always adjust our position or, worst comes to worst, we can take our loss and move on and make up the losses on other sucker trades. In this particular case though, BWLD went up 5% since we made the trade and is now dropping back 5% on earnings – right back to $77 and that will wipe out the short caller and the short putter and we get to keep their $3.30 PLUS whatever value is left on the spread we bought to cover the trade. That's all it take to BE THE HOUSE!

Selling options is no different for us. Sure BWLD could have blown up or down on earnings but we can always adjust our position or, worst comes to worst, we can take our loss and move on and make up the losses on other sucker trades. In this particular case though, BWLD went up 5% since we made the trade and is now dropping back 5% on earnings – right back to $77 and that will wipe out the short caller and the short putter and we get to keep their $3.30 PLUS whatever value is left on the spread we bought to cover the trade. That's all it take to BE THE HOUSE!

So, while we maintain the underlying philosophy of being the house, it is still fun to make a few predictions about the future but never confuse predictions with a strategy. Our STRATEGY is to expect that no one, not even me, can predict the markets – especially short-term movement – so, while we may have fun GUESSING on short-term plays – our JOB is to make consistent long-term money following macro trends and selling the risk to others.

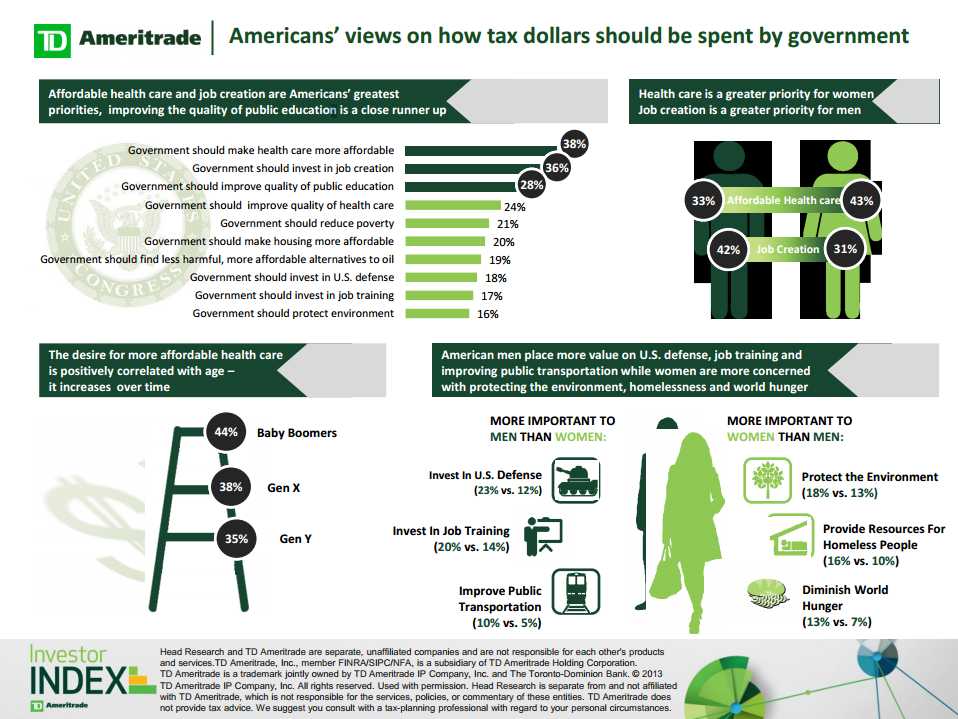

President Obama laid out some long-term goals for his next 4 years in office last night but they aren't TRENDS if he can't get the proposed legislation through Congress. As the WSJ notes: "The American people don't expect government to solve every problem," Obama said, while proceeding to offer a new government program to solve every problem. That's not an inaccurate portrayal of last night's address but tough nuggies to the GOP if they expected less of a fight from the President – especially when CNN highlights how out of touch the GOP is with the will of the American People, 62% of whom cited affordable and improving health care as 2 of the top 4 things they want the Government to spend their money on – followed by Creating Jobs (36%) and Improving Public Education (24%). Only 23% of the men favored spending more Government money on Defense (less than 11% of the total population) while women (52% of the voters) added Protecting the Environment (18%) and Helping the Homeless (16%) to the list of things the Government SHOULD be doing.

Even Marco Rubio, this year's minority Republican chosen to rebut the President (based on the Rich White Male Party's belief that this makes them more appealing to the people they hate), had to say "So Mr. President, I don't oppose your plans because I want to protect the rich. I oppose your plans because I want to protect my (rich) neighbors." OK, I may have added the word "rich" in front of neighbors but that's only fair because I'm a white guy and so was the rich white speechwriter, who thought having a Cuban guy say "neighbors" would make people watching on TV think he meant poor people.

Even Marco Rubio, this year's minority Republican chosen to rebut the President (based on the Rich White Male Party's belief that this makes them more appealing to the people they hate), had to say "So Mr. President, I don't oppose your plans because I want to protect the rich. I oppose your plans because I want to protect my (rich) neighbors." OK, I may have added the word "rich" in front of neighbors but that's only fair because I'm a white guy and so was the rich white speechwriter, who thought having a Cuban guy say "neighbors" would make people watching on TV think he meant poor people.

In fact, Marco Rubio is getting out of his $675,000 West Miami home so he and his family can get new, richer neighbors in DC, as he prepares for a possible 2016 run for the Presidency. Isn't blatant hypocrisy hysterical?

Speaking of hypocrisy – so far, so wrong on my prediction of a pullback from these market levels and oil is hanging around $98 this morning – over our $97.50 shoring line (/CL Futures) but we're happy to short at $98 as well with a nickel stop over the line as we're pretty sure we might lose 3 or 4 nickels but we still think there's a very nice .50+ pay-off in our future – especially with inventories coming up at 10:30. $98 isn't really all that impressive with the Dollar down at 80.08 and OPEC putting out a report warning of "political, price, economic, weather, environmental and geological" stumbling blocks that could prevent U.S. oil production from meeting lofty expectations.

Also, the API Report (which we usually ignore because it's a BS Industry Survey – sort of like asking the foxes for a hen count) showed a very surprising decline in crude stockpiles last night – the first one this year and that's making the NYMEX traders all brave this morning and, if they are happy to pretend to want to buy barrels of oil for $98 between now and next Wednesday (March contract expiration), we are very happy to promise to sell it to them on the premise that we fully expect to be able to buy barrels for somewhat less than $98 between now and then – enabling us to fulfill our obligation at a profit.

That's all futures trading is – it's not scary – it's simple!