Wheeeeeee on oil!

Wheeeeeee on oil!

Congrats to all who played that game with us as oil bottoms out BELOW $94 this morning (and still hasn't gotten back over the line). We took 1/2 the money and ran on our doubled-down trades on USO and SCO but $92.50 may be bust for this drop so we'll hang in and see how low we can go this week. Meanwhile, we got a short, sharp shock thanks to the Fed yesterday but it's perfect for the way we've been playing as we had a few short callers (GOOG, FAS, TSLA) that were getting away from us and Members were getting tired of my calling for patience as we've been waiting for this little correction for over a week now.

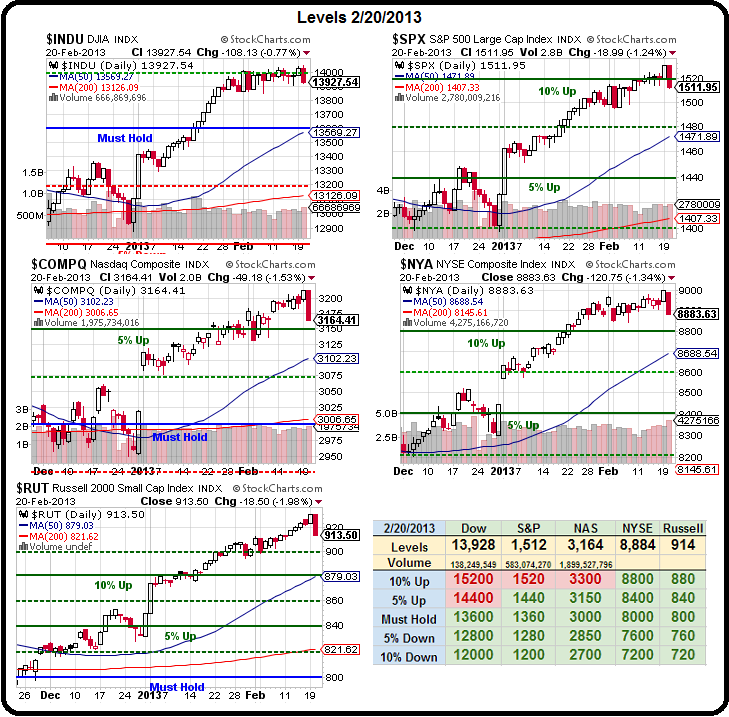

Using the Big Chart and, of course, our famous 5% Rule to tell us what's going to happen, we can see we had a 1,000-point run in the Dow from 13,000 (we don't count spikes) to 14,000 and that means we expect a 20% pullback (of the run) of 200 points to the 13,800 line as a HEALTY correction. Another 200 points would take us to 13,600 and – lo and behold – it's our Must Hold line and guess what – it MUST HOLD or the markets are truly turning bearish.

Of course we predicted the Must Hold line way back in 2009 so not to surprising that, overall, we end up consolidating there in the bigger picture (see bigger chart). We are NOT expecting to test 13,600 though, that's just the worst-case, where we would be BUYBUYBUYing on the dip but we HOPE to see 13,800 tested so we can get over it and consolidate for a real move (not a spike) over 14,000, as well as our 10% lines on the Nasdaq (3,300) and the S&P (1,520), which came so close to making us up our levels but failed – right on schedule!

We already went long on /NKD Futures in Member Chat this morning (over the 11,300 line) but, for a pullback in US indexes, we're looking for the following 20 and 40% pullback levels to hold (at worst):

We already went long on /NKD Futures in Member Chat this morning (over the 11,300 line) but, for a pullback in US indexes, we're looking for the following 20 and 40% pullback levels to hold (at worst):

- Dow 13,800 (weak retrace) and 13,600 (strong retrace and confirmed with Must Hold)

- S&P had a 120 point run to 1,520 so giving 24 back is 1,496 and another 24 hits 1,472

- Nasdaq (AAPLdaq) had a 200-point run to 3,200 so 3,160 and 3,120 with the 5% line at 3,150 providing strong support, as well as AAPL $450 being ridiculously cheap (we're long, of course).

- NYSE's 700-point run gives us a 140-point pullback to 8,860 and then 8,720

- Russell has led with a run from 800 to 920 so also 24-point pullbacks at 896 and 872 but, if the 10% line at 880 holds – the bears can kiss their assets goodbye.

We picked up long QQQ next weeklies yesterday as well as the market collapse was mostly caused by the rising dollar, which has popped from 80 to 81.50 (2%) since Friday. The market has NOT pulled back 2% in PRICE, even thought the thing it's priced in has risen 2% in VALUE. Things that should make you go hmmmmm….

As noted by Dave Fry on his SPY chart, we had an early sell-off on disappointing housing data but that was silly as it's winter and housing data is always disappointing in the winter (and we had two big storms that slowed things down all over) but this morning, in Member Chat, I pointed out that the AIA Architectural Billing Index jumped 6% to 54.2 in January with the New Projects Inquiry sub-index flying to 63.2 from 57.9 in December. "This is the strongest indication that there will be an upturn in construction activity in the coming months," says AIA's Kermit Baker (see very bullish chart).

This is a great indication of future spending – people and companies don't tend to hire architects to make plans for things that are not going to be built and building is the final leg to build the base under which this economy can shift back into high gear. THIS is what the Fed is worried about in their minutes – that the economy it TOO HOT and they are going to cause TOO MUCH inflation and, lo and behold – today we get a Core CPI that has jumped 50% in a month.

This is a great indication of future spending – people and companies don't tend to hire architects to make plans for things that are not going to be built and building is the final leg to build the base under which this economy can shift back into high gear. THIS is what the Fed is worried about in their minutes – that the economy it TOO HOT and they are going to cause TOO MUCH inflation and, lo and behold – today we get a Core CPI that has jumped 50% in a month.

This is no surprise to PSW Readers, who have been stocking up on gold as it goes down as well as DBA and yesterday we even decided SLV was playable at these lows (though I like gold, platinum, palladium and uranium better). Inflation is already baked into the economic cake and don't think that we can't take it 'cause it took so long for the Fed to bake it – and we'll never have that recipe again – Oh nooooooo!

Anyway, where was I before having a Donna Summer moment? Oh yes, inflation – duh! Moving on then. So of course we are bullish and how can the fact that the Fed sees the economy improving so much that they feel they may be overstimulating it be a bearish signal. The Fed is like a doctor and we are a patient they've been pumping blood into to keep alive and, now that we seem to be recovering, they don't think it's a good idea to keep pumping blood into us until we explode. Sounds reasonable to me, doesn't it?

So what does the Fed do? They have a meeting and they talk about taking us off life support to see how it goes. This does not mean they will pull the plug and walk away, nor does it mean they expect us to jump out of a hospital bed and run a marathon tomorrow but they WOULD like to see how we do without constant stimulus so they are going to SLOWLY withdraw it and CAREFULLY measure our response – ready to inject us again as soon as we show signs of weakness but HOPING that we are able to continue to recover without artificial means. Isn't this what they should be doing? Isn't this their job? Isn't this doing exactly the opposite of what people have been complaining they have been doing for 4 years? Shouldn't these idiots on TV be HAPPY about this?

So what does the Fed do? They have a meeting and they talk about taking us off life support to see how it goes. This does not mean they will pull the plug and walk away, nor does it mean they expect us to jump out of a hospital bed and run a marathon tomorrow but they WOULD like to see how we do without constant stimulus so they are going to SLOWLY withdraw it and CAREFULLY measure our response – ready to inject us again as soon as we show signs of weakness but HOPING that we are able to continue to recover without artificial means. Isn't this what they should be doing? Isn't this their job? Isn't this doing exactly the opposite of what people have been complaining they have been doing for 4 years? Shouldn't these idiots on TV be HAPPY about this?

I was lying in a burned out basement

With the full moon in my eyes.

I was hoping for replacement

When the sun burst thru the sky.

There was a band playing in my head

And I felt like getting high.

I was thinking about what a

Friend had said

I was hoping it was a lie. – After the Gold Rush