"Virtue untested is no virtue at all" – Milton

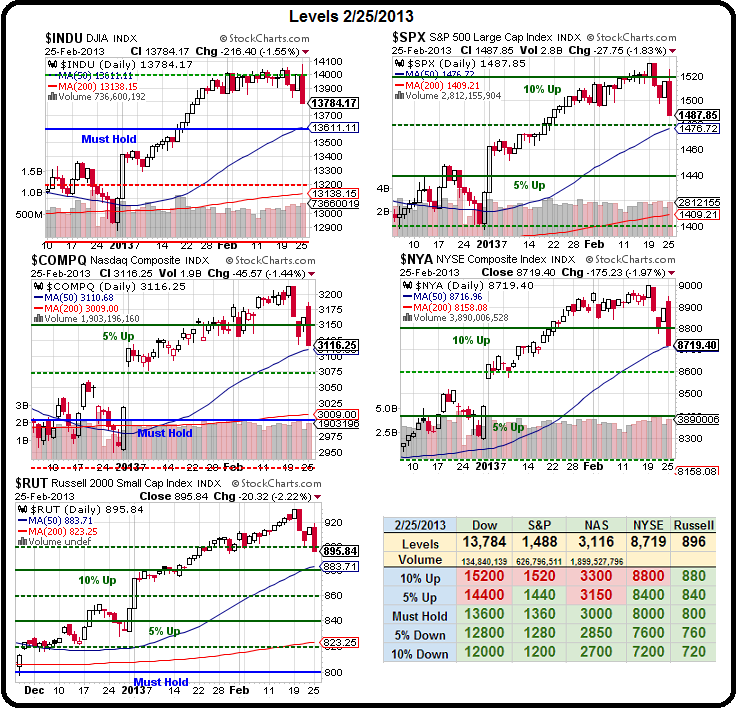

The same can be said for support lines and yesterday we tested two of them as both the Nasdaq and the NYSE tumbled down to EXACTLY the levels we predicted they would hit last Thursday. See that post for the full explanation of what happened yesterday (even though I actually wrote it last Thursday morning) but the key note, which is our action item for the day, was in the 3rd paragraph, where I said:

We are NOT expecting to test 13,600 though, that's just the worst-case, where we would be BUYBUYBUYing on the dip but we HOPE to see 13,800 tested so we can get over it and consolidate for a real move (not a spike) over 14,000.

So let's not call it a shocker when I put out our morning Alert to Members and included this quick cover note for our portfolios at 10:34 yesterday:

Dollar coming back now – 81.43 so good time to cover. SQQQ March $34 calls at $2.20 are just .50 of premium with SQQQ at $35.70 and that's very fair. Good ones to keep an eye on if AAPL fails $450 or the Nas can't hold 3,175 (right on the line now). NYSE 8,900 is a good confirmation spot too.

As it was urgent and a very important note, I also tweeted it out, so everyone could be properly protected from the drop we predicted but, of course, our Members had other downside hedges like our TLT longs in the $25,000 Portfolios, which gained a very nice 92% from our entry on the 13th but the SQQQ trade was a real winner, finishing the day at $4 – up 82% in a single day!

As it was urgent and a very important note, I also tweeted it out, so everyone could be properly protected from the drop we predicted but, of course, our Members had other downside hedges like our TLT longs in the $25,000 Portfolios, which gained a very nice 92% from our entry on the 13th but the SQQQ trade was a real winner, finishing the day at $4 – up 82% in a single day!

This is something I was just talking about with Dereck (Opesbridge Trader) last week – you should ALWAYS have a position in mind that you will use if the market either runs up or runs down on you. Just a simple momentum trade you are mentally prepared to jump on if key technicals break so you can either take additional advantage of a run or just to put the brakes on your losses while you re-group. Our SQQQ trade fell into the latter category as we were still pretty bullish over the weekend so a nice 82% gain on a hedge certainly took the sting out of a 1.5% drop in the indexes.

This is something I was just talking about with Dereck (Opesbridge Trader) last week – you should ALWAYS have a position in mind that you will use if the market either runs up or runs down on you. Just a simple momentum trade you are mentally prepared to jump on if key technicals break so you can either take additional advantage of a run or just to put the brakes on your losses while you re-group. Our SQQQ trade fell into the latter category as we were still pretty bullish over the weekend so a nice 82% gain on a hedge certainly took the sting out of a 1.5% drop in the indexes.

Although the selling was relentless into the close – it was only to the levels we predicted so we cashed in our very quick short profits and even picked up some Silver and Copper Futures longs very early this morning in our Member Chat but, as the morning is moving on, we are less enamored with the market – especially as the Dollar is once again rising over 81.85 – a big danger signal for the bulls.

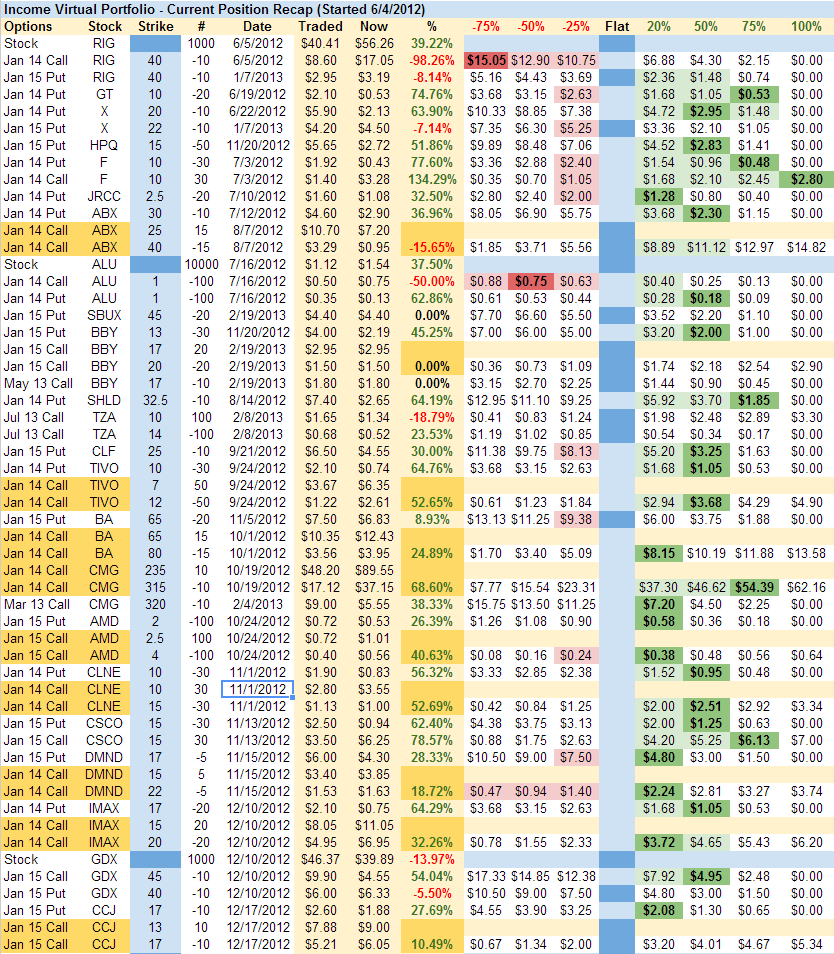

To that end, we have decided to take the virtual money and run on our Income Portfolio, which is so ridiculously ahead of schedule (goal of making $48,000 a year on $500,000) that it's embarrassing (up $110,000 in just 8 months) and also, with so many positions deep in the money, it's not very helpful to new Members coming in. So we're going to start a brand new Income Portfolio this week and I'm sure we will have some of the old, familiar names but with new positions and, of course, new opportunities as they come along (and they always do, which is why we love cash!):

As you can see, that's just our first 6 months worth of trades (that are still open – some have closed) and the portfolio got bigger than we like it to be simply because – there were no losing trades left to close! Of course there were losing trades (we made some mistakes early on) but we cut our losses and re-focused and were in a fantastic position to take advantage of the rally. Now, rather than sit on our laurels like most trading sites do – we would rather start from scratch because we are not here to post pretty numbers (as our AAPL Money Portfolio can attest!), we are here to TEACH TRADING!

First thing to learn about trading is "Cut Your Losses" second thing to learn about trading (and it's harder to teach than the first) is "Take Your Profits". Of course we will continue to keep tabs on our old Income Portfolio positions but most of them involve waiting for 2015 to come around so we can collect our full boat as positions mature – very dull stuff so we're doing a virtual cash-out now, we'll use $96,000 of the profits to pay our expenses for the next two years and we'll take the leftover $14,000 and go on a virtual cruise or whatever it is retired people like to do with windfall profits.

First thing to learn about trading is "Cut Your Losses" second thing to learn about trading (and it's harder to teach than the first) is "Take Your Profits". Of course we will continue to keep tabs on our old Income Portfolio positions but most of them involve waiting for 2015 to come around so we can collect our full boat as positions mature – very dull stuff so we're doing a virtual cash-out now, we'll use $96,000 of the profits to pay our expenses for the next two years and we'll take the leftover $14,000 and go on a virtual cruise or whatever it is retired people like to do with windfall profits.

Speaking of windfall profits – CZR had terrible earnings but mainly due to a $450M hurricane-related write-off at their Atlantic City properties and that's dropping them another 10% pre-market but still well-above our target on a trade idea that pays for our Members to come to our PSW Investment Conference in AC at Harrah's, which happens to be a CZR property. Back on 2/12, RPeri had asked if there was a trade that would make $625 by April to cover the costs of attending and I suggested:

PSW Conference play/Rperi – You can sell 15 CZR March $10 puts for .40 ($600) and risk owning $15,000 worth of CZR stock, which can at least give you bragging rights while you're there. The Sept $7.50 puts are .80 so pretty easy to roll if CZR can't hold their recent run to $12.50.

As long as CZR holds up over $10, the short puts expire worthless and the conference is paid for, which will make anything we learn there pure profit! Not only was that a great trade but, now that CZR has had the dip we expected on earnings, it's time to get bullish at around $10.50. Thank goodness we now have plenty of cash to allocate in our new Income Portfolio, right? We'll have to wait and see where things settle but on-line gambling should be great for CZR, who own the World Series of Poker franchise, which is exactly the brand-name draw that will pull in on-line gamblers in droves.

There's lots of news and earnings and Global stuff but we went over most of it in Member Chat this morning and not much of it matters as we have two days of Bernanke speaking to Congress ahead of us so let's hope we were right with our metal longs and our bullish stance as we go with the flow – ready to flip flop if our lines don't hold but they'll hold…. at least I THINK they will…