That was a fun dip, wasn't it?

That was a fun dip, wasn't it?

Did you know that yesterday there were a record number of VIX options purchased and that 28% were bought at the bid (indicating panic buying)? People sure are getting nervous ahead of the Sequestration which clearly, if you watch Fox or CNBC, marks the beginning of the END OF THE WOLRD.

Aren't these the same people who screamed for the past 4 years that we MUST cut the budget or we're doomed? Now the budget is being cut by about 8% and they are FREAKING OUT. So, were they wrong before or are they wrong now or are they just generally idiots we should ignore at all times?

I'm pretty sure it's the third one but the herd doesn't need a good reason to stampede – just a few of the nervous ones need to start running away and others will simply follow rather than waiting to find out what horrible thing the others are running away from. When that horrible thing is the MSM screaming about how HORRIBLE this new, artificial crisis will be – it does make it a lot harder for the average sheeple to ignore.

I'm pretty sure it's the third one but the herd doesn't need a good reason to stampede – just a few of the nervous ones need to start running away and others will simply follow rather than waiting to find out what horrible thing the others are running away from. When that horrible thing is the MSM screaming about how HORRIBLE this new, artificial crisis will be – it does make it a lot harder for the average sheeple to ignore.

It's fun to panic. We're designed to panic – we're not carnivores, we are omnivores who only developed sharp teeth pretty recently. Man, as an animal, has a highly developed flight reflex and that can influence our trading and it does as predators (ie. Cramer and his buddies) know that they can force you to abandon your positions if they simply make a lot of noise with threatening gestures (or charts).

This is why it's so dangerous to take positions in stocks you don't actually believe in. It makes you and easy target for predators because you'd rather abandon your position (which you have no real vested interest in keeping) rather than risk a loss. It's one thing to plant a tree but quite another thing to nurture it and fend off predators until it is strong enough to take root. We were discussing scaling in and sticking with positions in Member Chat this morning and it's well worth a read.

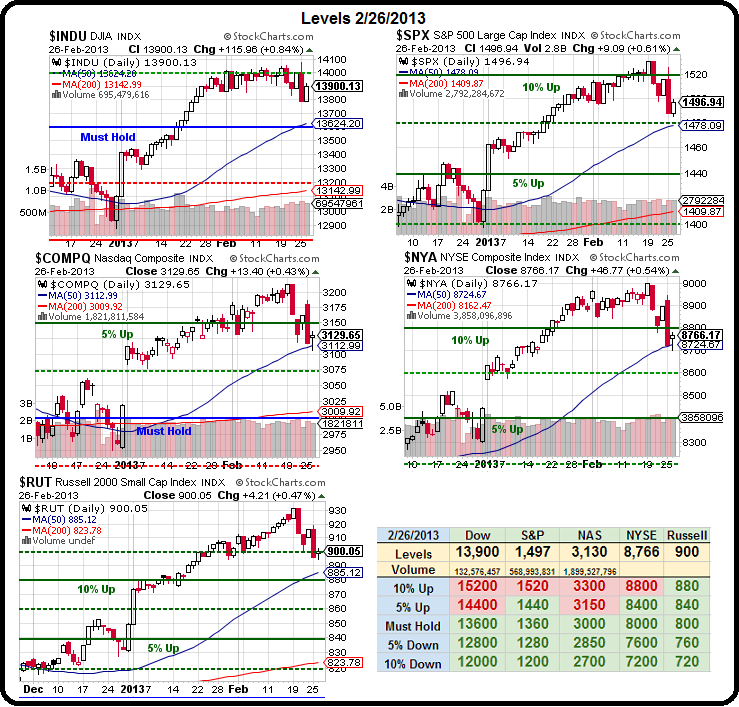

As predicted in yesterday's post, we held our 50 dmas on our first crash test but we are certainly not out of the woods as we have something called strong and weak bounce levels that we turn our attention to, now that we have established our drop zones. According to our 5% rule – this is exactly the retrace we expected but, now that we have it – the question becomes: Do we bounce right back and move on to new highs or are we simply consolidating for a move lower?

As predicted in yesterday's post, we held our 50 dmas on our first crash test but we are certainly not out of the woods as we have something called strong and weak bounce levels that we turn our attention to, now that we have established our drop zones. According to our 5% rule – this is exactly the retrace we expected but, now that we have it – the question becomes: Do we bounce right back and move on to new highs or are we simply consolidating for a move lower?

The Dow, for example, topped out at 14,060 (non-spike) and fell to 13,785 in about 24 hours so a weak bounce (in 24 hours from yesterday morning) would be 20% of the 275-point drop or 55 points or 13,840 and another 55 points is a 40% strong bounce back to (and now we round to the whole number) 13,900.

Where did the Dow finish yesterday? 13,900! See how easy the 5% rule is? Without so much fuss, let's go through the others and see how they performed:

- S&P 1,524 to 1,488 is 36 points so 1,495.20 is weak and 1,502.40 is strong so just over weak so far (and no, it's not that exact and I'll round off the rest).

- Nasdaq fell from 3,183 to 3,110 for 73 points and that makes the weak bounce 3,125 and strong 3,140 and they finished just over weak at 3,130.

- NYSE dropped form 8,940 to 8,715 for 225 and that makes our bounces 8,760 and 8,805 and they finished at 8,766 – just over weak.

- The Russell was rejected at 919 and fell to 895 for a 24-point drop and we'll call it 900 and 905 for our bounced and the RUT hit 900 on the nose and that is – just over weak (if we didn't round).

Well, I guess you don't need me to tell you that we'd better watch those weak bounce lines today, right? Keep in mind those are just short-term lines and they expire at the end of the day but it shows you a very quick and easy way to determine which way momentum is heading and, so far, that's kept us from panicking with the herd but we're more than happy to slap on some bearish plays (like we did on Monday) if our levels don't hold and you should be too.

Well, I guess you don't need me to tell you that we'd better watch those weak bounce lines today, right? Keep in mind those are just short-term lines and they expire at the end of the day but it shows you a very quick and easy way to determine which way momentum is heading and, so far, that's kept us from panicking with the herd but we're more than happy to slap on some bearish plays (like we did on Monday) if our levels don't hold and you should be too.

As Dave Fry notes on his Dow chart, Bern Bernanke stuck to the Hippocratic Oath "Primum non nocere" (First, do no harm) by reiterating his QE – not forever, but for a very long time – stance. Also the Dollar, as we expected, did not break over 82 and that was very helpful as well as expected as my Morning Alert to Members called to make aggressive moves with our FAS and AAPL positions and we ditched copper (/HG Futures) at $3.5655, which was up .02 from our morning entry ($500 per contract) while we rode silver (/SI) to $29.40 from $28.85 for a huge .55 gain at $500 per penny per contract!

I was, of course, up at 3am today as well, but there was nothing obvious to trade in the Futures so I went back to bed. This is the hardest trick for people to learn when playing the Futures – most of the time – you should not be playing!

We added 4 positions already to our brand new Income Portfolio after retiring our old one with a 20%+ gain in just 8 months (see yesterday's post). With $500K of virtual cash to play with, there are many, many temptations but, ahead of the Sequester, we're taking things slowly – just in case. AAPL has their big investor conference today so we'll be watching them closely (hopefully everyone there will boo David Einhorn) but it's too bad AAPL doesn't sell more durable goods, as those things are FLYING out the doors with flying being ironic as it's ex-transport due to BA's delivery halt – get it?

Another thing we'll be getting today is huge gains on COH, which we just added 2 days ago per my comment in Member Chat (we had intended to grab them on the dip):

Another thing we'll be getting today is huge gains on COH, which we just added 2 days ago per my comment in Member Chat (we had intended to grab them on the dip):

COH/Jophil – Thanks for reminding me. I think they hold $45 and the 2015 $40 puts can be sold for $5.50 for a net $34.50 entry, which is double the dividend so a good solo play. If you want to goose the potential upside – the $50/60 bull call spread is just $3 so net $2.50 credit still gives you worst-case entry at net $37.50 (19% off) and, of course, you can then do some call selling, like the April $49s at $1.05, which is as much as the dividend ($1.20) in just two months.

Not only did they hold $45 but they are back to $48.40 pre-market on StreetInsider rumors they might be for sale. That's what happens when things get too cheap in an M&A-frenzied environment – it makes it very hard to stay short on stocks and it's great for brave little options players like us – who take advantage of the panic of the beautiful sheeple.