Ring! Ring! It's 7:00 A.M.!

Move yourself to go again

Cold water in the face

Brings you back to this awful place

Knuckle merchants and you bankers, too

Must get up an' learn those rules

Weather man and the crazy chief

One says sun and one says sleet – The Clash

It's happening again.

I'm becoming concerned that we've gotten too complacent with the rally and people just aren't worried enough by global macros. Do you know the Hong Kong market fell 3% yesterday as "Bird Flu" strikes again? This is how the last crash started – we were thinking a little flu story from Asia wasn't going to be enough to affect Global equities (although there are a good bunch of Biotechs who will benefit – I'm sure Pharmboy will have a list in Member Chat).

We had a bounce yesterday that reminded me of the trained seal show we saw at Sea World, where they will do anything you want for a fish. That's how the Banksters have trained the sheeple the past few months – as Cramer (the brain-washer in chief) has been saying – you HAVE to buy these dips.

Or do you? We went short last week and this week we've been talking about either taking the money and running on our successful bullish positions or, in the very least, making sure they are very well protected for a possible big dip. Yesterday we added some aggressive TZA longs (ultra-short on the Russell) in Member Chat as the index "recovered". We're already down again in the Futures, back to yesterday's lows ahead of the NFP report at 8:30. The Nikkei dropped back below the 13,000 line, where we've been shorting the /NKD futures and the mainland Shanghai Composite is closed but 6 people are dead already from Bird Flu and that means massive poultry destruction, rising food prices, etc. are inevitable in China – even if this outbreak is quickly contained.

We're not all doom and gloom on this one data point, of course but the toppiness and the incidents in North Korea and the falling US jobs numbers and Industrial Production in Europe etc. can only be ignored for so long before it starts to really pile up and sending investors back to cash. Air China dropped limit down (10%) as did China Southern Airlines this morning – it won't be good for PCLN if this thing spreads and I like shorting them below the $700 line anyway and they don't report earnings until May 6th so I'm all for selling the April $700 calls for $11.50 or taking the April $720/700 bear put spread for $12.50, which has a 68% upside in two weeks if PCLN fails to hold $700.

We're not all doom and gloom on this one data point, of course but the toppiness and the incidents in North Korea and the falling US jobs numbers and Industrial Production in Europe etc. can only be ignored for so long before it starts to really pile up and sending investors back to cash. Air China dropped limit down (10%) as did China Southern Airlines this morning – it won't be good for PCLN if this thing spreads and I like shorting them below the $700 line anyway and they don't report earnings until May 6th so I'm all for selling the April $700 calls for $11.50 or taking the April $720/700 bear put spread for $12.50, which has a 68% upside in two weeks if PCLN fails to hold $700.

8:30 Update: And wheeee! Now THAT's what I was talking about! Just 88,000 jobs added in March and that's miles below the 200,000 expected and far worse than indicated by the ADP report. Unemployment just 7.6% too so almost not even good enough to expect more Fed help – a double whammy!

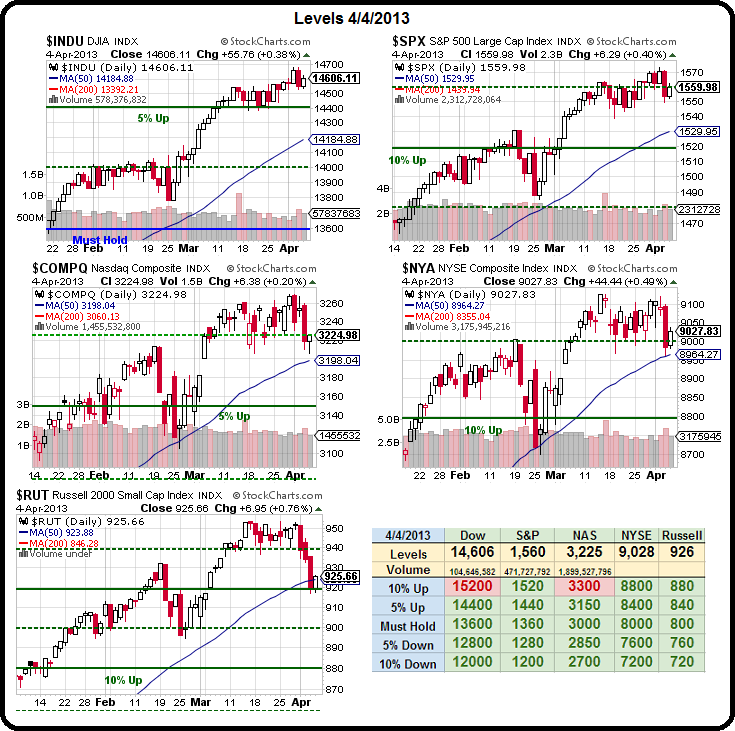

Futures are down well over 1% and now we'll get to see what levels really hold but be careful – the Dollar is testing 82.50 and that's down 1% from yesterday's open so it's artificially making things look about 1% better than they are – FOR THE MOMENT. If that moment passes as people panic back to the Buck – we could see another leg down into the weekend. Just like that we're going to be back to testing 14,400 on the Dow – that's why it was our focus short as it topped out last week and we have to watch that $92.50 line on oil because, if that goes – we can expect 14,400 to fail as well as XOM (we're already short) and CVX begin to take the index down with them.

Futures are down well over 1% and now we'll get to see what levels really hold but be careful – the Dollar is testing 82.50 and that's down 1% from yesterday's open so it's artificially making things look about 1% better than they are – FOR THE MOMENT. If that moment passes as people panic back to the Buck – we could see another leg down into the weekend. Just like that we're going to be back to testing 14,400 on the Dow – that's why it was our focus short as it topped out last week and we have to watch that $92.50 line on oil because, if that goes – we can expect 14,400 to fail as well as XOM (we're already short) and CVX begin to take the index down with them.

It's sad as I was really hoping to finally have a reason to raise our ranges on the Big Chart but, not this week, it would seem as the bad news finally catches up with our indexes. We're also long on the VIX and that should be fun as well as we test that 15 level once again. Nothing would make us happier than seeing the VIX rise back to 20 as we are primarily in the Premium SELLING Business, after all…

Actually, that $92.50 line is a nice spot to go LONG in the oil Futures (/CL) as we are heading into the weekend and the NYMEX crooks try not to let macro FACTS get in the way of a good pump job. So playing oil bullish off that line with very tight stops below it can be a nice bullish offset for some quick Egg McMuffin money. The NFP report was not all bad news with the labor force participation rate down 496K which drops U-6 unemployment (which counts that factor) to 13.8% from 14.8% a year ago. A bright spot, those working part-time for economic reasons – often called "involuntary part-time workers" – fell a whopping 350K to 7.6M, so better quality jobs are probably allowing people to quit crappy second jobs making the NFP seem weaker than it is – how's that for a bullish spin?

Also very important to watch – violent swings in the Japanese government bond prices forced the Tokyo exchange to twice temporarily stop trading in them overnight. JGB prices first continued to rise sharply in wake of the new BOJ policy – the yield plunging to 0.315% – but investors rushed to take profits, and the yield then soared to 0.62%. This for a product in which a 2 basis point move makes headlines. Let's not lose sight of the fact that Japan has taken drastic, violent action with their new, massive stimulus package, which is on a scale as if the Fed announced a $5Tn stimulus in the US.

It remains to be seen what the repurcussions of that scale of economic tinkering will be.

Have a great weekend,

– Phil