This is getting silly.

This is getting silly.

Not just because we shifted bearish – we're not bearish enough to root for a crash but, from our neutral to slightly bearish perch – this is, as Dave Fry said the other day, ridiculous.

I've been pointing out to Members that we're now in a pattern where we rise on low volume (or no volume in the Futures) and then have volume selling at the opens and closes, followed by nothing but buyers on low volume again. It kind of makes you wonder if any real people at all are trading the market or if the whole thing is just a bunch of trade-bots doing the Bugs Bunny thing (5:10 in this video)..

This is a sign to get out folks – cash is king in this situation or, if you are determined to ride out a dip – get yourself some good hedges. We're ready to slap on some longs if they actually do pop new highs but the RUT failed our 932 line yesterday and that kept us bearish one more day at least. If we do have to buy, we'll be holding our nose all the way but, as I noted to Members yesterday, there were 11 stocks off the top of my head that were still dirt cheap if we're really in a massive rally and, if you can still buy X for $17.50 or DBA for $25.75 – what kind of half-assed rally is it anyway?

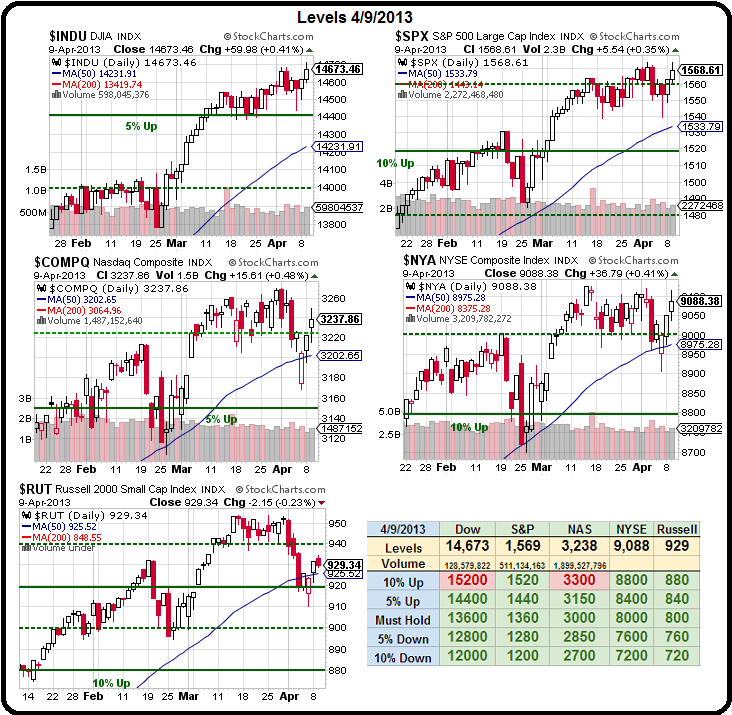

Looking at the Big Chart – we are still PATIENTLY waiting for a proper sign to adjust our levels higher but look at the RUT – FAIL! Looking at our other indexes – some may see breakout but I see double-top and our DIA June $141 puts are down to $1.45 and we can spend .75 to roll then up to the $144 puts ($2.20) and DD to get a bit more bearish this morning in our $25KPs.

Looking at the Big Chart – we are still PATIENTLY waiting for a proper sign to adjust our levels higher but look at the RUT – FAIL! Looking at our other indexes – some may see breakout but I see double-top and our DIA June $141 puts are down to $1.45 and we can spend .75 to roll then up to the $144 puts ($2.20) and DD to get a bit more bearish this morning in our $25KPs.

Oh, I'm not publishing on Seeking Alpha anymore so you can expect more trade stuff in the morning post until I get another publisher (already in the works) for our morning posts. In my last post there, on 3/28, in the comments, I pointed out that SA had redacted links in my article to articles and charts regarding Income Inequality, possibly because the right wing-nuts over there complain to the editors whenever I sound "too liberal."

That's OK, I left Forbes for the same reason years ago and I'll probably survive without SA as well. In fact, we've got a ton of new sign-ups from people who were glomming our morning posts for free and now realize that ride is over. The amount of money we got in new Memberships yesterday was more money than SA pays in a year – it was never about the money – I just like to get the word out because, if I don't talk to Capitalists about the evils of Capitalism, who will?

I get away with it because I also make you money so you put up with my Liberal Rantings to get to the gooey chocolate center and I'm fine with that – I'm a Capitalist too! I am also a Socialist, which is what they call a Communist in America these days and if I can't change a few hearts and minds with my writing along the way – then why bother? I could just go sit in a hedge fund full-time and trade all day – it would be boring, but profitable.

I get away with it because I also make you money so you put up with my Liberal Rantings to get to the gooey chocolate center and I'm fine with that – I'm a Capitalist too! I am also a Socialist, which is what they call a Communist in America these days and if I can't change a few hearts and minds with my writing along the way – then why bother? I could just go sit in a hedge fund full-time and trade all day – it would be boring, but profitable.

I like to write and I like to share (this is where my Socialist streak benefits you Capitalists) and yes, I also get a kick out of getting national conversations going so I do crave a little national exposure so I'll be looking for another outlet but, for now, it's just us chickens in the morning post so I'll be putting more trades here – especially below the fold (where free viewers can see partial articles), which is right about —– here.

I already have more Twits following me (60K) than I had followers on SA (57K) but their Macro View Daily went out to 236,000 people and that's the audience I'll miss but now they'll be missing out on our earnings trades this quarter like the CREE trade we added to the $25KPA yesterday:

CREE/Jrom – I'm never a big fan of them at these levels. There's not much growth here – they simply go in and out of favor with MoMo traders and, currently, they are in favor. They are a $6.5Bn company that has made a total of $350M in the past 3 years but, as usual, this is supposed to be the year they pop. So expectations are high for .33 this Q from .20 last year and .30 in December.

For the year they are projecting $1.30 per $53.50 share (41 p/e) so they CAN'T make any kind of mistake on earnings (4/23). Therefore, I'd sell 5 May $55 calls for $3.10 ($1,550) and buy 5 Sept $57.50/62.50 bull call spreads for $1.60 ($800) for a $750 credit and, if CREE fails to take $55 into May expirations (17th), you make $750 plus whatever is left on the longs. CREE would have to be up around $60 (up 15%) before you have any major trouble and anything flat or down is a winner. Let's do 10 of those in the $25KPA.

Uh-oh – STOP THE PRESSES – the Fed is releasing their minutes at 9am as they leaked yesterday – this is going to get crazy fast!

Uh-oh – STOP THE PRESSES – the Fed is releasing their minutes at 9am as they leaked yesterday – this is going to get crazy fast!

Damn, /NKD is at 13,500 – a good short still. Nas 2,810 (/NQ) is also a good line to short off.

See, I just tweeted that out. Please do me a favor and tweet out some stuff (or retweet or "like" or whatever) too as I'm kind of into playing the Social Networking game at the moment. I figure if Justin Beiber has 37M followers, I should be able to get to 250,000, right? Anyway, so here's the Fed Minutes and the key thing here is the discussion of whether or not QE continues to be effective.

The Futures are holding so far but the Dollar has moved over 82.50 and over that mark is bearish so we'll see how the open goes but we were playing for a sell-off on the Fed Minutes at 2pm – it will be interesting to see if this early release changes things. I think this "accident" happened because we had a TERRIBLE 3-year note auction yesterday and they simply can't afford to have a terrible 10-year auction or suddenly the US can become Greece with no EU to bail us out.

TLT dropped from 123.43 to 120.65 yesterday and below 120 coming into the 10-year would not be good. So far, so wrong on the Nikkei as it's up at 13,535 now but 13,550 is the next line to try a short and, as always, with tight stops over the line. The minutes show "all but a few" Fed officials agreed that they want to keep the $85Bn monthly QE going "at least through midyear." Now that's interesting. A few is at least 3 and midyear is July, just 3 months away. Cramer is on CNBC spinning his ass off but this does not sound like real rally fuel to me.

Some at the March meeting felt the Fed would be able to begin tapering the program down around midyear. Others saw the Fed continuing through September before tapering down, and a few wanted to keep the program going at its current pace through 2013 and into 2014. Some also held out the possibility of increasing the program if the economic outlook deteriorates.

Still, it's a technical rally, not a fundamental one, and we need to watch our levels but these minutes were released at 2pm yesterday to "about 100 Congressional Staffers and Trade Lobbyists" but don't be outraged – that's Capitalism baby! So what did the well-connected do after the 2pm release of the notes (allowing time for phone calls, pay-offs, transmission of leaked minutes and analysis of same)? Well, back to Dave Fry's chart – down we went into the close.

Why would we trade differently this morning off the same notes?