We had an extensive discussion about BitCoin as it went over $200 in Monday's Member Chat and I even decided to make a special note on the subject, which I tried to publish on Seeking Alpha but it's still sitting in the "pending publication pile" with no explanation as to why it was rejected there (you can read it from my tweet here).

Interesting though as I had just warned people in comments on SA, before I left for vacation, that the arbitrary censorship of information on "free" sites like SA can make them very expensive for people who are hoping to trade with unbiased information.

The title of my proposed post was "Bitcoin – The Next Major Currency or Just another Ponzi Scheme" and, as I additionally noted that morning in Member Chat:

Oh yes, I forgot to link to "The Bitcoin Mining Guide" – Imagine if you were investing in a foreign currency and there was a guide for how you can print your own or, even worse, the Government in question was making money selling you "mining equipment" which, in fact, is nothing more than an algorithm you run on your computer! You would RUN from that currency and never think about it again, right? Not Bitcoin – it's going up and up and up.

Seriously, this is no different than when my daughter gets gold in WarCraft for completing quests. They have tons of "merchants" too who accept her gold and they give he cool potions and magical armor, etc, which in fact, you can get people on Ebay to buy for real US currency. I should write an article based on pitting Madeline and her friends using WarCraft and Ebay against some Bitcoin miners and see who makes more money over a weekend….

While we were debating the issue in Member Chat, I was looking pretty stupid as BitCoin went to $220, then $240 and, finally $260 – before crashing yesterday all the way to $110 in (as you can see from the 2nd chart) a fairly textbook bubble run. The only difference is, with modern technology – idiocy that used to take months to play out can now be cycled through in days.

Which brings us back to the real markets: Are we, in fact, also in a bubble or is this a real and sustainable rally?

Which brings us back to the real markets: Are we, in fact, also in a bubble or is this a real and sustainable rally?

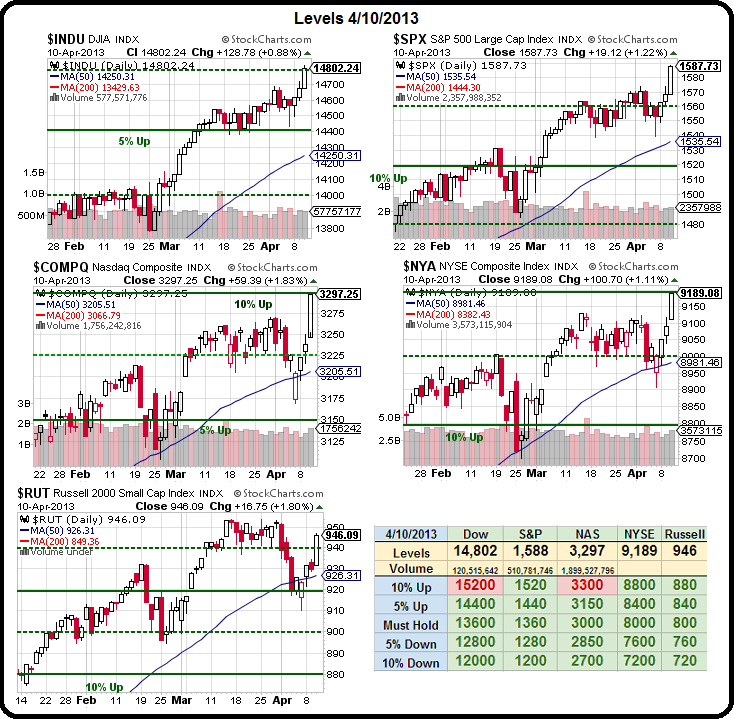

Look at the charts of the Dow and the S&P and then look at the chart of BitCoin and the Bubble Chart. See any familiar patterns? Fortunately, the time-frame on the indexes is days, not hours but it's the textbook pattern nonetheless and we've been setting up for the big drop as we add more short positions because the macro data simply doesn't support the currrent valuations – except for on thing.

That one thing is $1,400,000,000,000 that is being donated by the BOJ towards the Global Stimulus effort. Currently, the BOJ's run rate is $75Bn a month, just shy of the Fed's $85Bn a month of QInfinity (though the infinity part is now subject to debate – see yesterday's post).

Keep in mind that Japan's entire GDP is $6Tn so this is 23% of their GDP over two years, which would be like our own beloved Fed announcing another $3.7Tn in stimulus over the next 24 months ($153Bn a month). Clearly we would expect some of that money to spill out of Japan (their bonds pay 0.1%) and into other markets and, of course, that's why the Yen fell all the way to 99.9 to the Dollar yesterday but that was where we predicted the top would be (as noted in Monday morning's Alert to Members – also Tweeted).

The reality is that the BOJ's easing is a doubling down of QE3 BUT (and it's a Big But) their easing, of course, competes with our easing to some extent and our combined easing is terrible for Europe, who is going the other way with a "brilliant" austerity plan that has popped Greece's unemployment to a record 27.2% with youth unemployment at – get this – 59.3%. That's 2 out of 3 people finishing school with no job – imagine the repercussions if those were your children and their friends.

The reality is that the BOJ's easing is a doubling down of QE3 BUT (and it's a Big But) their easing, of course, competes with our easing to some extent and our combined easing is terrible for Europe, who is going the other way with a "brilliant" austerity plan that has popped Greece's unemployment to a record 27.2% with youth unemployment at – get this – 59.3%. That's 2 out of 3 people finishing school with no job – imagine the repercussions if those were your children and their friends.

Well, you may not have to imagine for long as President Obama signed the $108Bn sequester order for FY 2014, cutting discretionary spending by $91Bn (10%) to the lowest level since 2004. Just as a point of interest, in April of 2004, the S&P was at 1,100 and the Dow was at 10,000 BUT (orignal flavor), don't worry folks, Government spending is only 20% of our GDP so cutting 10% of it is only cutting… oops… it's still 2%…

We'll see how comfortable our consumers are at 9:45 and we have a 30-year note auction at 1pm and then we see Consumer Credit at 3pm with a peek at the Fed's shocking Balance Sheet after the market closes. Charlie Plosser sought to diffuse some of that shock this morning by discussing with a Hong Kong audience some of the possible ways in which the Fed might trim their current $3.2Tn in long-term securities (20% of GDP) down to a somewhat closer to manageable reality $1Tn without destroying life as we know it.

We'll see how convinced people are at 1pm but I'm loving our currently-underwater shorts.