Wheeeeeeee!

Wheeeeeeee!

Are we finally getting a little bit of reality this morning or will this dip too (down 0.3% in the Futures) be bought with abandon. Europe is down about 1% and we just got a revenue miss by JPM but earnings beat by .21 (15%) on the top line yet it's still not enough, so far, to justify that $50 line – as I had warned our Members on Monday. We're still waiting for WFC to give us more color but we've been playing XLF to top out at $18.50 and we were sweating bulllets yesterday but stuck to our guns into these reports.

As you can see from Dave Fry's XLF chart, we are in a serious uptrending channel that could go to $19 but I really think we need a little correction first and you can see the volume trailing off at these levels – we're really primed here for a volume sell-off if any of our early reporting banks trip up.

Actually, forget the banks, the XLF is all about BRK.A now, with Warren Buffett's conglomerate now making up 8.5% of the index at $159,935 a share. That's right – for most Americans, that is like trading houses but there are 1.65M of those shares outstanding for a $263Bn market cap with an average daily volume of 51,000 shares. That's 51,000 transactions at $159,000 a piece – now don't you feel silly trying to save an extra nickel when you bid on your little stocks?

There are people who have money and people who are rich. – Coco Chanel

The B shares of Berkshire are a more accessible $106.73 per share and we bought in last at $85 so we're thrilled and, in fact, our problem yesterday is we had only targeted $100 so they are well over our goal and we may have to roll our short calls but we're waiting until earnings because, of course, this is getting silly with a p/e of Berkshire of 18, which is 13% higher than the S&Ps p/e of 15 and what is Berkshire really but a proxy for the S&P?

The B shares of Berkshire are a more accessible $106.73 per share and we bought in last at $85 so we're thrilled and, in fact, our problem yesterday is we had only targeted $100 so they are well over our goal and we may have to roll our short calls but we're waiting until earnings because, of course, this is getting silly with a p/e of Berkshire of 18, which is 13% higher than the S&Ps p/e of 15 and what is Berkshire really but a proxy for the S&P?

Yes, they should be given a premium because Buffett is a better picker of stocks than Standard and Poors' but, historically, he's not 13% better so either the S&P should be 13% higher (1,800) or Berskhire should be 13% lower ($92.85) or somewhere in between and $100 was our fair value target for Berkshire so we're sticking with that until and unless they prove us wrong with blow-out earnings.

The rich are always going to say that, you know, just give us more money and we'll go out and spend more and then it will all trickle down to the rest of you. But that has not worked the last 10 years, and I hope the American public is catching on. – Warren Buffett

Ah, here's Wells Fargo – they also missed top-line revenues but beat earnings by .03 at .92 and also not enough to justify their run-up back to $37.50 yesterday. The bank is raising its dividend AND buying back shares but the net interest margin is slipping from 3.53% expected to 3.48%, which isn't terrible unless it's a trend and they're not really priced for any kind of bad news with a p/e of 11.16 vs JPM at 9.48.

Ah, here's Wells Fargo – they also missed top-line revenues but beat earnings by .03 at .92 and also not enough to justify their run-up back to $37.50 yesterday. The bank is raising its dividend AND buying back shares but the net interest margin is slipping from 3.53% expected to 3.48%, which isn't terrible unless it's a trend and they're not really priced for any kind of bad news with a p/e of 11.16 vs JPM at 9.48.

Meanwhile, ROFL, oil is collapsing and I certainly don't need to tell you where we stand on that. Down to 91.82 at the moment and could go much lower as they still have 146M open barrels on the NYMEX scheduled for May delivery to Cushing, OK – a facility that can't possibly take more than 20M barrels as it, along with the entire US private storage system AND the SPR – is totally full.

Gasoline is testing $2.80 into the weekend but natural gas is zooming higher, at $4.22, on all sorts of speculation that we're going to take a year's supply and pressurize it and put it in the ground and stick another year's supply on ships and maybe another year's supply at LNG terminals so, actually, it makes sense and we were happily bullish on nat gas around $3 but this may be a little too far, too fast as it's all based on a lot of speculation that LNG is coming – but it's just another scam in reality and has nothing to do with real demand.

Today's big news is that Gazprom in Russia is pushing to expand the use of LNG in vehicles but this is the same as agenda as the "Pickens Plan" as Gaszprom has so much natural gas they can't find anywhere to unload it so they are trying to create markets for it. Oddly enough, in this country, CHK is still languishing at $20, roughly last year's average price – even though last year Natural Gas averaged $2.75 (35% less than $4.20). So, either people don't believe $4 is sustainable or CHK is way underpriced at $20. ECA is also cheap at $19.45 and we'd love to go bullish on them but there's that overall market pullback we're expecting first.

Today's big news is that Gazprom in Russia is pushing to expand the use of LNG in vehicles but this is the same as agenda as the "Pickens Plan" as Gaszprom has so much natural gas they can't find anywhere to unload it so they are trying to create markets for it. Oddly enough, in this country, CHK is still languishing at $20, roughly last year's average price – even though last year Natural Gas averaged $2.75 (35% less than $4.20). So, either people don't believe $4 is sustainable or CHK is way underpriced at $20. ECA is also cheap at $19.45 and we'd love to go bullish on them but there's that overall market pullback we're expecting first.

In yesterday's Member Chat we were discussing Corporate Profits being much higher than they were in 2007, when we were at these market highs but my "rebuttal" to that was:

Profits/StJ – Wow, much better than I thought but, keep in mind that in 2007, there was the assuption that profits would keep going higher and nothing could derail the rally so the forward p/es were generous. Now earnings are up about 33% and the question is are we 33% more cautious than we used to be. Logically, you also have to consider that these Corporate profits are also based on QE (probably 1/3 is bank profits) and, of course, we have rapidly declining conditions in Europe and Asia along with 100% more Global Debt than we had then AND the IMF just dropped US GDP projections for 2013 from 2% to 1.7% (not affecting the Futures so far).

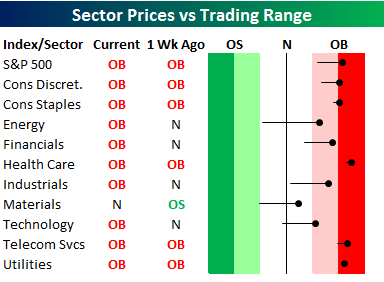

As you can see from this Bespoke Chart (thanks Dawn), we have a few sectors that are clearly overbought and you can see why we've been scooping up the Materials during this rally – they are the only real bargains left!

As you can see from this Bespoke Chart (thanks Dawn), we have a few sectors that are clearly overbought and you can see why we've been scooping up the Materials during this rally – they are the only real bargains left!

We're not expecting a crash – just a correction – but a correction is going to feel like a crash after having a 20% run without getting one. The Dow is up to almost 15,000 from 12,600 at Thankgiving and that's 19% with 15,120 being the tippy top and 14,515 being our expected pullback (20% of the 20% run), which is why we picked up the DIA June $144 puts (now $1.75) to protect our long positions.

We also kept our IWM today $92.50 puts but only because we got stuck with them on yesterday's sharp rise. We're in at .12 and faced .04 into the close so we decided we'd rather gamble holding them in our short-term portfolios than take the loss ($800). We need to see the RUT below 940 for that gamble to pay off but, again, we think we are toppy no matter what and, if these aggressive shorts don't work this week – we'll certainly try them again – especially if we test the very tops of our rally expectations.

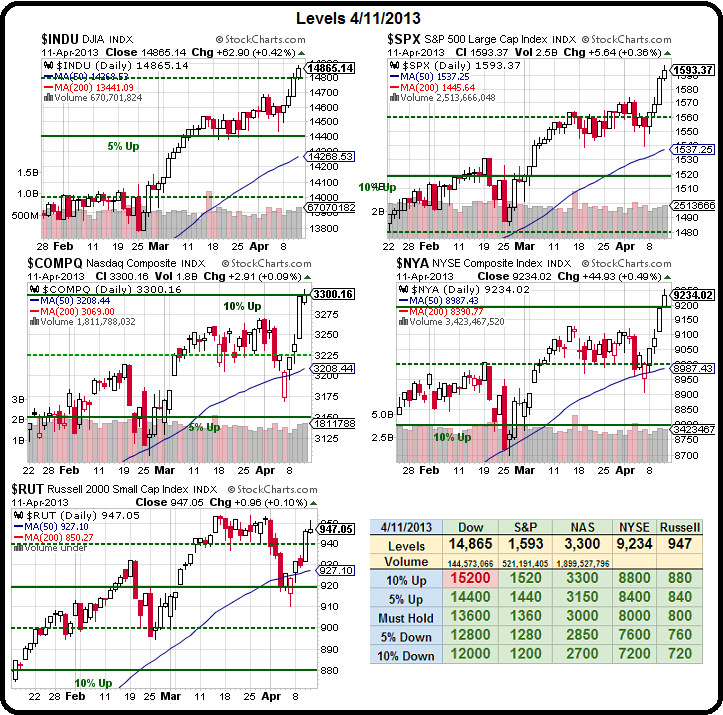

We are, in fact, right where we're supposed to be based on my March 17th, 2012 5% Rule Review, where Dow 15,000 was our target (now 14,865) along with S&P 1,600 (now 1,593). If we can get over those technicals, then ignore all my bearish fundamentals, as those will be thrown right out the window as we head into the next round of frenzied buying but, until then, we're still erring on the side of caution. Last month, we also discussed levels and just yesterday we finally made our 3,300 goal on the Nasdaq – the second to last red box on our Big Chart.

We are, in fact, right where we're supposed to be based on my March 17th, 2012 5% Rule Review, where Dow 15,000 was our target (now 14,865) along with S&P 1,600 (now 1,593). If we can get over those technicals, then ignore all my bearish fundamentals, as those will be thrown right out the window as we head into the next round of frenzied buying but, until then, we're still erring on the side of caution. Last month, we also discussed levels and just yesterday we finally made our 3,300 goal on the Nasdaq – the second to last red box on our Big Chart.

All we're asking the Nasdaq to do is hold it for a day and we're happy to throw in the bearish towel but those fundamentals do weigh heavily on the markets and, unless earnings can give us a REALLY good reason to ignore them – I think we'll be getting those pullbacks before making another run at 16,000, 1,600, 3,300, 10,000 on the NYSE and 1,000 on the Russell, which will be our new Must Hold lines if we have to redraw.

That makes our new -10% lines 14,400, 1,440, 2,970, 9,000 and 900 and our new -5% lines will be 15,200, 1,520, 2,970, 9,000 and 900. That's why we're very cautious before rolling our numbers higher. We've been tempted to do so since March but we just want to be sure before saying the "right" level for the market is where we are now and looking for another 10% gain before the next time we plan to get bearish.

BUT (see yesterday's Big Buts) we've got 10%'s worth of stimulus courtesy of the BOJ so, unless earnings actually mess up and disappoint – we should be expecting us to grind higher as a combined $155Bn a month is poured into global liquidity each month by the BOJ and the Fed.

We got March Retail Sales this morning and they sucked (down 0.4% vs up 0.1% expected by leading economorons) and the Producer Price Index fell 0.6% vs 0.2% expected by more economorons (why do we even bother asking them?) but it was led by a 3.4% decline in energy prices and screw those guys – we don't want them making money anyway.

We got March Retail Sales this morning and they sucked (down 0.4% vs up 0.1% expected by leading economorons) and the Producer Price Index fell 0.6% vs 0.2% expected by more economorons (why do we even bother asking them?) but it was led by a 3.4% decline in energy prices and screw those guys – we don't want them making money anyway.

So don't let them tell you we're Japan now – PPI is down because oil was ridiculously over-priced and now it's correcting. Food is up 0.8% but you couldn't tell it from DBA, which is way down at $25.78 and a great inflation hedge.

The DBA Jan $23/26 bull call spread is $2 and you can sell the 2015 $25 puts for $1.55 for net .45 on the $3 spread that's $2.78 in the money to start with a potential 566% return on cash if DBA makes $26 into January expirations. It's good to have an inflation hedge or two in place in case we are too bearish and the markets do take off – I'll try to come up with another couple this weekend.

Have a good one,

– Phil