Wheeeeeee!

Wheeeeeee!

I do so love it when a plan comes together. I also love it when we can make $500 per contract on Nikkei shorts (/NKD) early in the morning, which makes it all worthwhile to get out of bed early. I was sure enough about the /NKD to tweet that note from Member Chat out – to make sure no one missed it. I also tweeted an out note at 6:15 but now it's 7:18 and we're shorting the Nikkei again, this time below the 13,300 line with very tight stops above.

No I'm not fickle – that's just the way we play the Futures – very quick ins and outs using major support lines for on/off switches, which is simple enough, but ONLY when other indicators AND the macros dictate the move. By taking ALL those additional factors into account, we can be right 60% of the time or more and that, combined with disciplined position management strategies – can pay for many, many Egg McMuffins.

No I'm not fickle – that's just the way we play the Futures – very quick ins and outs using major support lines for on/off switches, which is simple enough, but ONLY when other indicators AND the macros dictate the move. By taking ALL those additional factors into account, we can be right 60% of the time or more and that, combined with disciplined position management strategies – can pay for many, many Egg McMuffins.

Of course, long-term macros hold up for us too as we called a bit of an early top on March 27th (when we thought we'd get an EOQ drop-off) and my Tweet from that morning's early Member Chat was shorting /NKD at 12,500 and shorting oil at $96 (/CL). That Nikkei move was ultimately good for $1,000 per contract while oil bottomed out this morning at $88.23 – good for a gain of $7,770 per current contract! We actually missed this last leg down but we caught the first one, of course.

We also got a nice dip in Natural gas this morning (same Tweet) and caught a ride there from $4.27 to $4.25, which doesn't sound exciting but Nat Gas (/NG) Futures pay $100 per penny, per contract – so not too shabby and can continue to be played bearish below that line.

We also got a nice dip in Natural gas this morning (same Tweet) and caught a ride there from $4.27 to $4.25, which doesn't sound exciting but Nat Gas (/NG) Futures pay $100 per penny, per contract – so not too shabby and can continue to be played bearish below that line.

We're not expecting a big correction – just A correction and we'd be thrilled to see a 5% pullback that holds up. We won't be so thrilled to see every little dip reversed – as it has been all month – as it makes us suspicious that it's fake and we may see a sharper downturn after April options expirations (Friday).

So far, the US markets have been running away from the slowdown that's been hitting the Global markets all year. Of course, that was our investing premise this fall – that US equities would be the best place to park your money this year and we went as far as to favor the Russell, as those companies average less than 25% of their business outside the US vs. over 50% for S&P companies.

So far, the US markets have been running away from the slowdown that's been hitting the Global markets all year. Of course, that was our investing premise this fall – that US equities would be the best place to park your money this year and we went as far as to favor the Russell, as those companies average less than 25% of their business outside the US vs. over 50% for S&P companies.

But now, as you can see from this chart (as well as all the recent data), the Global markets are into a serious downturn and we've become concerned that the US can't simply ignore all the bad news for the rest of the year. Expectations for earnings are fairly high and I don't think we'll be seeing too many beats – especially from early reporters – perhaps we'll have more luck when the small caps begin reporting at the end of the month.

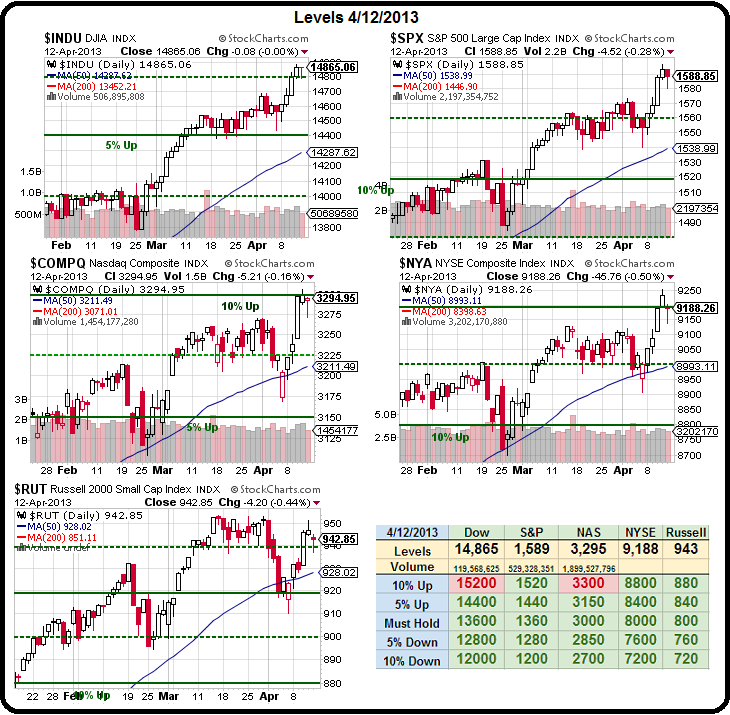

Meanwhle, we went over our Big Chart this weekend and discussed our expected pull-back levels. Jfawcett asked if I thought we'd get a 20-40% pullback (of the run-up) and my response was:

Meanwhle, we went over our Big Chart this weekend and discussed our expected pull-back levels. Jfawcett asked if I thought we'd get a 20-40% pullback (of the run-up) and my response was:

Pullback/Jfaw – I hope not 20-40% (off the top line). No, the Fed isn't going away and neither is the BOJ – ESPECIALLY if we have a crash.

I just think the rally is ahead of itself and we're due for a pullback to a more realistic level. I'd call 1,350 a pre-QE3 base on the S&P and QE3 is good for 20% and that's 1,620 and a 20% retrace from that is 1,566 and a 40% retrace is 1,512 so those are our test lines on a pullback. If we hold a weak retrace (1,566) then we're still bullish and good for another 10% over 1,620 (to 1,782), which is essentially what Goldman is projecting and that makes sense with the BOJ added to the mix – just not in a straight line.

We have gotten ourselves a bit bearish and, maybe, too bearish as the markets have gone up and up without a pullback. To that end, I put up "5 Trade Ideas that can Make 500% in an Up Market" as we need so UPSIDE heges – in case we're positioned too bearish and the markes do break on through to the other side (something we've been waiting for since March 12th).

We have gotten ourselves a bit bearish and, maybe, too bearish as the markets have gone up and up without a pullback. To that end, I put up "5 Trade Ideas that can Make 500% in an Up Market" as we need so UPSIDE heges – in case we're positioned too bearish and the markes do break on through to the other side (something we've been waiting for since March 12th).

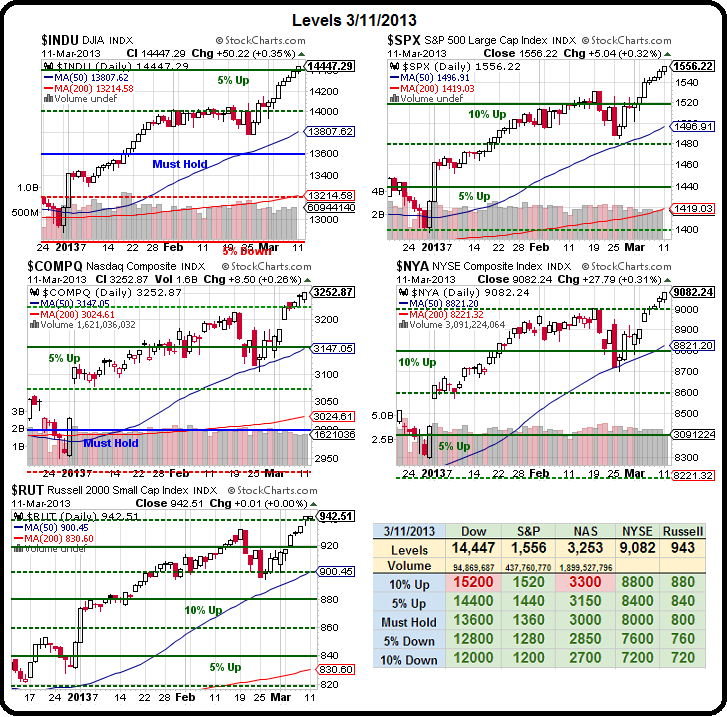

Back on March 12th, the Dow was at 14,447 and the S&P was 1,556. The Nasdaq was 3,253, the NYSE was 9,082 and the Russell was 943. Where did the Russell finish on Friday? 943.

So clearly, we have not broken on through to anything in the past month – despite all the interim excitement. The Dow has caught up a bit (up 2.9%) and that's healthy, as it was seriously lagging and the S&P managed to gain 22 points (1.4%), the Nasdaq added 31 (1%), NYSE put on 106 (1.2%) and a goose-egg for the Russell.

We know the Dow is meaningless and I analyzed the Dow on March 7th and we decided 15,000 was our max for this earnings period – even if all goes well. This is why we decided to focus on Dow shorts with that index up testing 14,900 ahead of earnings – the rewards to the downside have begun to outweigh what we believe are the risks. Heading back to 14,440 is our immediate concern and we'd be happy to BUYBUYBUY back at 14,040, which is where we feel a major correction could take us. We would have been pleased with the April dip back to 14,440 but it reversed too quickly (same day on low volume) for a proper test.

8:30 Update: Nat Gas Futures just hit $4.20, that's up $700 per bearish contract since my morning tweet and I just tweeted out a note not to be greedy on that one (should be obvious). Meanwhile, I don't know what's bouncing the Futures other than a dip in the Dollar (82.25) and the news that DISH is offering to buy S for $7 but the offer is 33% DISH stock, which is up 20% since the Fall and, ordinarily, I'd advise Sprint to tell Dish to shove it but Sprint has lost $10Bn in the past 3 years with $4.3Bn of that last year and $1.3Bn last quarter so my advice to Sprint in this case is that it's better than a well-deserved bullet to the brain and my advice to DISH shareholder is – RUN AWAY!!!!

DISH does not make enough money (under $3Bn in last 3 years and only $636Bn last year) to stop the gaping, gushing, bleeding of S and Dish does have $7Bn in cash, which is nice, but they already have $11Bn in debt and S has another $24Bn in debt and another $7Bn of cash so now we have $14Bn in cash, less the $12Bn they are offering to buy out Sprint shareholders and a combined $35Bn in debt with a combined operation that lost $3.7Bn last year. The whole combined company only has 70,000 employees so, unless they make an average of $53,000 each and you can cut 100% of them and still run the company – there's not going to be an easy path to profits here.

DISH does not make enough money (under $3Bn in last 3 years and only $636Bn last year) to stop the gaping, gushing, bleeding of S and Dish does have $7Bn in cash, which is nice, but they already have $11Bn in debt and S has another $24Bn in debt and another $7Bn of cash so now we have $14Bn in cash, less the $12Bn they are offering to buy out Sprint shareholders and a combined $35Bn in debt with a combined operation that lost $3.7Bn last year. The whole combined company only has 70,000 employees so, unless they make an average of $53,000 each and you can cut 100% of them and still run the company – there's not going to be an easy path to profits here.

We went over the news (mostly bad) in Member Chat so I won't re-hash it here. Jeff Kennedy is running a great TA Series over in Chart School, check that out if you are a fan of the squgglies and – let's be careful out there!