Chart o’ the Day: “Due for a Wipeout”

Courtesy of Joshua M Brown, The Reformed Broker

On Monday we had a major day of distribution and both the internals and momentum turned decidedly against a continued advance for the US stock market. The next day we staged a 150 point bounce in the Dow but it was an unconvincing one from my perspective. On TV that afternoon I had mentioned that this is probably the beginning of a correction – of the same variety we've seen in each of the last three Aprils as economic data improvement softened and earnings began coming in from Corporate America. If I'm right, we slog through a tough spring and then set ourselves up for rally into year-end as housing gains spread the wealth and good vibes into the rest of the economy.

But there is another possibility worth considering. One in which the cyclical bull market meets its demise exactly where history would suggest it "should."

Unfortunately, this would mean right about now.

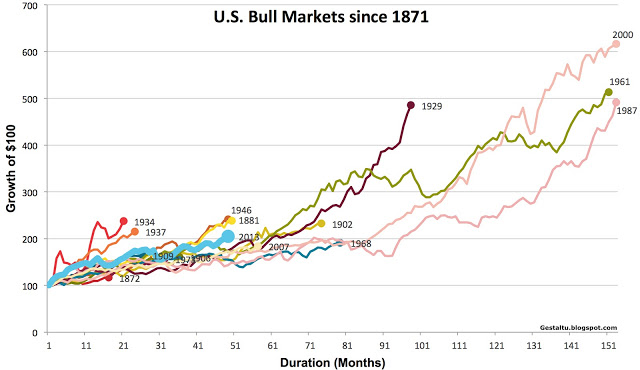

I came across this chart on a blog called GestaltU thanks to a link on Greenbackd. Below you'll be looking at the current bull market versus all of the prior comparable bull markets…

Chart 1 describes every bull market since 1871 in the S&P, including duration and magnitude information. The lesson from this analysis is uninspiring for equity bulls, as we will see. The core hurdle is that the current bull market has (through end of February) already delivered 105% of gains, against the median 124% bull market run through history (using monthly data). Of course, this means that, should this bull market deliver an average surge, investors can hope for less than 20% more growth from this cycle. Further, given that the median bull market has historically lasted 50 months, and we are currently in our 49th bull month, we are about due for a wipeout.

Now of course, there are no "rules per se – markets can and will do whatever they want regardless of what's taken place in the past. You'll be hard-pressed to find the same exact conditions of the present moment in any of these prior periods. But you will find similarities.

And even if the past does not hold concrete answers, it at least holds a framework with which we can interpret what we see before us today. Ray Dalio has built a $100 billion hedge fund based on exactly this premise.

Click over for more on the history of bull markets, it's a great read.

Source:

What the Bull Giveth, the Bear Taketh Away (GestaltU)