63,500 ounces.

63,500 ounces.

That's how much physical gold the US Mint alone sold on Wednesday, as gold fell to $1,350. For the month, 147,000 ounces (4.5 tons) have been removed from the mint at a 20% discount to last year's $1,650 average price. Don't worry about the mint – they have an average purchase price of about $90 and the US has 8,000 tons of it sitting around so, if someone wants to buy $200M worth in a month – that's fine with us but consider that the guy(s) buying 4.5 tons of gold for $200M might not be stupid.

We were discussing a great article in the Daily Bell (thanks Scott) that summed up my take on the recent gold move quite succinctly:

Following the wikipedia.org definition, the PSYOPS war on gold is intended to influence the target audience's value system, belief system, emotions, motives, reasoning and behavior. I would add, especially this last, which is what directly affects the price of gold.

The latest stage of the war began many weeks ago, with regular takedowns of the price of gold in waterfall fashion, at set times of the day. More recently, there appeared a series of planned announcements of oncoming doom from individuals prominent in finance and from bank analysts. The scenario painted for gold was one of a sky darkened by approaching thunderstorms.

The purpose of the 4-12 PSYOPS was to instill fear in the minds of the "target audience" – investors in gold. If you shoot a crow, and hang it up in your field, the crows – your "target audience" – will avoid the field. The same principle applies to investors in gold.

The identity of the target audience of the PSYOPS War on Gold is clearly revealed in the front-page article of the Financial Times, American edition, on Tuesday April 16, 2013. Under the main headline, "Investors in rush to dump gold," is a graph of the performance of the gold price from January 3, 2011 to date, showing essentially no gain at all.

Notice the wording: "Investors… rush… dump gold."

This is a classic example of PSYOPS.

It was most certainly not "investors" who caused the huge, historic collapse in the price of gold. It was a very few banks, working in cooperation with each other, in a pre-planned fashion. They sold, in huge amounts of tens of billions of dollars, not physical gold, but futures contracts – the infamous "paper gold." It was the banks who rushed to "dump" the gold and not investors.

We've been playing gold by scooping up miners like ABX but so far, so wrong on that one, although they did bounce nicely off $17.51 on Wednesday and back over $18.50 on very heavy volume – playing right into my premise (and Price's) that what we're witnessing is simply a Bankster takeover of the gold market as they first scare the sheeple out of the market and then scoop up physical gold and the miners and, before you know it, Cramer and co. will seamlessly flip-flop and tell you to BUYBUYBUY gold before it's too late as they begin to bang the inflation drums once again.

We've been playing gold by scooping up miners like ABX but so far, so wrong on that one, although they did bounce nicely off $17.51 on Wednesday and back over $18.50 on very heavy volume – playing right into my premise (and Price's) that what we're witnessing is simply a Bankster takeover of the gold market as they first scare the sheeple out of the market and then scoop up physical gold and the miners and, before you know it, Cramer and co. will seamlessly flip-flop and tell you to BUYBUYBUY gold before it's too late as they begin to bang the inflation drums once again.

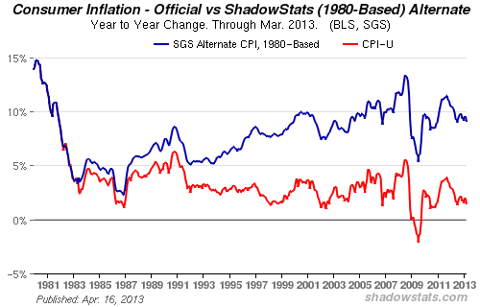

As you can see from this ShadowStats chart, inflation is already here – just not "officially" as the Government's definition of inflation is constantly being adjusted so as not to measure it. ShadowStats simply applies the same inflation measures we used in 1980 without the official fiddling and it's showing inflation at just under 10% for the last few years – EACH.

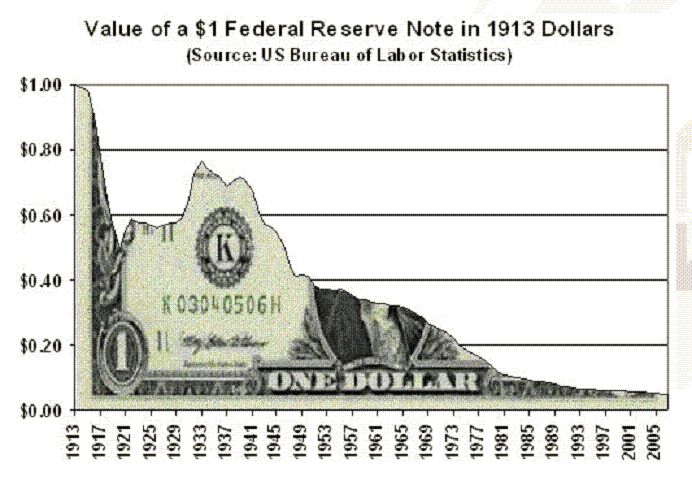

That makes sense because, if you look at a chart of the US Dollar – it's down over 50% during that time so that's 100% inflation since 1993, around 5% a year without compounding. Of course, as we know, the Dollar is artificially supported (from zero?) by the BOJ and the PBOC and the Euro has also crashed to help the Dollar stay off the worthless line but I'm sure – with another few years of Fed easing – we can break right through that floor!

That makes sense because, if you look at a chart of the US Dollar – it's down over 50% during that time so that's 100% inflation since 1993, around 5% a year without compounding. Of course, as we know, the Dollar is artificially supported (from zero?) by the BOJ and the PBOC and the Euro has also crashed to help the Dollar stay off the worthless line but I'm sure – with another few years of Fed easing – we can break right through that floor!

Does that mean gold is the ultimate investment? No, it's just shiny bits of metal and generally does not outperform the stock market over time. But, it does have SOME value as a means of exchange and it's not at all likely that that value has dropped 20% since January, nor is it likely that it will stay this low over the long run. That's what a good investment is all about – buying things now that will be worth more in the future.

Unfortunately, for many "investors" who start at the 1-minute chart all day, the future means 15 minutes or, for those who think they are long-term because they look at day charts – months. Real investments make returns over years based on long-term macro trends that firm up over time. Very few people have the patience for that these days.

Unfortunately, for many "investors" who start at the 1-minute chart all day, the future means 15 minutes or, for those who think they are long-term because they look at day charts – months. Real investments make returns over years based on long-term macro trends that firm up over time. Very few people have the patience for that these days.

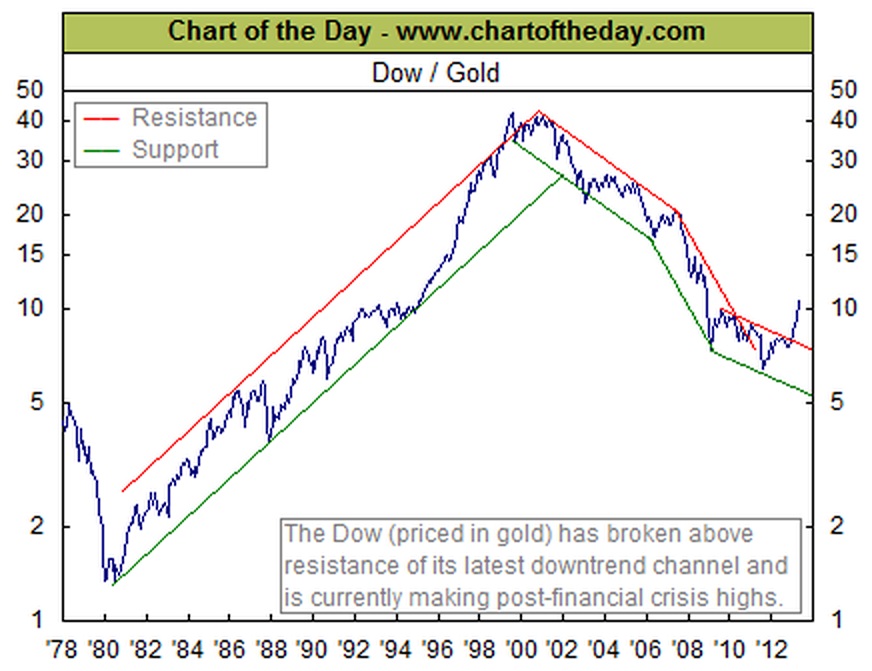

As you can see from this Dow/Gold chart, gold has flatlined and now fallen since QE2 and QE3 were put in place and stocks are outperforming gold by a mile now. We figured, given this trend, that buying gold stocks (miners) might make sense but, so far (after a few weeks), no.

So, plenty of inflation and, so far, it's NOT pushing up commodity prices – that's gotta be great for the Dow, who are primarily users of commodities and sellers of finished goods. Even XOM and CVX have refining and chemical operations that benefit from lower petroleum input costs that mitigate the downside effect of falling oil prices. AA is too small to hurt the Dow and CAT would be the only other component negatively impacted by sliding commodities but, otherwise, things are looking up for our senior index.

We're short the Dow (and XOM) at the moment because moves like this rarely come without corrections but we're also not expecting a big correction because the real story is that 10% inflation which, for the most part, has been squeezed first into equity prices and hopefully, next into home prices and then, still hopefully, into wages before it creeps back into commodities again.

We're short the Dow (and XOM) at the moment because moves like this rarely come without corrections but we're also not expecting a big correction because the real story is that 10% inflation which, for the most part, has been squeezed first into equity prices and hopefully, next into home prices and then, still hopefully, into wages before it creeps back into commodities again.

Any inflationary rally that doesn't include wage inflation (and hiring) is ultimately doomed to failure. Unfortunately, that's been the case for the last 30 years as wages for the bottom 80% have fallen as a percentage of GDP, with more and more money trickling up to the top 10%.

For many years, US Corporations have been able to ignore the plight of US Citizens as they plied their goods in foreign markets but, now that they've reached saturation points abroad (and those economies are feeling the strain) it is hoped that they do something to revive the home markets – before they are irrevocably damaged. Hopefully our "leaders" will wake up and at least get up enough courage to SUGGEST to their Corporate Masters that we need a better path forward than the one we've been stumbling down.

Have a great weekend,

– Phil