Courtesy of Lee Adler of the Wall Street Examiner

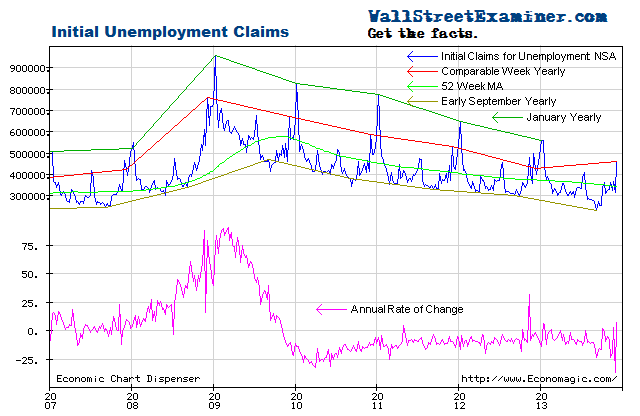

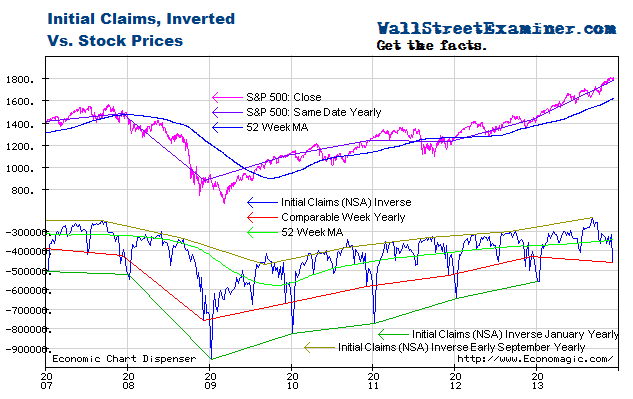

The trend toward fewer initial unemployment claims continued this week at a pace near the average of the past several years. Bubbling stock prices are still ahead of this trend, a fact made possible, and likely to continue, because of the Fed’s QE.

The Labor Department reported today that the seasonally adjusted (SA) representation of first time claims for unemployment fell by 18,000 to 324,000 from a revised 342,000 (was 339,000) in the advance report for the week ended April 27, 2013. The consensus median economists’ estimate of 346,000 for the SA headline number was too pessimistic for the second straight week. It is normal for forecasters to be wrong, not just because economic forecasting is quackery, but also because the seasonally adjusted number, being made-up, is impossible to consistently guess (see endnote).

The headline seasonally adjusted data is the only data the media reports but the Department of Labor (DOL) also reports the actual data, not seasonally adjusted (NSA). The DOL said in today’s press release, “The advance number of actual initial claims under state programs, unadjusted, totaled 298,692 in the week ending April 27, a decrease of 27,143 from the previous week. There were 333,476 initial claims in the comparable week in 2012.” [Added emphasis mine]

For purposes of this analysis, I adjusted this week’s reported number up by 2,500. The advance report is usually revised up by from 1,000 to 4,000 in the following week, when all interstate claims have been counted. Last week’s number was approximately 2,700 shy of the final number for that week released today. The adjusted number that I used in the data calculations and charts for this week is 301,000, rounded. The final number for the week, to be released next week, should be near that.

The actual filings represent a decrease of 9.7% versus the corresponding week last year. That’s not as good as the 12.1% drop last week, but it’s still better than the average year to year improvement of the past 2 years of -8.8%. The year to year comparisons are now much tougher as the number of job losses declined sharply between 2009 and 2011, so this week’s number is all the more impressive. especially given that it follows a very good number the previous week.

The current week to week change of a decrease of 25,000 in the NSA number compares with an average change of a decrease of 10,000 for the same week over the prior 10 years. The comparable week has had extreme variations with both increases and decreases. In 2012 the comparable week had a drop of 37,000, while in 2011 there was an increase of 28,000.

The Labor Department, using the usual statistical hocus pocus, applied seasonal adjustment factors ranging from about 1.05 to about 1.15 to the week corresponding to this one over the last 10 years. This week they applied a factor of 1.05, which was below the range.

The real time withholding tax data, which showed strength throughout April until a dip at the end of the month, suggests blowout payroll numbers. It’s hard to fathom how professional economic forecasters can miss the weekly claims estimates for the past two weeks on the weak side given this data.

The consensus forecast of economists is for +155,000 in seasonally adjusted non-farm payrolls. That would be a 1.46% gain on a year to year basis. Withholding tax collections covering the pay periods including the reference date of the 12th were up an average 12.3%. Adjusted for earnings inflation and the increase in tax rates would imply a real rate of gain around 2% to 3.3%.

I will continue to watch both withholding and claims closely for any sign of deterioration. The dip in withholding at the end of the month is something to watch, but the trends still look strong in both indicators. The Federal spending sequester that took effect in March had shown no ill effects in the withholding data until possibly this week, while the tax increases that took effect in January have not had a measurable negative impact.

The correlation of the broad trends of claims with the trend of stock prices over the longer term is strong. It can be clearly seen when the claims trend is plotted on an inverse scale with stock prices on a normal scale.

Stock prices broke out of the top of their range channel earlier this year in response to the Fed’s QE 3-4. The rate of improvement of initial claims has varied from week to week and month to month, but over the last two years the trend has been remarkably consistent.

Stock prices were running with the trend until the Fed started QE3 and 4 late last year and early in 2013. The Fed’s QE3-4 money printing campaign has had far more success in creating a stock market bubble, which was one of Bernanke’s stated goals (in slightly different words), than in driving economic growth.

As long as the trend of new claims remains strong and the Fed (now joined by the BoJ) keeps cashing out the Primary Dealers every month via its asset purchase programs (QE3-4), I would not expect the uptrend channel in stocks to break down.

The central banks have the markets well rigged. A bear market, or even just a major correction, is likely only when conditions force the central banks to change course.

Note: There is no way to know whether the SA number is misleading or a reasonably accurate representation of the trend unless we are also looking at charts of the actual data. And if we look at the actual data using the tools of technical analysis to view the trend, then there’s no reason to be looking at a bunch of made up crap, which is what the seasonally adjusted data is. Seasonal adjustment just confuses the issue.

Seasonally adjusted numbers are fictional and are not finalized until 5 years after the fact. There are annual revisions that attempt to accurately reflect what actually happened this week. The weekly numbers are essentially worthless for comparative analytical purposes because they are so noisy. Seasonally adjusted noise is still noise. It’s just smoother. So economists are fishing in the dark for a fictitious number that is all but impossible to guess. But when they are persistently wrong in one direction, it shows that their models have a bias. Since the third quarter of 2012, with a few exceptions it has appeared that a pessimism bias was built in to their estimates.

To avoid the confusion inherent in the fictitious SA data, I work with only the actual, not seasonally adjusted (NSA) data. It is a simple matter to extract the trend from the actual data and compare the latest week’s actual performance to the trend, to last year, and to the average performance for the week over the prior 10 years. It’s easy to see graphically whether the trend is accelerating, decelerating, or about the same.

The advance number for the most recent week is normally a little short of the final number the week after the advance report, because the advance number does not include all interstate claims. The revisions are minor and consistent however, so it is easy to adjust for them. Unlike the SA data, after the second week, they are never subsequently revised.

Read Durable Goods Orders Show US Manufacturing Continuing Secular Decline

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.