Now this is interesting.

Now this is interesting.

We had a 1% sell-off yesterday into the ECB's expected rate cut (and they did, indeed, cut rates 0.25% this morning) and that sent the Euro flying up to $1.32 again (we discussed why in Member Chat yesterday) and the Dollar fell to 81.50 again (yesterday's low) and the Futures are up about half a point at 7:57.

So, are happy days here again or is this just more irrational exuberance?

As you can see from Dave Fry's weekly Dow chart, we're holding the bottom of the steeply rising channel so far but that Dollar has dropped from 83.32 last week to 81.50 this week and that's 2.2% and 2.2% of the Dow is 323 points so try putting 14,427 in as the bottom of that candle and you'll get a better idea of how the Dow is really doing without Central Bank shenanigans.

Unlike Mr. Fry, we are not long on the Dow – not in the short-term anyway. We are, in fact, using DIA puts as one of our hedges and TZA is another one, though I did want to cash out the more volatile TZAs yesterday in anticipation of an ECB bounce. While the Dow is holding up fairly well – that's just 30 companies. The Russell has 2,000 companies in the index and they dropped like 2,000 small rocks yesterday, falling the full 2.5% for the day – indicating they are more likely to drop another 1.25% than to bounce more than 0.5% today.

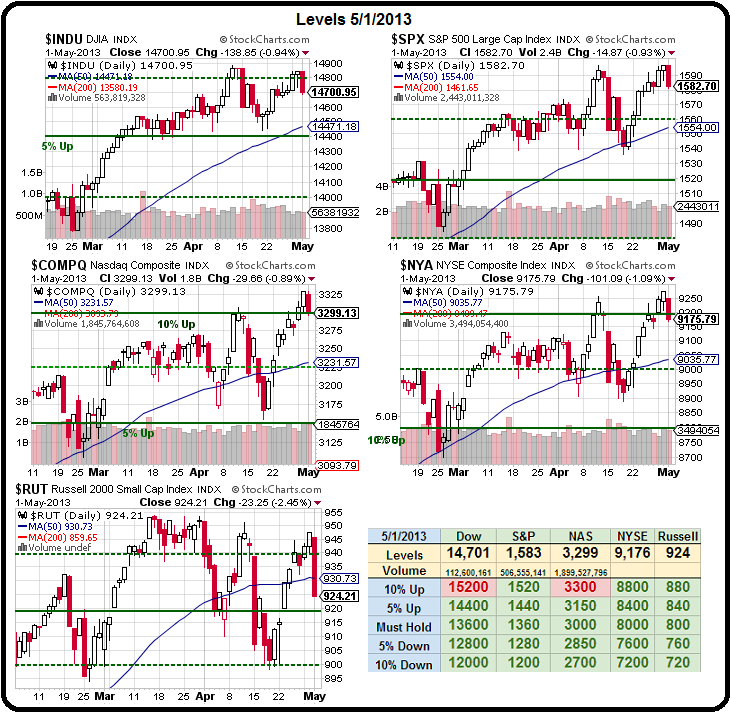

As you can see from our Big Chart – those "M" patterns we were expecting are beginning to form and, of course, AAPL is keeping the Nasdaq above it's 10% line but thing can turn ugly very very fast if our favorite stock drops again. We did, in fact, add two new AAPL trade ideas to our AAPL Money Portfolio in this morning's Member Chat and we do plan to sell a few short calls to lock in some of this run's gains on that one. As to the indexes – we have fat support lines at 3,300 on the Nasdaq (10%), 9,200 on the NYSE (15%) and 920 on the Russell (15%) and, if those 3 break – we're looking at another 2.5% drop with virtually no support so watch out for a Dollar bounce that can set the whole thing tumbling down.

Frankly, we could care less what the indexes do as long as our earnings and Futures plays behave themselves. Yesterday, in the morning post, I noted that we liked to play the S&P Futures bearish at 1,595 (/ES), those fell to 1,575 during the day and, at $50 per point, per contract, that trade idea was good for $1,000 per contract. Even if you didn't stop out of the pair trade with oil (/CL), we're still at $91.30 on that contract and that's down $700 per contract so a good pair to trade. We took a quick, small gain on gasoline in Chat and then it too collapsed on poor inventory numbers and the Dollar is still long on the 81.50 line but long on the Dollar means we're once again short on everything else this morning.

Frankly, we could care less what the indexes do as long as our earnings and Futures plays behave themselves. Yesterday, in the morning post, I noted that we liked to play the S&P Futures bearish at 1,595 (/ES), those fell to 1,575 during the day and, at $50 per point, per contract, that trade idea was good for $1,000 per contract. Even if you didn't stop out of the pair trade with oil (/CL), we're still at $91.30 on that contract and that's down $700 per contract so a good pair to trade. We took a quick, small gain on gasoline in Chat and then it too collapsed on poor inventory numbers and the Dollar is still long on the 81.50 line but long on the Dollar means we're once again short on everything else this morning.

Back on April 4th, we set up an earnings play for FB for our $25,000 Portfolio which looked like this:

- Buy 10 Sept $26 calls for $2.84 ($2,840)

- Sell 10 Sept $30 calls for $1.27 ($1,270)

- Sell 6 May $25 puts for .92 ($552)

- Sell 6 May $28 calls for .93 ($558)

So we spent net $460 in cash and FB's earnings were good but not great and it looks like they'll open right at $28 this morning but, as you can see, we were biased a bit bullish and hopefully both the short puts and calls will be wiped out and we'll be left with about $2,500 on the spread for a net profit of about $2,000 or 400% on cash in less than a month. Gotta love those earnings trades!

Another one in our $25,000 Portfolio that came up yesterday was LVS. On that play, our trade idea was:

- Buy 5 Sept $57.50 calls for $3.45 ($1,725)

- Sell 5 Sept $62.50 calls for $2.75 ($1,375)

- Sell 5 June $57.25 calls for $2.05 ($1,025)

As this spread had a net credit of $675, anything under $57.25 is a huge win for us and it looks like we nailed this one as well. That trade we only initiated on Monday – so very, very time efficient! Earnings plays are lots of fun while we wait (patiently, I hope) for our longer-term positions to mature. At the moment (8:55), the Nikkei is over the 13,900 mark and that makes a great shorting line on /NKD with tight stops as the Yen leaps up 1% to 98.40 (not likely to hold).

As this spread had a net credit of $675, anything under $57.25 is a huge win for us and it looks like we nailed this one as well. That trade we only initiated on Monday – so very, very time efficient! Earnings plays are lots of fun while we wait (patiently, I hope) for our longer-term positions to mature. At the moment (8:55), the Nikkei is over the 13,900 mark and that makes a great shorting line on /NKD with tight stops as the Yen leaps up 1% to 98.40 (not likely to hold).

We have Consumer Comfort at 9:30 and that should be good and Natural Gas Inventories at 10:30 and we already played those short yesterday at $4.40 and those fell to $4.33 yesterday for a lovely $7,000 per contract gain. We took the money and ran on those, of course but we're still short with UNG puts into the report this morning. Tomorrow is Non-Farm Payrolls and that trumps everything else – so tune in for that one and let's keep drawing those M's!