Wheee, what a ride!

Wheee, what a ride!

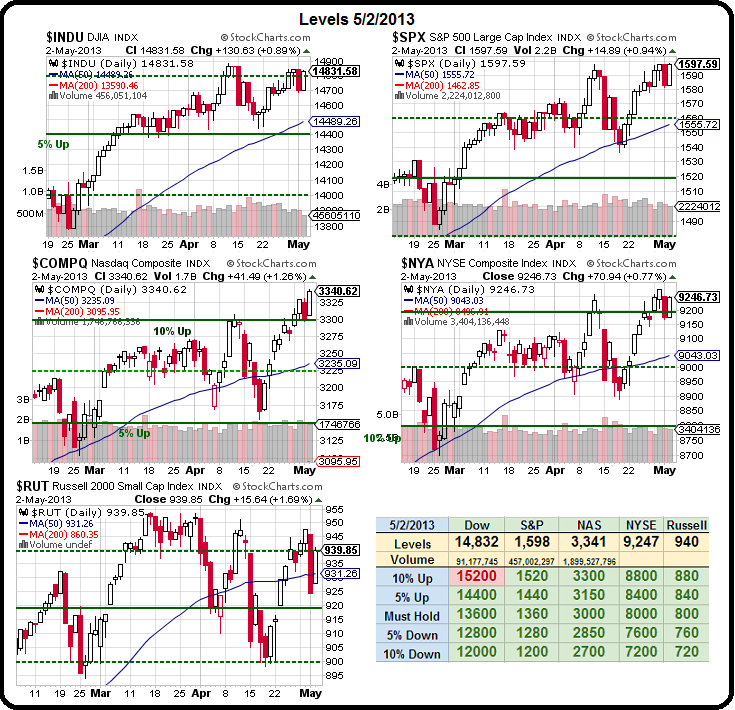

As you can see from the Big Chart, we've been up and down and over and out and each time we find ourselves flat on our our face we pick ourselves up and get back in the race – that's the markets…

"You're riding high in April and shot down in May" are the lyrics from the Sinatra song and that is, indeed, life in the markets so we'd be foolish not to have any hedges – just in case – and we rolled ours yesterday to guard against a May drop-off but, as I reminded our Members yesterday, in this crazy market – we need our upside hedges too:

DBA was one of our "Five Inflation Fighters Set to Fly" (Part 1 and Part 2) from the 20th and ALSO was one of our "5 Trade Ideas that can make 500% in an Up Market" along with CLF, X, ABX and our 1,844% upside plays that was long AAPL and the Qs (going well so far, thank you very much!). I don't make posts like this very often, they are essentially when I'm making major top and bottom calls and, historically, they've done very well.

If you haven't had a chance to pick up some bullish plays recently, these 10 ideas are good places to start!

We don't know for sure which way the markets will go. On the whole, we're still playing this for a short-term correction but long-term bullish as it seems inevitable that this Tsunami of cash flying out of now all 3 major Central Banks will eventually be the rising tide that lifts all equities. This morning, in our early Member Chat session, I noted:

We don't know for sure which way the markets will go. On the whole, we're still playing this for a short-term correction but long-term bullish as it seems inevitable that this Tsunami of cash flying out of now all 3 major Central Banks will eventually be the rising tide that lifts all equities. This morning, in our early Member Chat session, I noted:

Europe up about 0.25% and, if we take Draghi at his word – how can we short anything? Where else is there to put money but US equities if you want to get a return? Well, gold, I guess – but they've done a great job of spooking people out of that now. Real Estate should also be good but again, too many people have been burned. So, pullback or no – where do we put our money? 10-year bonds? Corporate Bonds? Currencies? Cash? China? Emerging Markets? Europe? Japan? Oil? No, there just is nowhere else to put money and it's not that US equities have a great story – just a better one than those guys!

Money has to go somewhere and they are printing more of it every day…

Speaking of China, CYB (Yuan) continue to make new daily all-time highs despite the fact that China sets the trading band and despite the fact that their exports have dropped off markedly – in part, due to their strong currency and rising labor costs. Of course, the higher Yuan keeps a lid on inflation and that's very important to the Chinese Government so it's not easy to ascertain their intentions here but, as I also noted this morning, Chinese scientists have combined bird flu with swine flu to create the World's most deadly virus – so who knows what those guys are thinking?

Speaking of China, CYB (Yuan) continue to make new daily all-time highs despite the fact that China sets the trading band and despite the fact that their exports have dropped off markedly – in part, due to their strong currency and rising labor costs. Of course, the higher Yuan keeps a lid on inflation and that's very important to the Chinese Government so it's not easy to ascertain their intentions here but, as I also noted this morning, Chinese scientists have combined bird flu with swine flu to create the World's most deadly virus – so who knows what those guys are thinking?

The chart on the right, from the South China Morning Post, is very interesting as you can see China's incredible rise in GDP has not been generally reflected in it's stock market. You can also see how tightly they control their currency to keep their economic indicators in-line with their 5-year plans. Does this make Chinese stocks a good buy? Of course not – where do you think all those Chinese Billionaires came from? YOU put money in an ADR, THEY take cash out of the companies and buy land. You would think after 850 years of trading with China that we'd finally wise up but foreigners continue to be taken to the cleaners year after year…

8:30 Update: 165,000 new jobs in April and February revised up to 332,000 and March up to 138,000 is another 114,000 jobs added from the past two months as well as the nice beat of 145,000 jobs expected for April. In short, this report could not have been better and the markets are flying in the Futures. Even better, unemployment is STILL 7.5% – so the Fed keeps on printing!

8:30 Update: 165,000 new jobs in April and February revised up to 332,000 and March up to 138,000 is another 114,000 jobs added from the past two months as well as the nice beat of 145,000 jobs expected for April. In short, this report could not have been better and the markets are flying in the Futures. Even better, unemployment is STILL 7.5% – so the Fed keeps on printing!

Looks like we'll be seeing S&P 1,600 this morning. So much for Sequestration dooming us all. Let's cut some more military spending quick! Hourly Earnings were up 1.9% and that, to me, is more important than anything else because giving 155M working people 2% more is like hiring 3M more people and that's 250,000 people a month. What we had been doing for the past 5 years is cutting people's salaries while hiring some more – that has no net effect on GDP. If we can get wages moving up past the rate of inflation – THAT would be a recovery.

More pay for more workers means more demand for Dollars and the the Euro fell from $1.314 to $1.304 in about 5 minutes after that jobs number came out. The Pound also took a pounding, back to $1.547 and they Yen fell rose from 98 to 99, which is weaker, as it's how many Yen for a Dollar. The Nikkei, of course, is loving that and leaped 200 points to 14,150 and is a great short there (/NKD) and certainly if it tests 14,200 an even better one. Similarly, if the S&P fails to hold 1,600 (/ES) – that's going to be a great short too – as will be the Russell (/TF) off the 950 line.

More pay for more workers means more demand for Dollars and the the Euro fell from $1.314 to $1.304 in about 5 minutes after that jobs number came out. The Pound also took a pounding, back to $1.547 and they Yen fell rose from 98 to 99, which is weaker, as it's how many Yen for a Dollar. The Nikkei, of course, is loving that and leaped 200 points to 14,150 and is a great short there (/NKD) and certainly if it tests 14,200 an even better one. Similarly, if the S&P fails to hold 1,600 (/ES) – that's going to be a great short too – as will be the Russell (/TF) off the 950 line.

Still, on the whole we're dealing with an uber-strong major data set. Factory orders at 10 may take some of the steam out of the rally as may ISM Services at the same release but, if they also beat low expectations – this week can finish off with a big bang. So much for TLT, which didn't hit our 125 shorting target and now will be lucky to hold 120 as the idea of giving the Government money to hold for 20 years at 3.5% is looking sillier and sillier every day.

This should get our beloved AAPL over the $450 mark. We added more AAPL longs in Member Chat yesterday and, as featured in last weekend's Stock World Weekly, it was just 8 days ago that AAPL was at $394 and people were panicking and I said to Members in last Wednesday's Morning Alert:

We'll see what holds on AAPL today but the math is inescapable. They are trading at $380Bn. They have $145Bn, they will make another $35Bn by the end of 2013 ($180Bn). In 2014 and 2015 they will make another $100Bn ($280Bn in cash) and, over that period, they will pay out $40Bn in dividends (10% of the stock over 3 years) and buy back $60Bn worth of the stock (15.7%) which will make $50 a share on 1Bn shares more like $58 a share on 850M shares and that's assuming they ONLY grow revenues 3-4% a year for 3 years. That's all I'm going to say on the subject – you have a chance to buy this stock for $394. Maybe it will get cheaper, maybe it won't. Either way, math is math and, over time, all of Cramer's screaming and yelling is not going to make a bit of difference.

Let's buy back the May $410 calls for $5.75 in the $25KP.

I also like the May $440 calls, now $1.10 but we're already bullish on AAPL so just a fun play for those who don't have them.

If you followed the charts and didn't go long on AAPL when I pounded the table – don't even look at the price of those calls this morning… Of course, I've also been pounding the table on our 10 bullish trade ideas mentioned above for almost a month now – some of those are still relatively cheap – as I reminded our Members yesterday. If this is really the start of the next leg of a major rally, there will be lots of things to buy – but let's see if these stick first.

Have a great weekend,

– Phil